Apache plans to bring forward the shutdown of the Forties oilfield by 11 years amid a £200m spending slash.

The US oil firm, which took over the North Sea giant from BP in 2003 and recently announced plans to end UK drilling, intends to cease the field’s production in 2026.

Court documents seen by Energy Voice confirm the plan which would bring an end to Forties 51 years after it started production and helped launch the North Sea industry from Aberdeen.

Apache had, in a plan drafted just last year, intended to keep it going all the way to 2037 with capital expenditure of £238m planned for 2022-2029.

But a new scheme from the company, which has been contested through the proceedings by former operators and partners, has greatly accelerated the timeline and cut the spending.

Apache now expects to spend just £9m on Forties between 2023 and 2030 and has modelled a cessation of production date of 2026, the documents reveal.

Whether it actually happens on this timeline is in question, though, as the England and Wales High Court case went against Apache, and the plans may need to be redrawn.

The Texas-headquartered firm said on Wednesday it is making an appeal.

New statement

In a new statement – issued on Thursday evening – Apache said the 2026 calculation is due to the inclusion of prescribed inflation costs, equating to nearly 20% between 2022 and 2024, which the firm said is “unrealistic”.

It went on to say that has the effect of “artificially pulling” the cessation date to 2026, and Apache has requested an amendment to the Decommissioning Security Agreement – a contract with the former owners and partners in Forties in which it is in a legal dispute – with a new date of “2030 or after”.

The High Court documents state that Apache’s proposed plan model for 2023 mean “the Field would cease production in 2026” – however Apache’s new statement on Thursday evening said it does not view that as “likely or realistic”.

These points were not made in the ruling, which outlined Apache’s legal arguments, or in the firm’s original statement.

In the case, the judge sided with Esso, Shell and BP in his ruling that Apache’s inflation calculations do not match the terms of the DSA.

Apache said trade body Offshore Energies UK recently recommended revisions to DSAs due to inflation costs.

Though not mentioned in the court documents, it comes amid Apache’s recent decision to cease drilling in the North Sea, leading to job cuts, citing the UK Government windfall tax.

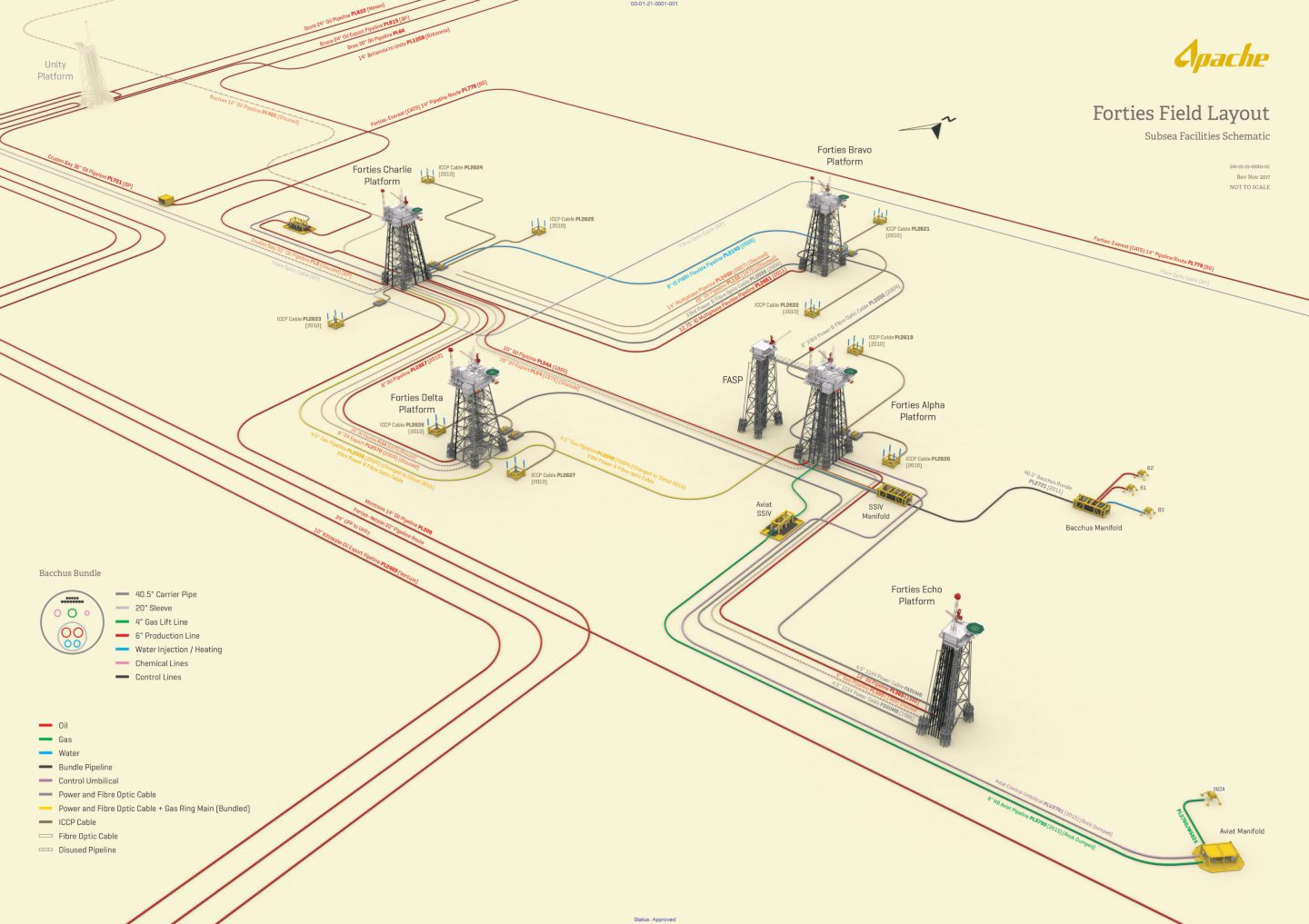

Forties, which was discovered more than 50 years ago and first produced in 1975, lies around 170 miles off Aberdeen with a series of five manned platforms.

Forties: Apache in legal battle with NEO, Esso, Shell and BP

The details were revealed in a legal case between Apache, as Forties operator, and current and former partners/ owners of the field: NEO Energy (which holds a small stake), Esso Exploration and Production, Shell, and BP.

The split of current decom obligations between these parties is not clear.

Apache and the other firms were disputing the construction of a Decommissioning Security Agreement (DSA) – a contract which obliges Apache and NEO Energy to provide security to cover costs of decommissioning.

Under UK law, should the current owner of a platform fail to meet decommissioning costs, then that obligation falls to other partners or former owners.

Part of what led to the disagreement – and the reason cited by the judge for the accelerated timeline to end production – is Apache including a calculation of inflation, citing a £779m cost, in the plan. This then factored into its estimate of the proved reserves remaining at Forties.

Esso, Shell and BP argued successfully that this inflation estimate does not fit with the terms of the DSA contract, and Judge Mark Pelling instructed that an independent expert should come up with a plan which reflected the ruling.

Asked whether the judgement will alter its intentions for Forties, Apache confirmed it is making an appeal.

A spokesperson said: “Due to an ongoing appeal of the judgment and confidentiality provisions in the Decommissioning Security Agreement, we cannot comment.

“With the need to give certainty over events that will occur years in the future the Decommissioning Security Agreements prescribe assumptions and formulas which must be applied by the Operator for the purposes of calculating security.

“Whilst they should therefore generally reflect operations, this will not always be the case.”

Spokespersons for Shell and BP welcomed the ruling, while NEO and Esso did not respond to requests for comment.

Apache, Forties and the windfall tax

Earlier this year Apache said it will stop new North Sea drilling, including infill work to keep its hubs going, blaming the UK Government windfall tax on the sector.

That’s despite maximising economic recovery obligations from the regulator, which commentators said contravene that plan.

Apache still has the Beryl field, which is thought to have plenty of production life remaining, with questions swirling on its future.

The firm’s latest calculations for Forties saw annual production decline from 7.1m barrels in 2023 to 1m in 2040, compared with 2022’s estimate of 8m barrels that year, to 1.7m in 2045.

Alex Kemp, a petroleum economics professor at Aberdeen University, highlighted that the effects of the recent Energy Profits Levy (EPL) – or windfall tax – on the calculations aren’t clear from the documents.

“I think the interesting point of the story is not that it is approaching cessation of production, but it is clear that the operator has said this needs to be accelerated by quite a lot and incremental projects are not now being seriously thought about.”

Professor Kemp said his recent modelling of the 35% UK windfall tax rate shows that incremental projects – such as small tie-backs and infill work which boost mature hubs like Forties – are hit hard.

“The idea that investment is cut there because the returns to these incremental projects are not very high would be consistent with the findings of our study on the EPL, especially when the rate was increased.

“And such projects might not become very interesting from the point of view of a company…well, Apache has interests in a lot of other places, and so on.”

Professor Kemp said the drop in capex of nearly £230m suggests a “major reappraisal”, noting that Apache’s assessment of the extra oil to be retrieved from Forties has “dramatically reduced”.

That’s not necessarily unexpected, however, noting examples like the former Argyll field redevelopment in the 1980s, when an attempt to revive it failed as estimates proved wrong.

“So the idea that in a mature field there could be similar reappraisal is not, to me, terribly unexpected.

“You would think, at first, the reservoir engineer would know the decline rates, but not necessarily always.”

Inflation and the DSA

In terms of Apache’s argument on inflation, which it took into its calculations for proved reserves at Forties, professor Kemp said it was “was a bit surprising to me that in the DSA a really quite low rate of cost inflation was assumed”.

He added: “What we can say is that cost inflation in the North Sea and in the oil industry generally has increased over the last few months.

“That relates across the board to drilling costs, drilling rig hiring rates have gone up, and people costs have gone up as well, larger than might have been expected earlier.”

Why wouldn’t the partners want inflation considered? It’s a legalistic point that, even if the world environment has changed due to factors like the Russian invasion of Ukraine, the ruling requires Apache to stick by the terms of the DSA.

Professor Kemp wouldn’t discuss the legal points, but did note that such documents “should reflect the economic realities”.

On the case, a Shell spokesperson said: “Shell fulfils its obligations for financially sound and responsible decommissioning of its assets, including those it no longer owns.

“Shell wants to ensure these obligations are also properly met by the operator and is glad to see that this position is supported by the Court.”

A BP spokesperson said: “BP pleased with the successful judgment which supports our position in this matter.”

The end of Forties?

With five platforms to be removed, any work to decommission Forties would be a huge effort carried out over several years.

This latest judgement leaves questions on whether the 2026 plan will proceed as outlined by Apache.

It has been more than 50 years since oil was first struck on Forties, which is one of – if not the – most important fields in the North Sea.

BP sold the “jewel in its crown” to the firm in 2003, when Apache had no track record in the UK North Sea, taking on the 230 staff and 35 onshore employees.

Recommended for you

© Supplied by DCT/ Kami Thomson

© Supplied by DCT/ Kami Thomson © Supplied by Apache

© Supplied by Apache © Supplied by DCT

© Supplied by DCT