North Sea operator Hartshead Resources (ASX:HHR) has submitted a revised gas offtake route for its Anning and Somerville development to the UK regulator.

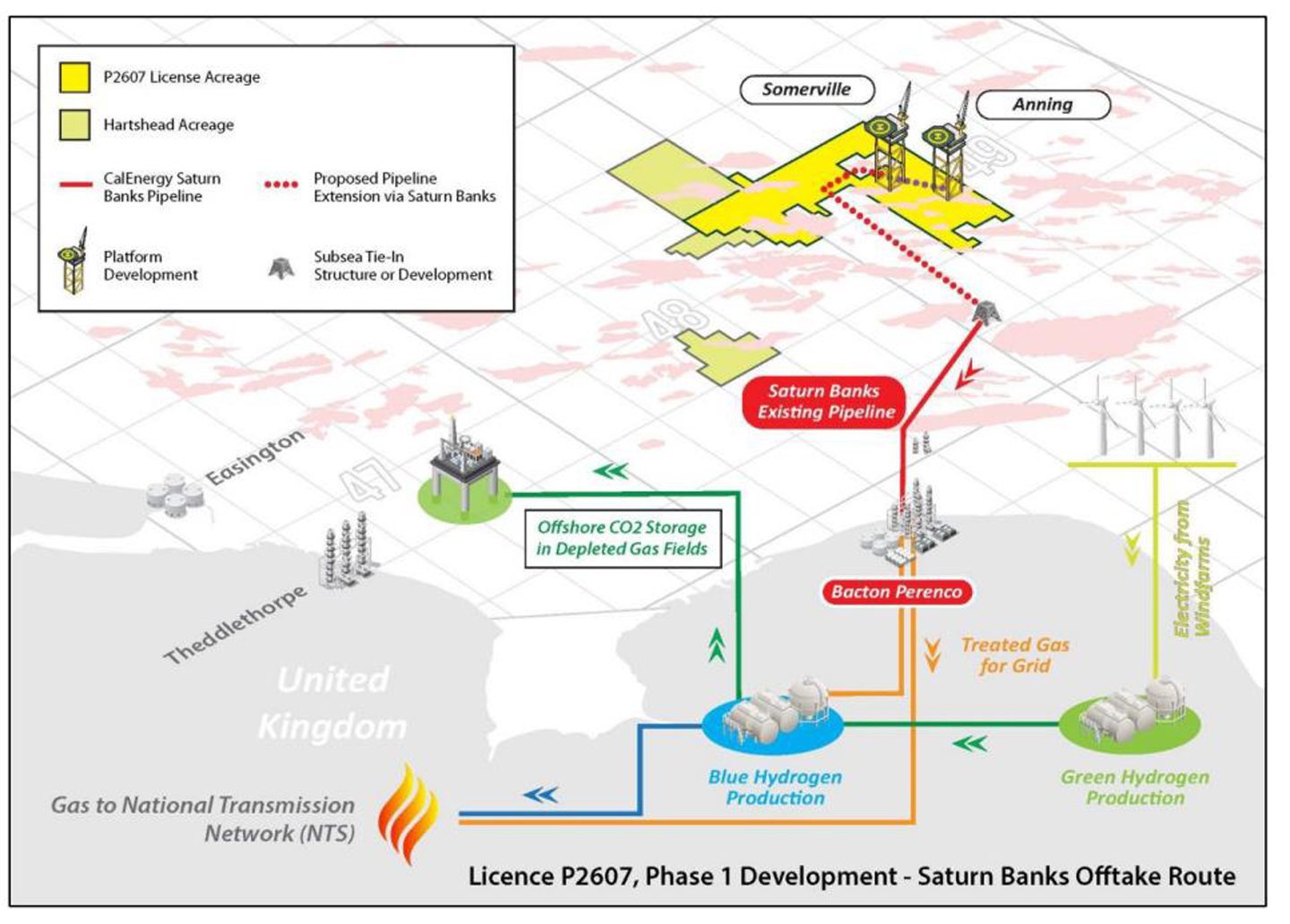

Hartshead said the selected export route now ties into the CalEnergy Resources owned and operated Saturn Banks pipeline system.

The Saturn Banks system was previously owned and operated by independent IOG, which went into administration in 2023.

The project will then transport gas to the Perenco owned and operated Bacton Terminal on the Norfolk coast for processing and entry into the UK grid.

The Perth-based firm said the project economics are “significantly enhanced” by the new route through reduced anticipated capital expenditure.

Previously, Hartshead had proposed a gas offtake route via the Shell-operated Corvette and Leman Alpha installations in the Southern North Sea (SNS).

The Australian firm holds a 60% interest in the P2607 licence comprising the Anning and Somerville gas fields.

Hartshead estimates the fields have combined 2p reserves of just over 300 billion cubic feet (Bcf) of gas.

The operator farmed out a 40% stake in Anning and Somerville to Viaro Energy subsidiary RockRose Energy in 2023 in a £105 million deal.

Since then, Viaro has provided a “financing backstop” worth A$800 million (£415m) to progress the first phase of the project after Hartshead encountered financial difficulties.

In July last year, Viaro also agreed a deal to acquire the SNS assets of Shell and ExxonMobil, including the Corvette and Leman Alpha assets.

Anning and Somerville offtake route

Hartshead said the “far superior” offtake route via the Saturn Banks pipeline system holds significant advantages over the previous route.

This includes increased production volumes capacity, accelerated production, a simpler tie-in to host infrastructure and superior economic performance.

In addition, Hartshead said the new route will lead to the earliest projected first gas date for the development.

Hartshead is “in advanced discussions” regarding capital investment for pipeline infrastructure associated with the development, the company said.

This includes the potential for 100% funding for the extension of the existing Saturn Banks pipeline to the Anning and Somerville field development area.

“Potential for re-use of other existing infrastructure, such as the re-purposing of

an existing production platform, is also being investigated and progressed,” Hartshead said.

“This platform re-use is also the subject of infrastructure funding discussions.”

The operator said discussions regarding commercial and technical specifics for transportation and processing of gas are “progressing well”.

Hartshead Resources

In its most recent quarterly update, Hartshead Resources chief executive Chris Lewis said the company remains “fully focused” on progressing its Anning and Somerville gas field project.

“We are pleased that certainty has been provided in relation to the fiscal policy for the oil and gas industry in the UK, and that the government has seen the vital important of retaining first year capital expensing and full capital allowances,” Lewis said.

The company is also considering further exploration opportunities around the Anning and Somerville field which could “provide significant secondary economic value”.

Recommended for you

© Supplied by Hartshead Resources

© Supplied by Hartshead Resources