© Supplied by DC Thomson

© Supplied by DC Thomson Oil and gas sector leaders have warned that thousands of jobs and billions of pounds of investment would be “wiped out” under Labour plans to increase the windfall tax.

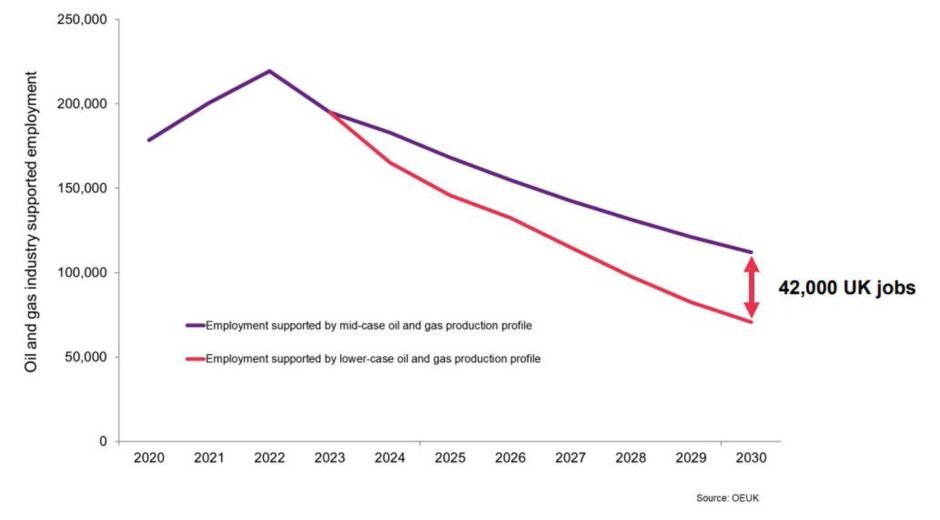

Trade body Offshore Energies UK (OEUK) has claimed up to 42,000 jobs and £26 billion of economic value would be lost after Labour unveiled manifesto plans to increase tax rates and cut investment allowances if it takes power.

In a briefing note for its “Prosperity Plan Policy” on Thursday, Labour confirmed proposals to hike to the industry’s headline tax rate from 75% to 78% – in line with that of Norway – and “end the loopholes in the levy that funnel billions back to the oil and gas giants”.

The party also plans to extend the sunset clause, currently planned for March 2028, until the end of the next parliament.

Professor Paul de Leeuw, director of the Energy Transition Institute at Robert Gordon University, said if the measures were introduced, it would “further undermine investor confidence in the UK’s offshore energy industry, thereby putting the UK’s world class supply chain and workforce at risk”.

Analyst firm Welligence said “it may very well herald the end of oil and gas investment in the North Sea” should Labour come to power.

OEUK on Friday said that based on the “limited information” provided, this will likely result in no new investments being made in UK oil and gas projects with the impact being felt immediately.

It has asked for an “urgent meeting” with the Labour party leadership.

‘Impact felt across the economy’

In a statement the trade body noted that Labour “has consistently said it will work in partnership with business” and that it recognised the important role the UK offshore energy sector in the journey to net zero.

It complained that Thursday’s announcement was made “without engagement with the industry.”

That is despite Labour leader Keir Starmer’s visit to Aberdeen in November in which he met with sector representatives, who at the time reported a ‘frank and honest’ exchange of views.

Russell Borthwick of the Aberdeen and Grampian Chamber of Commerce said the Labour windfall tax announcement “let us down badly”.

OEUK chief executive David Whitehouse added on Friday: “Labour either can’t do the maths or haven’t considered the alarming jobs impact that will be felt up and down the country.

“With no new investment, 42,000 jobs will go, and we could start to see the effects as early as this year.

“These are not faceless numbers but decent, hardworking people working across the UK to provide the energy we will need today and in the future.

“The impact of no new investment will be felt across the whole economy – today we estimate the UK will lose £26 billion of economic value. It will undermine the very industry which can and must play a critical role in delivering a homegrown energy transition.

“Last week I listened carefully to the Shadow Chancellor promise that Labour will work in partnership with UK businesses. We’ve always said the path to net zero is through working together between government, business, and people, ensuring no individual, community or sector is left behind – that’s not what we’ve had from Labour. The least this industry, our people, and our communities deserve is an urgent meeting with Labour leadership.”

Factcheck: Are 42,000 jobs at risk?

OEUK’s modelling uses estimates of how industry expenditure and production supports jobs.

Its calculations suggest that an additional 42,000 direct, indirect and induced jobs could be lost across the economy based on a ‘no further investment scenario’, compared with its ‘mid case’ scenario which already sees a drop in employment as North Sea production declines.

The same metrics are used to estimate the loss in gross economic value added (GVA), which shows a fall of £26bn.

The likelihood of the withdrawal of all new investment remains to be seen, though OEUK says this is a realistic outcome.

Mr Whitehouse said OEUK estimates of 42,000 jobs being lost compared a “base case of continued investment” with a scenario of limited investment up until 2030.

“When you do that, you recognise the amount of capital that will not be spent as a result of the investment, and that ties directly to jobs,” he said.

“Under our analysis, I think we would expect the impact to be effectively immediate and in terms of the 42,000 jobs that we quote, that will be by the end of the decade.”

Professor de Leeuw of RGU, who produced a report last year on the potential for the workforce to flux through the transition, was asked whether the number is credible.

“To successfully deliver the net zero agenda, the UK needs to re-establish its credibility as a world-class offshore energy investment basin, underpinned by a stable fiscal and regulatory regime, and with a supply chain and workforce to match.

“However, the plans published by the Labour Party yesterday and the departure from its flagship policy – and commitment – to spend £28 billion per year to deliver the green agenda has created shockwaves across the country.

“If the combination of the changes announced yesterday were to come about, including increasing the tax rate on the oil and gas sector to 78%, removing some of the investment allowance and extending the Energy Profit Levy to 2030, it will further undermine investor confidence in the UK’s offshore energy industry, thereby putting the UK’s world class supply chain and workforce at risk.”

Labour windfall tax is ‘worst fears’ realised

Speaking to Energy Voice, Mr Whitehouse said the announcement made by Labour yesterday was the sector’s “worst fears”.

He said that while the 3% increase in the headline rate of tax is “an issue”, what is more concerning to the sector is the removal of capital allowances.

“Fundamentally, what that means is the allowances you get when you invest will be slashed under Labour’s plan,” he said.

“The headline rate does not help but the slashing of the capital investment allowances is what causes the concern around continued investment.”

Asked about Labour’s wider green energy investment plans and the potential for thousands of jobs to be created in the renewables sector, Mr Whitehouse said the oil and gas sector is still needed to support the energy transition.

“Continued investment in oil and gas actually provides the support to the very companies that were looking to invest in the energy transition,” he said.

“You take away the investment in oil and gas in the UK, and you will make investment in the wider energy transition much less attractive and importantly, will undermine the various supply chain companies that we need for the UK to take advantage of the transition.

“Taking away the oil and gas investment has an impact not just on oil and gas, but across the entire energy transition.”

Mr Whitehouse said investment in the North Sea and the wider energy transition is the “biggest opportunity that Scotland and the UK has”.

“We need governments to be creating an environment where investment in that area is irresistible,” he said.

“There’s no doubt uncertainty drives away investment, there’s no doubt that windfall taxes drive away investment.

“If we’re not careful, we will fumble the huge opportunity that the UK and Scotland has.”

‘Triple body blow’

Last year Robert Gordon University’s Energy Transition Institute estimated that up to 95,000 roles could be at risk by 2030 in a scenario where the decline in oil and gas jobs exceeds new opportunities available in offshore renewables.

At the time, OEUK and RGU noted that that £200 billion of spending is needed in UK offshore energy by the end of the decade, 90% of which would land in the supply chain.

Yet they warned that £100bn of North Sea investment had already been stalled due to political uncertainties.

Meanwhile, upstream oil and gas analysts Welligence said the windfall tax changes from Labour would represent a “triple body blow for a sector which is already reeling from earlier hits landed under the Conservatives”.

“This latest announcement from Labour seems to serve only one purpose – to further destabilise and erode confidence in a region which is already struggling,” Welligence said.

“Should Labour win the next General Election it may very well herald the end of oil and gas investment in the North Sea, but even if it does not, this latest announcement does the sector no favours.”

Welligence modelled the impact the changes would make on three operators in the North Sea – Apache, Equinor and CNOOC.

Under their analysis, the value of the companies’ investments in the Beryl and Forties, Buzzard and Rosebank developments respectively would decrease by hundreds of millions of pounds.