Shell (LON: SHEL) has given up on a Southern North Sea prospect, despite it being located directly next to the region’s largest find in a decade.

Reabold Resources (LON: RBD) – which farmed into licence P2332 last year – confirmed on Wednesday that the oil giant had relinquished the permit.

The company had been bullish about the chances of success at the prospect, in the event of a discovery at Pensacola – it was subsequently confirmed to be a generational find.

It also played up the importance of Shell as the operator of P2332, highlighting the group’s knowledge of the region.

Its understood that prior to a drill or drop date, the operator recommended not progressing to the next stage of the licence and as such the partners released it.

The supermajor’s decision to give up on the licence will be seen as a blow to Reabold, which hasn’t had its troubles to seek in recent times.

A small group of disgruntled shareholders has sought to topple the firm’s board twice in the last year, citing the low share price and “knee jerk” decision making.

Acquired through Simwell deal

Reabold acquired a stake in P2332 as part of its acquisition of Simwell Resources, a deal formally announced in September.

Addressing shareholders ahead of a crunch vote on the board’s future in November, Sachin Oza, the firm’s co-chief executive, claimed a discovery at Pensacola would be a big boon for the chances of success at P2332.

He said: “A successful well at Pensacola significantly de-risks and enhances the value of P2332. Shell is operator on both licenses, and it has a very comprehensive data set across both licences.

“Because of that, I think we would feel really strongly encouraged on the value enhancement of that P2332 licence.”

Pensacola was later found to be “one of the largest natural gas discoveries” in the Southern North Sea sector for many a year.

Unrest bubbling away in background

The firm’s top brass subsequently survived the attempt to oust them, though the unhappy group of shareholders attempting to gain control of the company haven’t gone away.

And Shell’s decision to let go of the permit, despite Pensacola bearing fruit, will likely give further momentum to their cause.

Adding insult to injury, on the same day that Reabold announced the licence had been handed back, a major upgrade to Pensacola was revealed.

According to estimates from Deltic Energy, which is partnered with Shell on the project, it may hold around twice as much gas as first thought, as well as material volumes of oil.

Despite the P2332 setback, Reabold insisted the licence has been valuable in providing data to better understand its other assets.

In a note issued to the London Stock Exchange, the company said: “The work undertaken on all our Southern North Sea licences has provided the Company with valuable data and added to our understanding of the Zechstein play, which is fundamental to our West Newton and Crawberry Hill assets onshore.”

Shell has been approached for comment.

Dunrobin and other prospects

Reabold also gave updates on a raft of other North Sea licences as the oil and gas firm continues to “high grade” its assets.

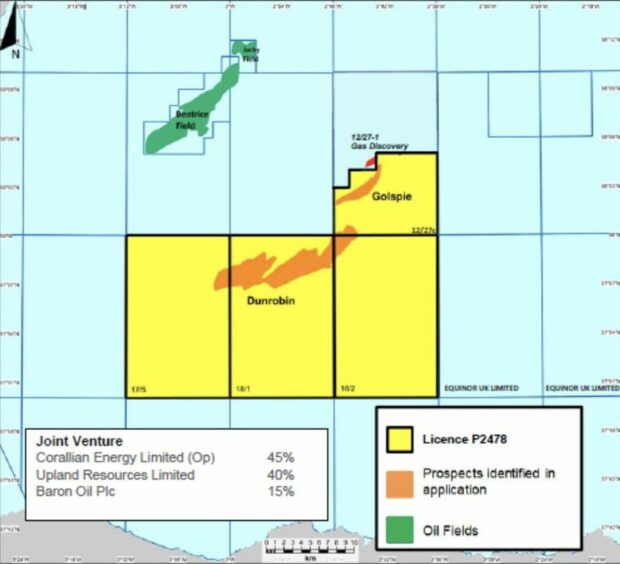

An extension to licence P2478, holder of the Dunrobin and Golspie prospects, has been secured, meaning the company now has until July 2025 to make a decision.

The permit, which Reabold operates with a 36% working interest, is estimated to hold 201 million barrels of oil equivalent (Mmboe).

Baron Oil and Upland Resources hold the remaining 64% interests in P2478, split equally between the pair.

In the Southern North Sea, licence P2486 has been retained as the operator, Horizon Energy Partners, continues a farm-out process – a drill or drop decision is expected before July 2024.

Mr Oza said: “With an abundance of value opportunities within Reabold, the high-grading of our recently acquired North Sea licence portfolio is driven by the Board’s disciplined financial framework, where the highest return opportunities have been prioritised. We will look to farm down these high-graded assets to help fund the de-risking and value creation process.”

© Supplied by Reabold Resources

© Supplied by Reabold Resources © Supplied by Noble

© Supplied by Noble © Supplied by Baron Oil

© Supplied by Baron Oil