EnergyPathways (AIM: EPP) has entered into a £5.1-million loan facility to develop its Marram Energy Storage Hub (MESH) project.

Luxembourg-based corporate financing platform Global Green Asset Financing (GGAF) will provide the funds over a three-year term.

The loan facility will support the MESH project through the FEED phase with a view to reaching a final investment decision at the end of 2025.

The loan terms come with a minimum commitment from the lender of £2.55m.

Drawdowns will be subject to GGAF raising further capital, which is currently underway. Drawdowns must commence during the final quarter of 2024, and will be phased in line with EnergyPathways’ planned use of funds on the MESH project to develop a fully decarbonised integrated natural gas and green hydrogen energy storage facility.

Interest on the loan is charged on drawn down amounts at a fixed rate of 12.5% per annum and is payable monthly.

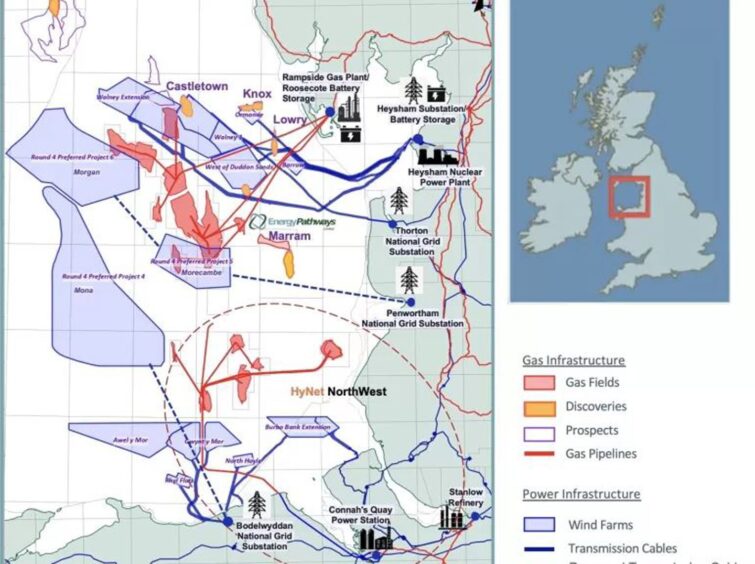

The MESH facility, located off the Lancashire coast, is being developed alongside EnergyPathways’ 35bcf Marram gas field.

The storage facility will have a capacity of around 50bcf of gas once completed, and will be used to store natural gas and hydrogen to supply the UK market.

MESH was originally planned to store natural gas produced from Marram, but EnergyPathways recently decided to focus on developing MESH project over Marram, moving straight to developing the storage side of the project.

CEO of EnergyPathways Ben Clube said: “This transaction demonstrates the strong investment appeal of EnergyPathways’ MESH project as a cleantech integrated energy infrastructure solution able to deliver reliable and decarbonised energy supply to the UK and its potential to deliver high yield infrastructure returns to investors over the project’s 20-year life.

“EnergyPathways has received a number of offers of financing, confirming the company’s view that its business model is well positioned to attract investment capital.

“The green loan facility, which offers good flexibility as well as access to minimally dilutive funding, demonstrates EnergyPathways’ commitment to financial discipline and delivering long-term shareholder value. EnergyPathways remains focused on developing additional cleantech and infrastructure financing solutions for the development of the MESH project.”