The newly-approved Green Volt wind farm could cut carbon and millions of pounds per year in fuel costs from one of the UK’s largest oilfields, according to new analysis.

Green Volt was approved this month as an INTOG (Innovation and Targeted Oil and Gas) round project from Flotation Energy – designed to decarbonise oil platforms with electrification.

The end users haven’t been named – but the project has been linked to Buzzard, operated by CNOOC and one of the largest oilfields off British shores.

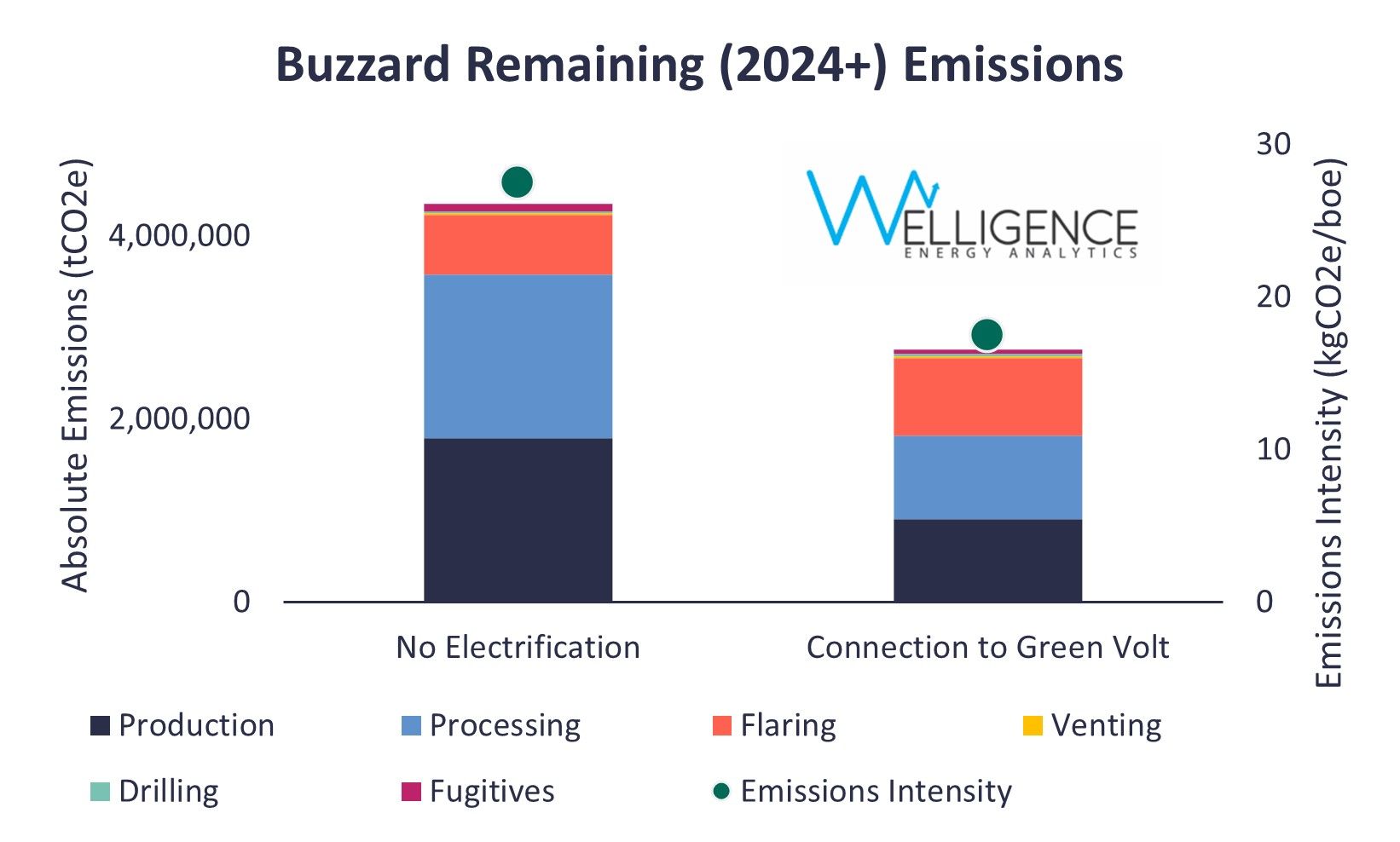

According to analyst firm Welligence, electrifying Buzzard through the 560 megawatt wind farm would cut the need for gas and diesel consumption by 80% and slash emissions by around 200,000 tonnes of CO2 per year.

That would mean fuel costs and carbon savings of $55m per year from 2029 and slashing Buzzard’s emissions intensity from 28kg per CO2 per barrel to 17 kg of CO2 per barrel.

Without electrification, Buzzard would have emissions in excess of 400,000 tonnes of CO2 per year.

Approved earlier this month, Welligence estimates Green Volt’s total project cost to be in excess of $2.6bn.

The project will be Europe’s first commercial scale floating windfarm, which developers claim will trigger up to £3bn investment and create hundreds of jobs.

Although supply chain benefits are expected, critics have highlighted the developers – Flotation Energy and Vorgronn – are Japanese-owned and Norwegian-owned respectively, so Scotland won’t have a share in the cash generated from power production.

It comes as oil and gas operators face stringent regulations under the new plans from the NSTA regulator to ensure every operational oilfield is electrified by the year 2030 or run on an alternative low-carbon power solution.

Operators have warned the move is likely to cut off investment and see numerous platforms shut down earlier than planned.

That comes as the UK is expected to require more oil and gas in coming years, with imports and demand outweighing domestic supply.

The Buzzard oilfield sits 62 miles north-east of Aberdeen.