A top economist at oil giant Shell (LON: SHEL) has cast doubt on the value of Westminster’s move to dish out scores of fresh exploration licences.

Laszlo Varro says the North Sea’s age means there is “no plausible scenario” where production from the basin “reverses its sharp historical decline”.

He references modelling from Shell in which oil and gas flows fall sharply because declining global demand for hydrocarbons hits prices, something that “is detrimental for a mature province”.

In an alternative scenario, where prices are higher and domestic production is preferred, “geological depletion” still wins, Mr Varro said.

It means the best the North Sea can hope for is a “long sunset”.

Posting in a personal capacity on LinkedIn, Mr Varro, VP for global business environment at Shell, said: “Given that most of the decline has already happened, the difference between the two scenarios has only a marginal impact on global oil and gas markets.

“UK oil and gas consumption is determined by global markets and the policy driven transformation of the demand side capital stock, not the last upstream projects on the North Sea.”

A key driver behind the latest North Sea licensing round, the results of which are expected soon, was Russia’s invasion of Ukraine.

Targeted sanctions against the Kremlin sent oil and gas prices – and household energy bills – skywards, and the UK careering into a generational cost-of-living crisis.

Energy security quickly became a key priority for government and oil and gas was back in vogue, after several months being pilloried around the COP26 climate conference.

Energy security not tied to more licences

But Mr Varro, formerly chief economist at the International Energy Agency, has also questioned whether stopping production from the North Sea would actually deliver a hammer blow to the UK.

He said: “The most plausible incremental source would be North America: a bit more shale fracking to supply UK import demand, some blue collar jobs relocating from Aberdeen to Oklahoma City, less tax revenues for HM Treasury, more profits for climate sceptic Republican private equity billionaires. Life would go on.

“Just please let’s not pretend that decisions on North Sea upstream would decisively influence the low carbon transition of the global energy system. For the transition it would be more useful to use the intellectual energy and enthusiasm absorbed by this debate on the much more impactful question of how to reduce global oil and gas demand.”

The crux of the debate

His points broadly mirror arguments made by climate groups in favour of blocking new oil and gas developments in the North Sea.

Proponents of further oil and gas licensing – not unaware that the basin is in its twilight years – claim while there is demand for hydrocarbons in the UK, it makes sense to meet that with domestic production as far as feasible.

Key to that line of thinking – aside from the economic benefits – is the fact that oil and gas production UKCS is cleaner than most other regions, meaning imports are worse overall for the planet.

According to recent research from the North Sea Transition Authority, domestically produced gas is on average almost four times cleaner than imported LNG.

Moreover stark figures released in 2021 showed that North Sea gas production could be on course to wrap up by the end of the decade unless fresh resources are added.

New licensing

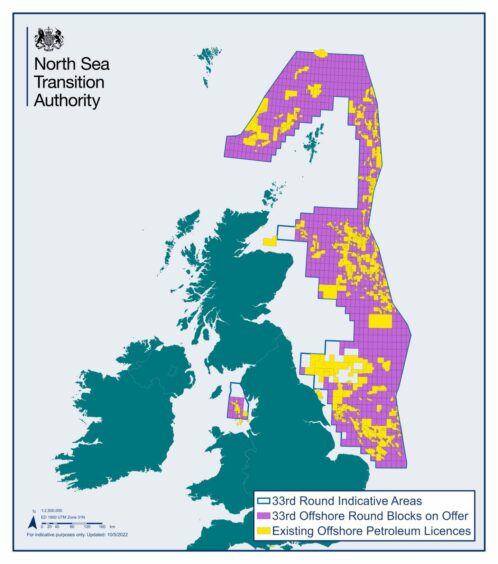

The results of the 33rd oil and gas licensing round are expected to be unveiled in September.

Almost 900 blocks and part-blocks were offered up by industry regulator the North Sea Transition Authority (NSTA).

Within that, the NSTA identified four priority gas clusters in the Southern North Sea, “which have known hydrocarbons, are close to infrastructure and have the potential to be developed quickly”.

A total of 115 applications, covering 258 blocks and part-blocks, were lodged by 76 companies, including Deltic Energy and Hartshead Resources.

Earlier this week Prime Minister Rishi Sunak, on a visit to Aberdeen, pledged to “max out” the North Sea’s reserves, though there is a strong chance his Conservative party could lose the next election.

Recommended for you

© Shutterstock

© Shutterstock © Olaf Kruger/imageBROKER/Shutterstock

© Olaf Kruger/imageBROKER/Shutterstock © Supplied by NSTA

© Supplied by NSTA