Airbus executives have hinted at a possible future return of the H225 Super Puma helicopter to offshore oil and gas operations.

The offshore industry widely abandoned the rotor type after a series of crashes, including one which killed 16 people in Norway in 2016, with one union official branding the helicopter a “flying coffin“.

Despite aviation regulators in the UK and Norway later clearing the Super Puma to fly again, the offshore sector has largely switched to using helicopters such as the Sikorsky S-92.

Since then, oil price downturns and the Covid pandemic led to an overall reduction in flights and an oversupply of aircraft servicing the industry in the last decade.

But speaking to reporters last week in France, Airbus head of energy Regis Magnac said as offshore demand for heavy-lift aircraft returns the unique capabilities of the Super Puma is attracting renewed interest.

“There are areas of the world where long, long distance flights — potentially with de-icing and [other capabilities] — are still needed, and there will be a need for replacement of the heavies flying there,” he said.

“This is where the 225 will come into play, because we believe that [with] its range capacities, de-icing capacity, [and] its cabin size can be a replacement for those needs — and can be the only replacement for those needs.”

Despite sustained demand for the Super Puma in other sectors, offshore unions remain unconvinced of the need for the helicopter to return to oil and gas operations.

Super Puma safety record

Before 2016, around 80% of Super Pumas globally were operating in the offshore sector.

However, the North Sea oil and gas sector abandoned the helicopter model after a CHC-operated flight crashed near Turøy, Norway, in 2016 killing all 13 people on board.

Other fatal incidents involving the Super Puma include a 2013 crash which killed four offshore workers during an approach to Sumburgh airport on Shetland.

A 2009 crash killed 16 people after a catastrophic gearbox failure caused the Super Puma helicopter to plunge into the water near Peterhead.

While the UK and Norway lifted a ban on Super Puma flights in 2017 following an investigation into the Turøy crash, the helicopter has not returned to North Sea fleets.

But with severe parts shortages limiting the operational availability of the S-92 in recent months, frustrated helicopter operators could be forced to consider alternative options.

Offshore sector speaking to Airbus

Mr Magnac said Airbus is now fielding questions on the Super Puma from the offshore sector and has recently hosted delegations from Norwegian unions.

These conversations are primarily focussed on the work Airbus is doing to further enhance safety beyond the solution that allowed it to return to service in 2016, he said.

Airbus Super Puma programme head Michel Macia said after “disappearing completely” from the oil and gas market in 2017, operators are beginning to contact Airbus once again.

“We did not communicate to the oil-and-gas market for a long time, but now they are coming and asking questions,” Mr Macia said.

“I think [it’s true] that, in particular in Norway, there is a lot of perception [about the Super Puma’s safety] . . . but I think that perception is changing.”

Airbus Super Puma safety efforts

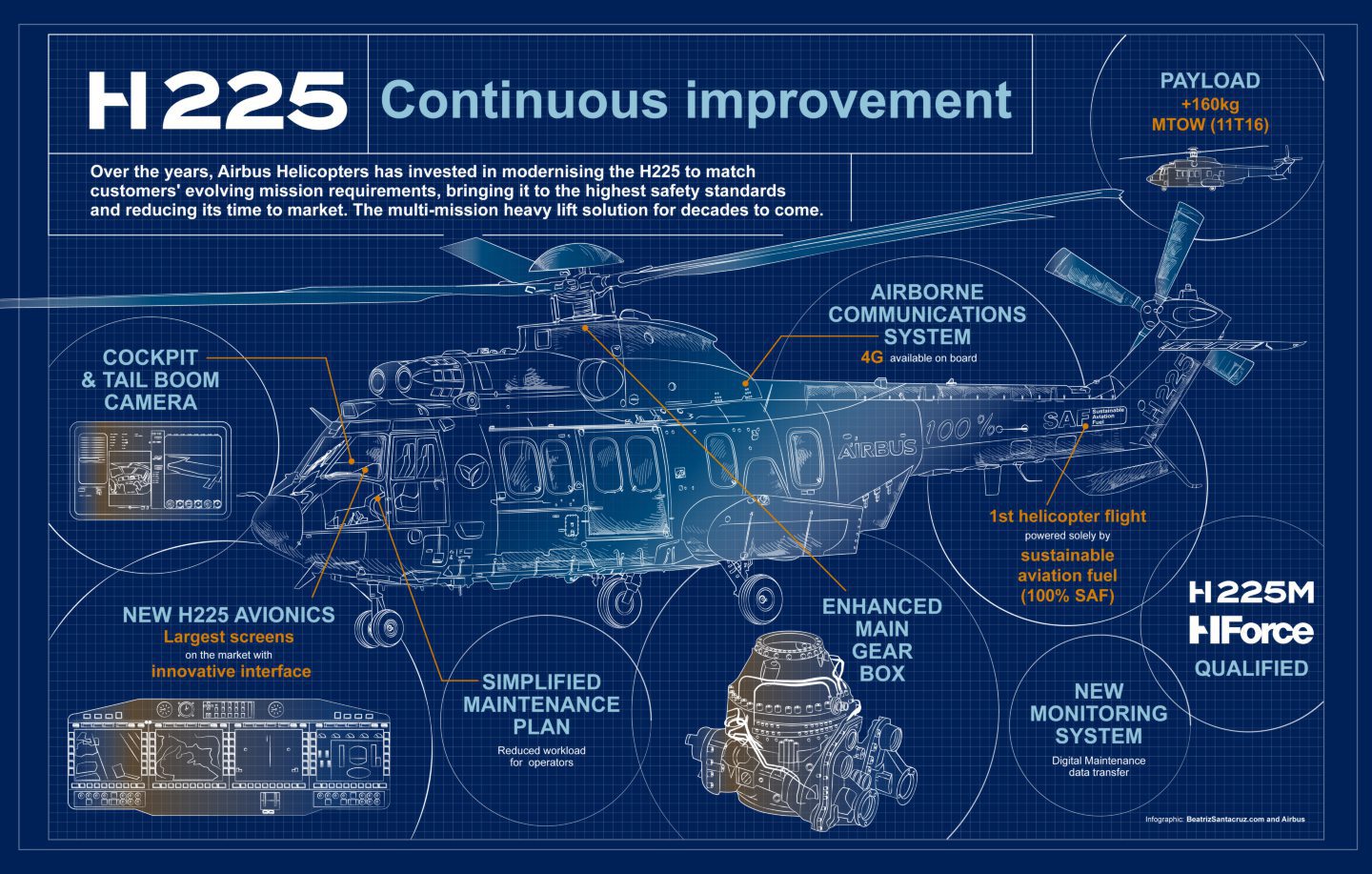

In 2023, Airbus introduced an enhanced main gearbox (eMGB) for the Super Puma which is now standard on all new-builds. The company is also retrofitting the eMGB on the existing helicopter fleet.

Airbus is also planning future upgrades to the aircraft’s navigation and communication systems and developing a crash-resistant fuel system, Mr Macia said.

Although the company currently has no orders for the Super Puma in 2023, Mr Macia said Airbus believes its success as a multirole aircraft will ensure its future for decades to come.

“What we want is this aircraft to be in the fleet beyond 2040,” said Mr Macia.

“We are not investing for one year or 10 years, we’re investing for the next 30, 40 years. So, we believe in the market — and we believe in this market because this aircraft is sustainable.”

Despite its confidence in the Super Puma’s safety standards, Airbus does not anticipate recent interest from the offshore sector to result in new orders in the immediate future.

The French aviation giant’s five-year H225 delivery forecast doesn’t consider deliveries into the offshore sector, with the company expecting any possible return to be beyond 2028.

Demand for North Sea heavy lift helicopters

Industry analysts told Energy Voice there is an appetite among offshore helicopter operators to increase the number of aircraft in their fleets.

LCI Analytics managing director Steve Robertson said there is strong demand for both super-medium helicopters and heavy-lift varieties like the S-92.

North Sea operators introduced super-medium helicopters like the Airbus H175 and Leonardo AW189 over the last ten years to fly some of the same routes previously flown by ‘heavies’.

However, Mr Robertson said super-mediums have reached 100% contracted utilisation in the North Sea, leading to more demand for the S-92, which remains the only comparable heavy-lift alternative to the Super Puma.

Mr Robertson said the number of S-92 helicopters contracted to offshore operators increased from 168 at the start of 2022, to 187 at the end of the 2023.

“Whilst super-medium types have been shown to offer advantages in certain scenarios vs heavy helicopters (including fuel and CO2 emissions savings), there remain a good number of offshore fields where the payload and range requirements will only suit a heavy helicopter,” Mr Robertson said.

“Demand for offshore helicopters is high at the moment, while available supply remains very limited.

“Operators have been looking at every option to secure capacity for upcoming contracts and contract renewals.”

Super Puma not a ‘quick fix’

However, Mr Robertson said the Super Puma will not be a “quick fix” for helicopter operators as it remains popular in other markets including defence, firefighting and private transport.

As a result, lead-times for the delivery of new aircraft are “likely to be in the order of at least 24 months”, he said.

Despite the delivery wait, Mr Robertson said North Sea operators will likely still be considering the Super Puma as a heavy lift option, as well as the upcoming Bell 525.

“Given the work that has been done by Airbus to understand some of the historic issues with the aircraft, coupled with the development of a new gearbox, it is likely that North Sea operators have been looking at it and keeping a close eye on developments,” he said.

Unions sceptical of Super Puma return

While Airbus executives have a positive outlook on the possible return of the Super Puma to the offshore sector, Mr Robertson said it would be a tough sell.

“The reality is that oil and gas communities in places such as Aberdeen and Bergen are relatively small communities where everyone knows each other, and an aviation accident can be devastating to them and is long remembered,” he said.

“Rotorcraft are highly complex machines and, whilst they are very safe, they very occasionally experience major issues in ways that had not been anticipated.”

“Airbus has done a lot of work to evolve the aircraft, and to demonstrate this positive evolution to helicopter operators… but the challenge will be convincing the labour unions in the UK and Norway.”

A representative from Industri Energi, Norway’s offshore union, told Energy Voice that while the union had liaised with Airbus on the Super Puma following the 2016 crash, there have been no official discussions or negotiations concerning its return to offshore service.

Industri Energi national officer Henrik Solvorn Fjeldsbø said Airbus had not yet completed all the recommendations made by the Accident Investigation Board of Norway.

“I don’t think that our members, the passengers, would accept being flown in the (Super Puma) 225, it’s as simple as that,” he said.

“Up until this day at least, we have an understanding with the oil and gas companies, the helicopter operators, that they’re not going to be using the (Super Puma).”

S-92 to remain North Sea ‘workhorse’

Mr Fjeldsbø said the union is holding discussions with offshore operators on new helicopter types, including super-mediums.

“There is ongoing work on that, but for the heavy (lift) parts, I think the S-92 is still going to be the workhorse in the North Sea and it’s going to be like that for the foreseeable future,” he said.

Mr Fjeldsbø said while Airbus is correct to say the Super Puma is currently the only other heavy helicopter option in the market for offshore operators, he doesn’t foresee there being sufficient need or those long-distance operations in the future.

“For the need that we have, the S-92 will be sufficient,” he said.

“I just don’t see it coming back to the Norwegian continental shelf and to be honest, I don’t even see it coming back in the UK.”

UK unions representing offshore workers have long been opposed to any suggestion of the Super Puma returning to the North Sea.

In 2017, Unite officials warned North Sea oil companies they would face a “battle with their workforce” over any plans to use the aircraft again.

Unite industrial officer John Boland told Energy Voice he believed Unite members would be “very concerned” if the Super Puma returned to the North Sea and said the union has had no recent discussions with Airbus concerning the helicopter’s safety.

Energy Voice contacted Airbus for comment but did not receive a response.

UK marks decade of helicopter safety

Earlier this year, the UK energy sector marked a decade without a fatal helicopter crash, although the sector has seen recent incidents involving the S-92.

But increasing demand for flights in oil and gas is coinciding with “rapid growth” in the UK offshore wind sector, which could see an extra 100 helicopters required by 2030.

With North Sea helicopter operators grappling with increasing financial pressures, the offshore energy sector is working to find a solution to ensure critical flights can continue.

Whether or not Airbus can convince energy firms operating in the North Sea that its Super Puma is part of that solution remains to be seen.

Recommended for you

© PA Archive/Press Association Images

© PA Archive/Press Association Images

© Supplied by Airbus Helicopters/B

© Supplied by Airbus Helicopters/B © Shutterstock / Photofex_AUT

© Shutterstock / Photofex_AUT

© Image: Lorette Fabre/Airbus

© Image: Lorette Fabre/Airbus