Australia’s Hartshead Resources (ASX:HHR) has appointed a new advisory firm, and extended a contract with another, as it seeks to raise funds for its flagship UK project.

Carlingford-GFI and LAB Energy Advisors will now work to support the group in finalising third party finance for its Southern North Sea Phase I gas fields development.

A number of options to secure cash are being explored, including a conventional debt facility, pre-payment on future production streams, publicly listed and private bonds and possible additional divestment of equity in the scheme.

Consideration of additional equity divestment follows the recent farm-out to Viaro Energy subsidiary RockRose Energy.

Discussions are already advanced on all of these fronts, Hartshead revealed, and the advisory team is now in place to deliver the optimum funding solution.

Carlingford are a UK based independent corporate finance firm, focused on raising funds and advising on transactions in upstream, energy transition, renewables and natural resources.

Meanwhile LAB Energy recently supported Hartshead in the successful farmout of 60% of licence P2607, which contains the Anning and Somerville fields.

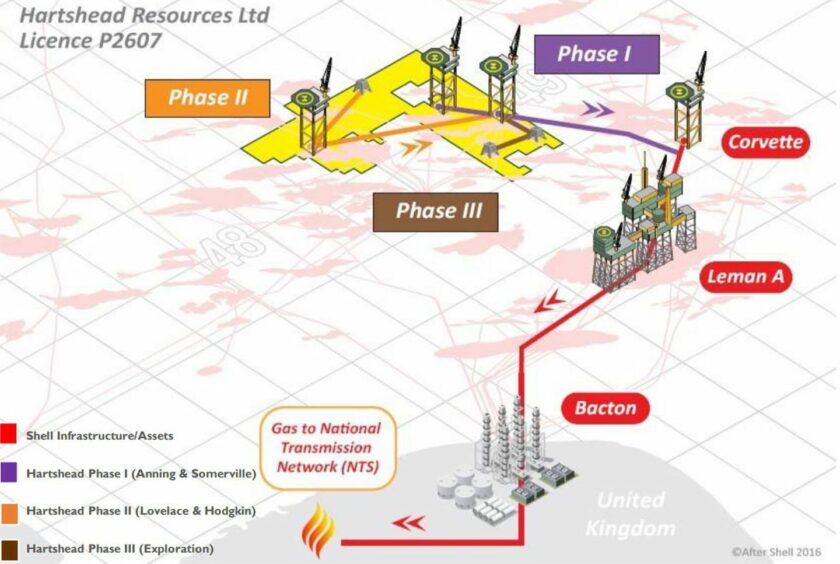

All in all the licence – which also covers the Hodgkin and Lovelace plays – and is believed to hold total 2P reserves of 301.5 billion cubic feet of gas, equivalent to around 52 million barrels of oil.

Drilling and simulation contracts for the project have been put to market, after plans for the Southern North Sea fields were lodged in mid-June.

A final investment decision (FID) on Phase 1 of the project, which includes the redevelopment and drilling of Anning and Somerville, is slated for Q3 2023.

Project development activities continue to progress as planned, Hartshead says, with recent activity including commencement of the platform seabed geothechnical surveys.

The main objectives of the geotechnical survey is to give the firm confirmation of the seabed and sub seabed soil conditions, needed to finalise the design and installation of the offshore facilities and to ensure the safe location of the jack-up drilling rig at the Anning and Somerville fields.

Chief executive of Hartshead, Chris Lewis said: “Carlingford are a sector leading corporate finance boutique with a strong track record of delivering structured project finance solutions for development projects on par with our Phase 1 gas development. LAB Energy successfully supported Hartshead in securing an excellent farmout with RockRose earlier this year. I am confident that the appointment of both Carlingford and LAB Energy will ensure the Company achieves the best outcome for shareholders as we move toward putting all of our required development funding in place, prior to taking FID later this year.

“We are rapidly progressing our Phase I development alongside our JV partner RockRose, with work across platforms, pipelines, wells and offtake advancing well. With the recent submission of the Field Development Plan we will now move to progress our Environmental Statement later this year. The Company and Joint Venture is very focused on delivering the key milestone of taking FID on Phase 1, later this year.”

© Supplied by Hartshead

© Supplied by Hartshead