Perenco’s UK arm more than doubled its profits last year due to soaring commodity prices, company filings show.

Annual accounts for the group’s North Sea businesses filed with Companies House show pre-tax profits reached £1.18 billion in 2022 – up from around £493m in the previous year – on total operating revenues of over £1.4bn.

Perenco UK Limited credited the rise to booming oil and gas prices, which also drove gross profit margins to nearly 70% – though this was partially offset owing to the impact of the UK’s Energy Profits Levy.

Post-tax takings amounted to some £555m.

According to its website the group – which employs around 700 people in the UK – produced around 40,000 barrels of oil equivalent (boe) per day across its UK North Sea operations last year, or just under 10% of its global production of 500,000 boepd.

The independent now operates in 16 countries, overseen by president and chairman François Perrodo, whose father Hubert founded the company in the mid-1970s.

Filings note that Perenco continues to work on its Southern Hub Asset Rationalisation Project (SHARP) – a move to combine “oversized” facilities across the Leman and Indefatigable assets into one fit-for-purpose production hub in a bid to extend field life and cut costs.

However Viaro Energy, a partner on the project, revealed via its own filings that the project is now “approximately 18 months late”.

Asked about the delay earlier this month, Perenco cited knock-on effects of the Covid pandemic, including the impacts on its workforce.

Alongside the SHARP overhaul, a wider equipment simplification drive for normally unattended installations (NUI) is expected to result in further emissions reductions. Beginning with the Excalibur NUI, Perenco said the programme is expected to result in savings of around 1,000 tonnes of CO2 equivalent.

A review of operations at the Dimlington Terminal is also ongoing to determine “the future mode of operation” at the site.

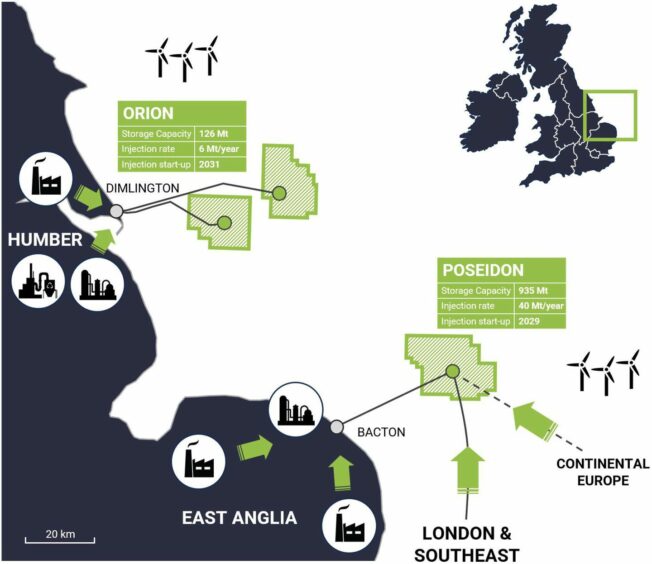

This summer the company secured a tranche of carbon storage licensing awards in the Southern North Sea in partnership with Carbon Catalyst. This includes permits which unlock the Poseidon scheme, based at the Leman fields, and the Orion project, which will use the decommissioned Amethyst field and the currently producing West Sole field.

The awards brought with them the creation of a new “strategic division” within the group, focused on CCS development.

Meanwhile, it is also overseeing a substantial decommissioning portfolio, including a suite of platform removals across the Amethyst field by decom partner Petrodec.

Annual accounts assess Perenco’s total UK decom liability to be around £1.17bn, with costs expected to be incurred between 2023 and 2041.

Wytch Farm impact unknown

The account filings include a brief update on the company’s onshore Wytch Farm development, where a pipeline leak in March 2023 resulted in a spill of around 200 barrels of reservoir fluid into an area around Poole Harbour.

As of its filing date at the end of September 2023, Perenco said that “24/7 cleaning and remediation operations continue” at the source of the leak, and that a detailed investigation is “ongoing”.

Further checks are being made to support a “partial reinstatement” of production, though the company said the financial impact of the event is not yet known.

Recommended for you

© Supplied by Perenco/CCL

© Supplied by Perenco/CCL