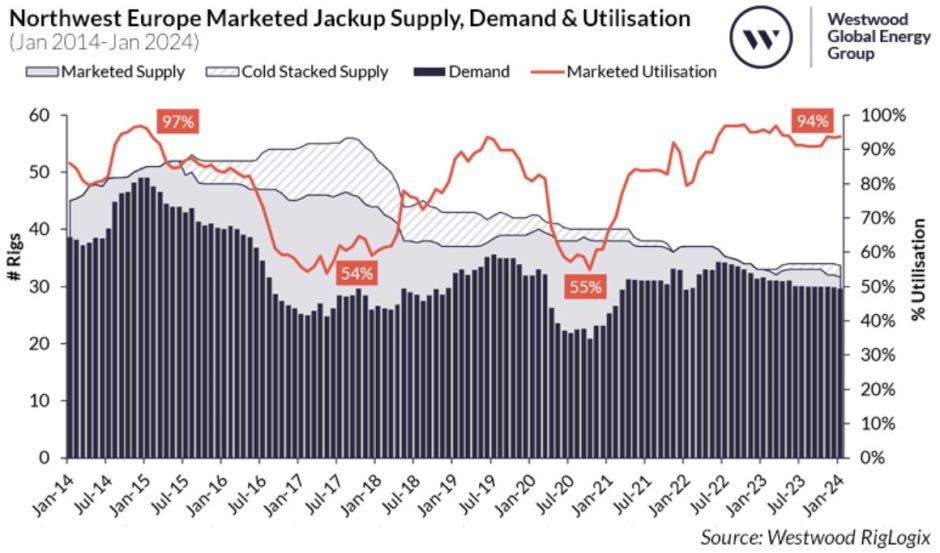

Use of North Sea oil rigs hit new highs at the end of 2023 as a stream of assets left for more lucrative and longer commitments elsewhere.

In an update published this week, Westwood Global Energy senior rig analyst Kathleen Gammack noted that utilisation hit 93%, with 30 rigs now committed out of a marketed supply of 32 units.

That contrasts with a low of 54% in February 2017, when 25 of 46 available units were working.

Between January 2018 and October 2021, a total of 18 units left the fleet and were either sold for non-drilling purposes, converted to Mobile Offshore Production Units (MOPUs) or scrapped.

Several more units have since relocated or been stacked and the past two months have seen five units complete offshore campaigns. All of these units have future work in place, but Ms Gammack notes that two have or are about to leave the region this quarter – namely the Shelf Drilling Perseverance and Valaris 247.

It follows a year of warnings by drilling contractors over the impact of tax policies and fiscal changes on the sector, with concerns that rigs will not return to the basin after securing work in regions like Australia and the Middle East.

A corresponding decline is seen in contract days with just 4,927 awarded in 2023, of which the bulk was for the UK sector (3,807 days) and Norway securing the least (303 days).

Rates ‘lagging behind’

Dayrates are trending upwards with increased demand, though in the North Sea these have stayed “lagging behind some other regions” she adds.

“Due to this and other contributing factors, including challenging tax regimes, the lack of certainty in the North Sea has driven drilling contractors to bid into regions offering longer duration programmes, often with higher dayrates.”

Westwood estimates that there are eight tenders yet to be awarded for work set to commence his year, representing around 1,178 days.

Three or possibly four campaigns are set to be contracted, she said, citing market sources. Work on ONE-Dyas’ two-well development drilling programme offshore the Netherlands, is “close to being awarded”, while early February saw Shell secure the Valaris 123 jackup rig for the Selene exploration well and Pensacola appraisal well.

One campaign is also being pushed into 2025, though two may also be deferred.

Just one drilling unit has free and clear availability from the end of Q1 2024, Ms Gammack says, though this is rumoured to be a frontrunner for one of the outstanding awards.

“Should extension declarations not materialise, or no new work get secured, a further seven units could become available but, for the most part, not until the second half of 2024,” she added.

Looking ahead, Westwood expects one as-yet unawarded tender for work in 2025 and 16 prospects that could represent just under 12 rig years, with development drilling (2,147 days), and well plugging and abandonment (P&A) (1,699 days) making up the majority of work on offer.

Jackup utilisation in the region is also strong – though again is largely due to an exit of units elsewhere – and expectations remain flat through the rest of the year.

“Drilling contractors, though keen to keep their harsh-environment units in the region, will undoubtedly be considering moving more rigs elsewhere if the contract term and economics make sense to do so,” Ms Gammack adds.

Westwood also warned that if further rigs leave for multi-year campaigns elsewhere there may not be enough capacity to fulfil some of the longer-term CCS and P&A campaigns, which could come to fruition from 2025 onwards.

As a result, a tightened supply and demand balance could result in a smaller pool of rigs to choose from and higher dayrates, all of which could make some of these campaigns uneconomic.

© Westwood Riglogix

© Westwood Riglogix