A deal to takeover gas developer EnergyPathways will see the firm listed in London, with a view to bringing online the Marram gas project in the Irish Sea later this decade.

Dial Square – a special purpose acquisition company (SPAC) – announced a proposed deal for a reverse takeover of EnergyPathways in March.

It now says it will raise at least £2 million through a private placement to complete its acquisition and admit the newly enlarged company London’s Alternative Investment Market (AIM).

The new company would be renamed EnergyPathways plc and listed on the AIM index under the ticker EPP. Dial expects its first day of dealings on or around 14 December 2023.

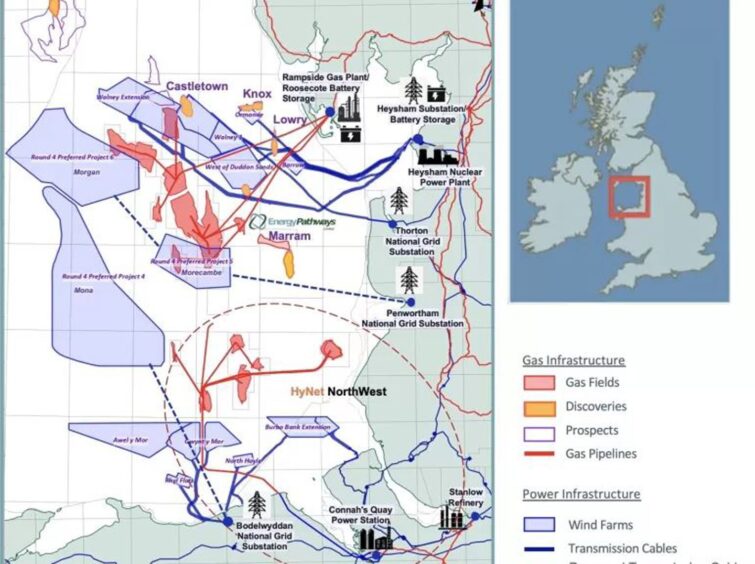

The company was formed to target UK gas assets, with an initial focus to develop its 100% owned and operated Marram field, a “ready-to-go” gas development in shallow water in the East Irish Sea.

Located in Block 110/4a in licence P2490 the gas field lies close to existing infrastructure and the developed Morecambe gas complex, and holds just over 35 billion cubic feet (bcf) of undeveloped 2P gas reserves.

Net proceeds of the proposed fundraising will be used to progress the Marram project through to a final investment decision (FID) in 2024, ahead of first gas in 2025.

In a market update on Monday Dial said the “high-value project” with offered a potential net present value (NPV10) of approximately £100m and an estimated payback period of 12 months from first production.

It said the firm intend to build a portfolio of projects and in the East Irish Sea area and has already made requests for additional licences in the region, and participated in the 33rd Licensing Round.

Dial said it would bring on a new board and management team with strong technical and commercial track record.

Commenting on the update, Dial Square non-exec chairman Neil Cousins said: “We chose EnergyPathways as the RTO target on the basis of its strong investment story and supportive market drivers. EnergyPathways’ story is highly topical and relevant to the UK market, and the value upside potential is clear to see from the Marram project economics.

“We were also attracted to their near-term news flow pipeline which provides plenty of scope for new and existing investors to benefit from progress towards FID and the award of additional and complementary licences.

“We look forward to communicating this investment proposition to the market in the coming weeks as we seek to raise the funds to complete the RTO and admission to AIM in mid-December. I’d like to thank our shareholders for their patience through this process and we hope to reward them with what we believe to be a highly compelling and value-accretive transaction.”

EnergyPathways CEO Ben Clube said: “We are very excited to bring our investment proposition to the London market. We believe the market drivers for our story are supportive in terms of the UK’s focus on Energy Security and demand for domestic natural gas to support the nation’s transition to Net Zero.

“The economics of the Marram discovery are robust and compelling, with an NPV10 that represents a large multiple of our current valuation. Upon completion of the fundraise, we aim to reach FID in 2024 and production of first gas in 2025.

“With a substantial cash flow profile in the first two years, we hope investors will be enthused by the project’s rapid rates of return. We are also seeing an improving political climate for our operations as the Government implements changes to encourage investment into the vital supply required to achieve the objectives of the nation’s energy policy.”

Recommended for you

© Supplied by EnergyPathways

© Supplied by EnergyPathways