Fresh from securing a farm-out deal, Orcadian Energy boss Steve Brown points to the strategic advantages of a new floating development at Pilot in the central North Sea.

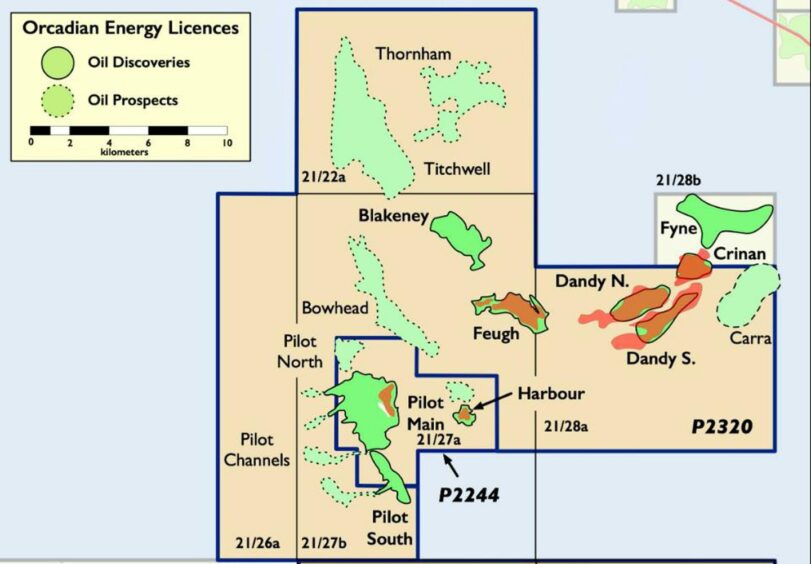

On Thursday Orcadian (AIM:ORCA) confirmed Ping Petroleum would take on an 81.25% operated interest in its flagship Pilot field in licence P2244 , ending months-long farm-out negotiations.

It marks the end of Orcadian’s control of the licence, which lies around 90 miles east of Aberdeen and remains one of the largest undeveloped discoveries in the region, estimated at around 79 million barrels.

Orcadian chief executive Steve Brown said it was the “area plan potential” offered by Pilot that makes the deal most interesting for Ping.

“When you look at their acreage position in the North Sea, they can see that adding Pilot – and potentially adding a licence around the Pilot area – really adds to the area plan for what was their foothold in the North Sea,” he added.

That includes the Anasuria Cluster, which it shares with Hibiscus, alongside other feed-in opportunities.

“But if you go a bit further west you come to Pilot and what that does is give you the opportunity to put a new, fully electrified FPSO on location – because it’s a big enough project to justify a new FPSO – and then that that actually helps the overall development of the area very much.”

Development plan

Orcadian has spent several years developing a Pilot development plan, using a polymer flooding technique to boost recoverable barrels and incorporating power from a floating wind turbine.

Under its plan, 34 wells would be drilled and produce via a pair of subsea wellheads, tied back to a floating production vessel. However, it has long acknowledged the need for a partner to carry the project to completion.

Mr Brown does not anticipate radical changes to this blueprint, but said some refinements had already been made with Ping’s input.

“In working with Ping we found some opportunities to optimise the field development plan and some opportunities to reduce the upfront cost of the development. Going for the initial batch of wells as subsea wells, that saves on the upfront cost of a platform.”

Increasing the concentration of polymer would also enable it to reduce the fluid handling requirements on board the FPSO.

“These are things we discovered in working with the Ping team and we think it will set the project off in the right direction.”

Ping’s experience in floating production – both at Anasuria and in securing the Excalibur FPSO for redeployment at its Avalon project – will also aid work at Pilot, he suggested.

“They also know the FPSO market for potential redeployment candidates probably as well as anyone does.

“So we’re really confident they can help us get the right solution for Pilot as quickly as possible.”

Details of potential vessel candidates are yet to be revealed, but any selection would require some degree of overhaul to fit the scheme’s electrification requirements.

Mr Brown pointed to a pair of INTOG wind farms – Flotation Energy’s Cenos project and Cerulean Wind’s Cedar wind farm – as potential candidates.

We happy Feugh

In its deal announcement, Orcadian also pointed to the “significant upside potential” around Pilot, and confirmed it and Ping are currently negotiating a joint bidding agreement to request an out-of-round application for the area of former licence P2320.

This contains the Blakeney discovery, with 2C resources of 25 million barrels, along with the Feugh, Dandy and Crinan discoveries, as well as prospects at Bowhead and Carra.

Orcadian was forced to relinquish P2320 earlier this year, but is emphatic as to the importance of the reservoirs within it to support a development at Pilot.

“One of the reasons we’re really keen to get that licence back is Feugh,” he says, noting that a gas cap at the top of the structure is set to be used as a balancing system for power and gas management during Pilot’s production.

“It’s very important in the whole electrification story and the whole minimisation of our emissions story.

“We think the NSTA understand that and we’re optimistic that they’ll give us an opportunity to apply for that acreage on an out of round basis,” he continued.

He also believes the licence contains a “great prospect” that could offer further development opportunity.

“We did a really innovative and interesting deal with TGS to access a lot of seismic data and for them actually to do some seismic processing for us and quantitative interpretation for us, and there’s a great prospect that we’d like to get back.”

Licensing round results

Outside of its budding partnership with Ping, Orcadian also awaits news from applications in the 33rd Licensing Round.

This includes an application for a viscous oil prospect in the outer Moray Firth with an unnamed partner, as well as “shallow gas prospects” on the mid North Sea High with Australian-based Triangle Energy.

However, conclusion of the deal for Ping’s operatorship of Pilot in Q1 next year will bring Orcadian’s solo run with the licence to an end – though Mr Brown will not be looking back.

“There’s still hurdles to get over, but it’s great to have a partner with some muscle alongside us and that really adds an awful lot of capability.

“And a partner that’s been very willing to listen to what we have to say about the subsurface – because that’s the bit we know best.”