More oil and gas companies are at risk of being left to pick up a defunct partners’ decommissioning liabilities due to this year’s downcycle, new analysis indicates.

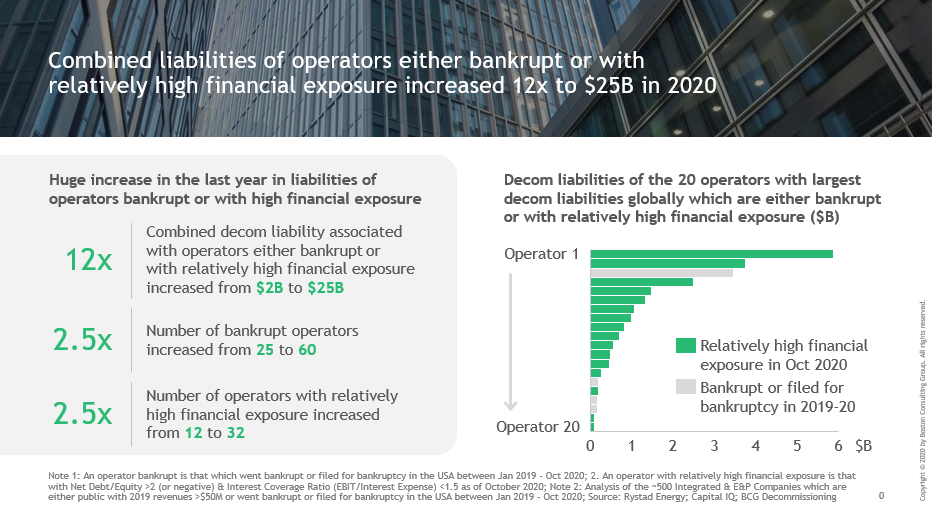

Boston Consulting Group (BCG) said the number of bankrupt operators had risen to 60 from 25 globally in the last year.

Thirty-two companies now have relatively high financial exposure, compared to 12 a year ago.

It means the combined decommissioning liabilities of operators either bankrupt or facing high financial stress relative to peers increased this year to $25bn from $2bn.

If these operators default, five companies and five countries could each be at risk of absorbing more than $1bn of spend as a result of liabilities flowing back to equity partners, past owners or to the state, depending on local regulation.

BCG flagged heightened concerns about some firms’ ability to cover their decommissioning obligations in April.

Seven months later, BGC said its latest analysis indicated its warning held true.

In the UK, liability reverts to any joint or previous asset owners if an operator becomes insolvent or lacks the financial resources to carry out decommissioning.

If none exist, then the liability falls to the government.

In January 2019, the National Audit Office predicted HMRC would end up refunding operators £12.9bn in decommissioning tax reliefs.

Under the Decommissioning Security Agreements system, companies can be required to deposit cash or another type of security, such as a letter of credit, into a trust.

If a company folds before carrying out its decommissioning obligations, the money can be used to cover its share.

As of November 2019, the UK Government had amassed around £850 million worth of financial security.

The UK oil and gas industry is engaged in a quest to lower predicted decommissioning spend by 35%, from almost £60bn to fewer than £40bn.

The OGA set the target in June 2017 and aims to achieve the forecasted reductions by 2022.

Two years into the mission, the halfway point had been reached, with costs down 17% to £49bn on a like-for-like basis, which did not factor in new or planned infrastructure projects sanctioned.

In August 2020, the OGA said a further 2% had come off the sticker price for UKCS decommissioning.

Recommended for you