A trio of Australian oil and gas firms are pressing ahead with development work on UK North Sea projects despite a “challenging environment”.

Hartshead Resources (ASX:HHR), Finder Energy (ASX:FDR) and Triangle Energy (ASX:TEG) all hold UK production licences, with the three firms all seeing success in the 33rd oil and gas licensing round.

It comes as North Sea operators come to terms with changes to the windfall tax and potential limits on future drilling under the UK Labour government.

Hartshead Resources

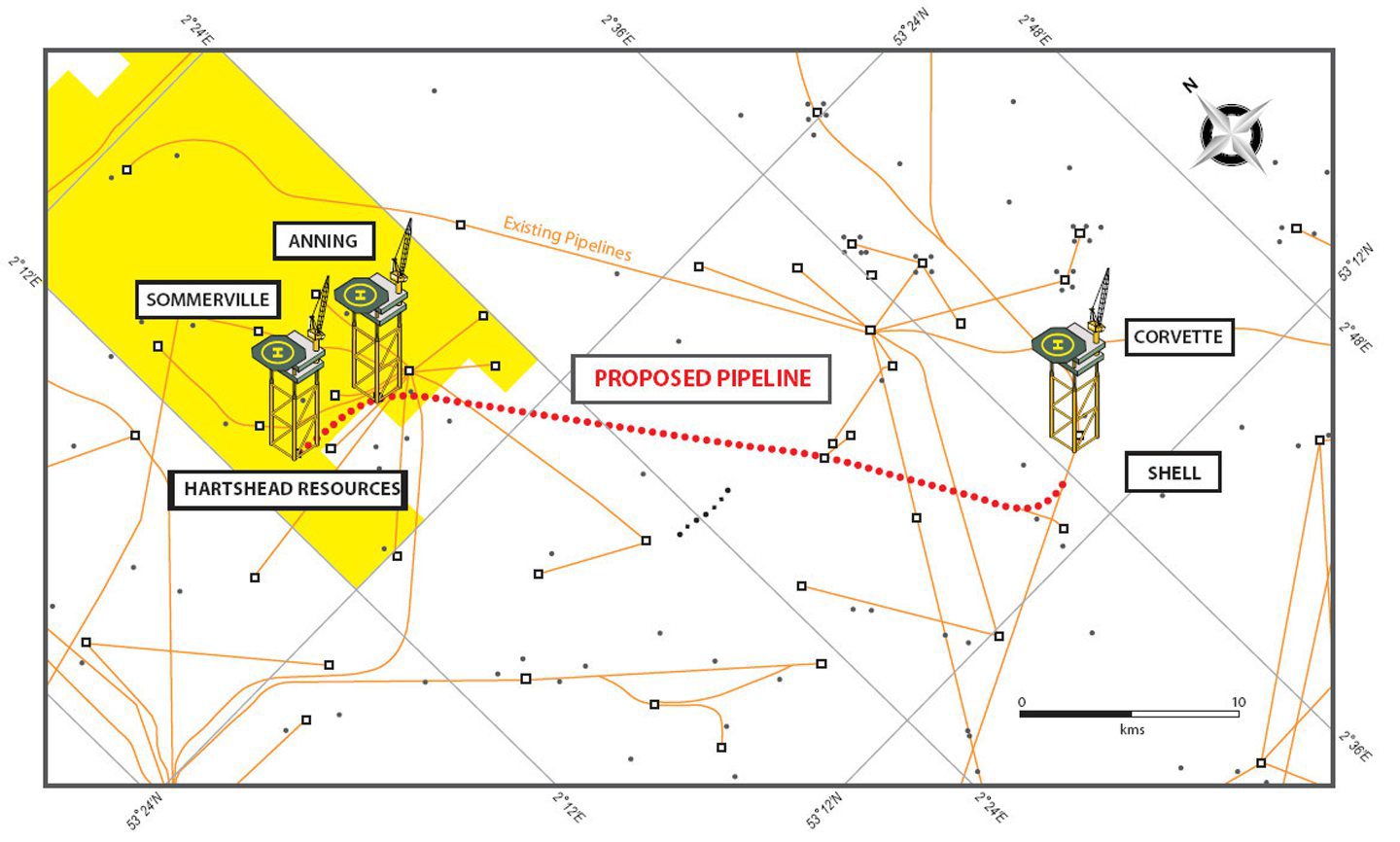

Perth-headquartered Hartshead is developing the Anning and Somerville gas project in the Southern North Sea (SNS), alongside the six licences it secured in the 33rd round.

Hartshead Resources chief executive Chris Lewis said the company remains “fully focused” on progressing its Anning and Somerville gas field project.

“We are pleased that certainty has been provided in relation to the fiscal policy for the oil & gas industry in the UK, and that the government has seen the vital important of retaining first year capital expensing and full capital allowances,” Lewis said.

Lewis said Hartshead is consulting with the North Sea Transition Authority (NSTA) regulator and its joint venture partner Viaro Energy on advancing the project through the field development stage and to a final investment decision.

Hartshead has also undertaken a “reassessment of the gas export route” for Anning and Somervile following, the company said.

“This work included a revised evaluation of an option that had previously been considered unavailable due to the circumstances at the time,” the company said in its quarterly statement.

“Recent changes in asset ownership and operatorship have seen this alternate route become promising as an alternate route to transport the Anning and Somerville gas to market.”

Last year, Viaro Energy a deal to acquire the Southern North Sea (SNS) assets of supermajors Shell (LON:SHEL) and ExxonMobil (NYSE:XOM).

Hartshead has previously looked at producing Anning and Somerville through a tie-back via the Shell-operated Corvette and Leman A installations.

In December, Hartshead said it met with Viaro to “assess project economics, export route options, and operational timetables” for the proposed gas project.

The company is also considering further exploration opportunities around the Anning and Somerville field which could “provide significant secondary economic value”.

Finder Energy

Meanwhile, fellow Australian operator Finder Energy is looking to secure partners to fund drilling activity across its portfolio of North Sea licences.

Finder said it is focused on short-cycle infrastructure-led opportunities that benefit from existing nearby production infrastructure.

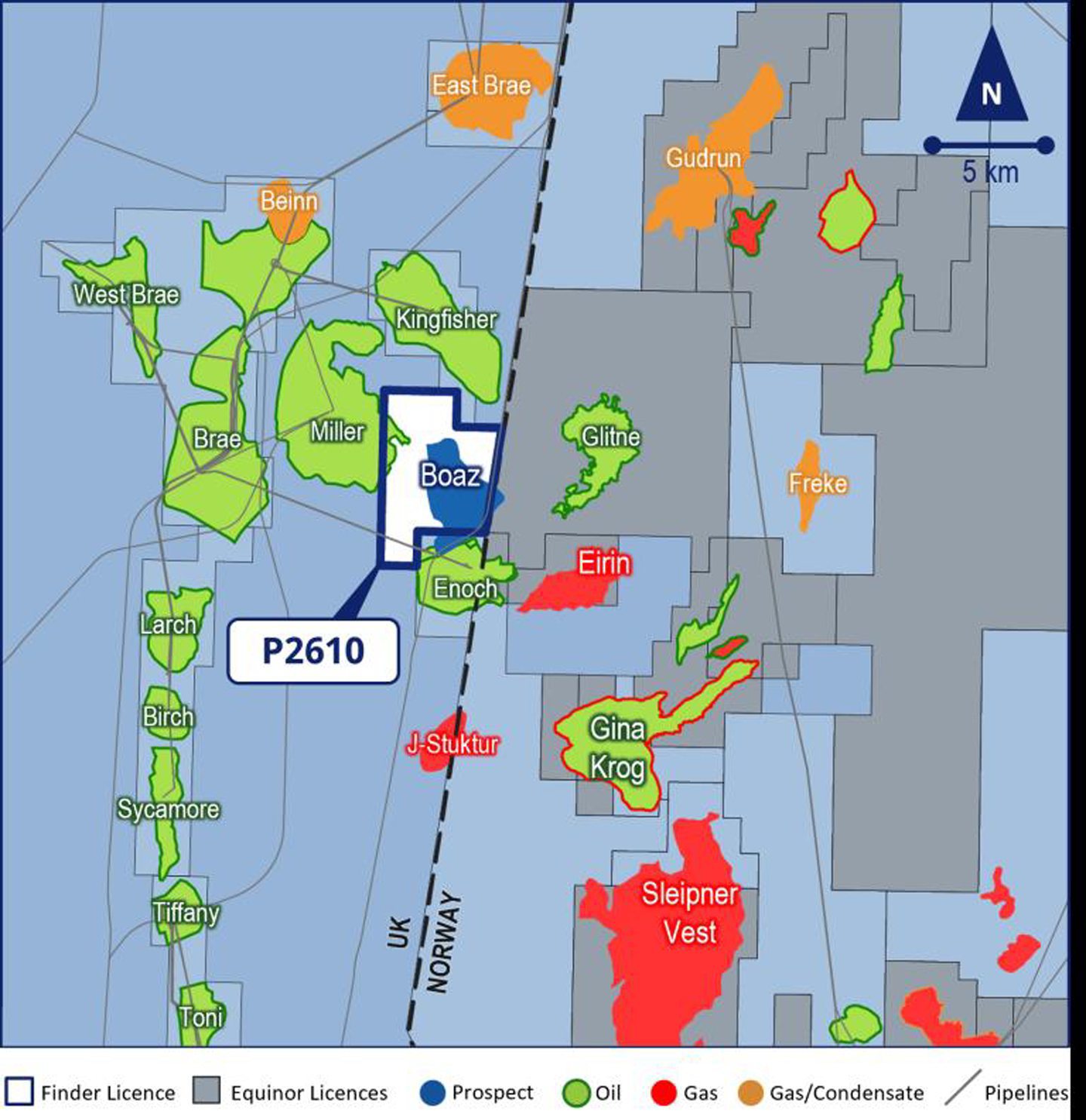

This includes its Boaz prospect located near the border between the UK continental shelf and the Norwegian continental shelf.

Finder holds a 50% stake in the P2610 licence containing the Boaz field alongside Norwegian operator Equinor.

The field is close to Equinor’s Gina Krog platform, and Finder said it expects “key wells” to be drilled in Norwegian waters adjacent to P2610.

Gina Krog drilling activity

Equinor is “aggressively pursuing gas exploration in the area to tie into their Gina Krog and Sleipner production facilities”, Finder said.

“Success in those updip wells has the potential to significantly de-risk Boaz, which will facilitate and add value to future farmout efforts to secure funding for a well to test the Boaz Prospect.”

Elsewhere, Finder is progressing a project to reprocess seismic data at its P2655 licence in the Outer Moray Firth.

The P2655 licence contains the Big Buzz prospect, which is close to Chinese operator CNOOC’s Golden Eagle and Buzzard platforms.

While Finder is “continuing to maintain farmout efforts”, its strategy is “hampered by the current political and investment conditions in the UK”, the company said.

Finder said this has “negatively impacted the industry and investment” and created a “challenging environment”.

The Perth-headquartered firm also holds a 60% stake in two licences alongside Dana Petroleum.

The P2530 licence is located near the Kittiwake field, while the P2656 licence sits just south of Finder’s P2655 and close to the Buzzard platform.

Meanwhile, Finder confirmed it has decided not to progress the Whitsun project as part of the P2528 licence, which it secured in 2021.

Finder farmed out 40% of the Whitsun licence to Dana Petroleum in 2022, but the joint venture partners decided to let the field licence expire in November.

Triangle Energy

Finally, Triangle Energy is continuing evaluation of its stakes in two UK North Sea licences.

The Perth-based company is partnering with Orcadian Energy (AIM:ORCA) on the Mid-North Sea High licence, which it secured in the 33rd licensing round.

Triangle also holds a 50% non-operated interest in the P2628 licence in the West of Shetland area alongside Athena Exploration.

The licence contains the Cragganmore gas field, with contains an estimated 527 billion cubic feet (Bcf) of gas.

Athena has previously outlined plans to establish a new production hub in the West of Shetland, while Triangle is targeting a possible future deal with Shell.

The London-listed supermajor holds interests in the nearby Tobermory and Bunnehaven gas fields.

© Supplied by Hartshead Resources

© Supplied by Hartshead Resources © Supplied by Finder Energy

© Supplied by Finder Energy