New analysis by WoodMackenzie sets out the “material opportunities” of the Rosebank and Cambo developments in terms of energy security, emissions and economics.

Analysis by the Edinburgh-headquartered energy experts and presented at the DEVEX conference in Aberdeen in June finds that the two major West of Shetland developments could address the UK’s energy import gap, while supporting hundreds of jobs and billions in economic value to the economy.

Equinor is expected to gain governmental approval to proceed with Rosebank within days. Projected to produce 300 million barrels of oil, first production would come online in 2027 – though remains subject to a final investment decision (FID).

Nearby Cambo is the second-largest untapped field in the UK, estimated to hold up to 800m barrels of oil in-place, of which its first development phase would recover around 170m.

Having withdrawn its support for the scheme in late 2021, minority partner Shell (LON: SHEL) recently initiated a formal process to sell its 30% stake in the project, kicking off a six-month process for marketing the stake with licence operator Ithaca Energy (LON: ITH).

Between them, resources of roughly 540 million barrels of oil equivalent (boe) would go some way towards addressing an ongoing supply gap to 2050, WoodMackenzie says.

Indeed, the group forecasts that between 2023 and 2050 the UK will see a deficit of oil and gas, of around 5 billion barrels and 1,000 billion cubic metres, respectively – even in a 1.5C compliant scenario.

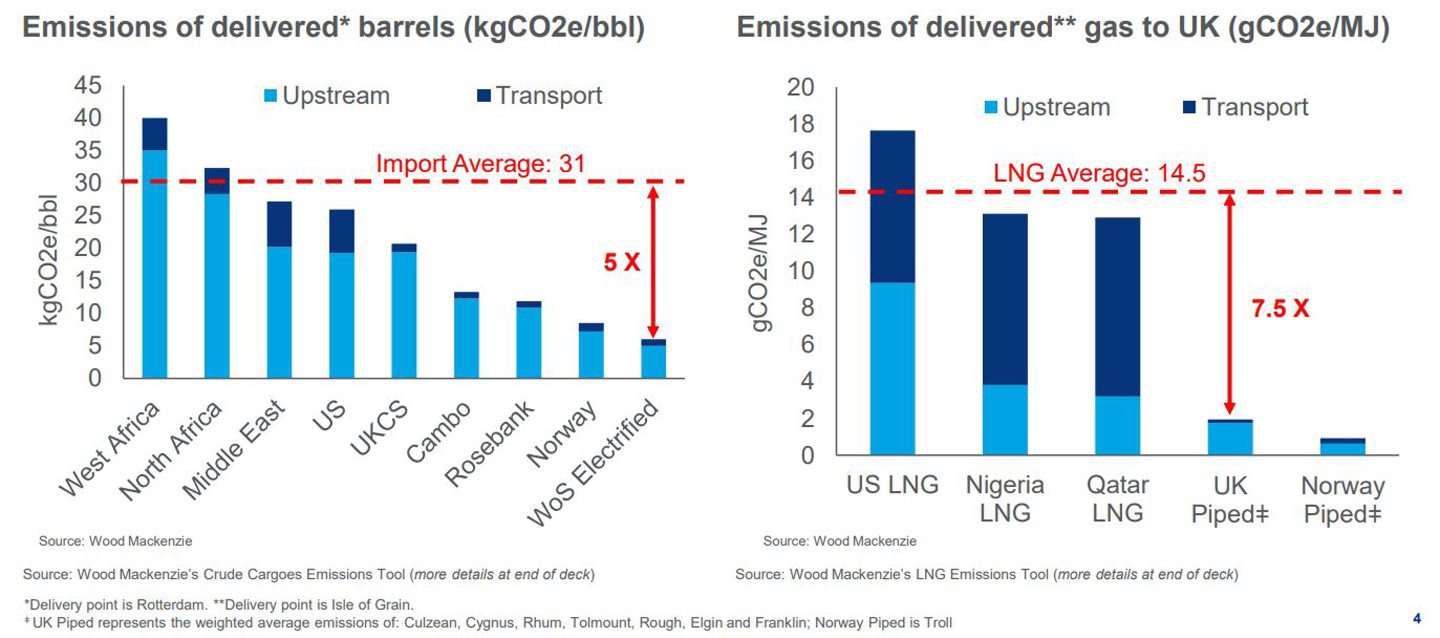

It also finds that production from the two fields would have “materially lower emissions” than imports – as much as five times lower in the case of oil produced from electrified developments.

Piped gas from UK developments is seven and a half times lower than the global average for liquefied natural gas shipments (LNG), though emissions intensity varies according to where the gas is produced.

Equinor has previously said that an electrified Rosebank would have emissions of 3 kg of CO2 per barrel, “one of the lowest ever CO2 footprints” in UK waters, compared to a local average of 20 kg per barrel and a global average of 30kg.

‘Barometer’ for North Sea’s future

At the same time, analyst expects £40 billion in gross value added (GVA) to the UK economy, an average of around £1.2bn per year over the next three decades.

They would help create and sustain an average of around 900 jobs over the same period, with a peak of 2,500 full-time equivalent roles around 2025 during the construction and commissioning phase.

Presenting the report, WoodMac vice president of energy Malcolm Forbes-Cable said: “From an economic perspective, the business-case for the development of these two fields is compelling and there is the added benefit of the additional energy security it would bring to the UK.

“With final investment decisions looming, both Rosebank and Cambo act as barometers for the future of oil and gas production in the UK North Sea,”

“If neither of these fields go to full development, it will be difficult to make a clear economic case for fields with less potential.”

Approval is a ‘lose-lose’ situation

However, both fields remain highly contentious in the eyes of climate campaigners and politicians, who argue the UK should not pursue development of any new oil and gas fields.

Both have been the target of campaigns against their development, with Rosebank’s overtaking the long-running Stop Cambo movement, waged against the backdrop of Glasgow’s hosting of the COP26 climate conference in 2021.

Campaigners also contend that the UK is unlikely to benefit from production from either field, as the majority of oil is exported on the global market and a lack of significant storage capacity means gas is routinely piped to and from Europe.

For its part, industry representatives say net flows are a more important benchmark, given that many oil products are refined in Europe and sold back to the UK.

Tess Khan, director of Uplift, said on Monday that even an electrified Rosebank would be a “lose-lose” for the UK public and energy security.

Moreover, electrifying Rosebank could involve diverting renewable energy that could be used to power many thousands of UK homes–energy that could help bring down people's bills & support our energy security, unlike Rosebank's oil which will be overwhelmingly exported.

/6— Tessa Khan (@tessakhan) June 26, 2023

“Electrifying Rosebank could involve diverting renewable energy that could be used to power many thousands of UK homes–energy that could help bring down people’s bills and support our energy security, unlike Rosebank’s oil which will be overwhelmingly exported,” she said on Twitter.

Recommended for you

© Supplied by WoodMackenzie

© Supplied by WoodMackenzie