The decommissioning bill for NEO Energy’s newly-acquired Exxon Mobil assets in the UK has been estimated at $1.1billion (£795m).

Neo announced a deal to acquire a package of assets in the Northern and Central North Sea from Exxon last month for $1bn (£707m on 24.2.21), the majority of which are non-operated stakes.

Neither firm disclosed the decommissioning liabilities, nor whether the share will be split, as has been the case with other UK deals.

Russell Alton, CEO of NEO, said at the time it was a “manageable profile” of cost.

Yvonne Telford, senior analyst at Westwood Global, said keeping things confidential is a regular feature of UK deals, but shed some light on what the size of the price could be.

She said: “Westwood estimates that the future decommissioning expenditure associated with the acquired assets by NEO Energy from ExxonMobil are approximately US$1.1 billion, real and undiscounted.

“As is common with many UK transactions, the terms of the decommissioning liabilities are regarded as confidential by the buyer and seller and therefore the split for the liabilities is not known.

“The total cost does not include future decommissioning tax liabilities which could range from 50% to 75% dependent on the asset and will reduce the net abex (abandonment expenditure) provisions.”

The tax regime in the UK allows firms to carry back tax losses from previous years against part of a firm’s decommissioning costs.

The addition of transferable tax history in the UK means NEO could use Exxon’s tax record to offset part of any liability they face.

Although some of the $1.1billion is expected this decade, abex is not expected to ramp up until post-2030 for these Neo assets, Ms Telford said.

In August, Wood Mackenzie issued analysis of the top decom spenders for the UK of the decade to 2030, with Exxon coming seventh at £800m.

Ms Telford, of Westwood, noted that the NEO deal does not cover Southern North Sea assets or some ceased fields currently being decommissioned, such as stakes in the Brent, Curlew and Goldeneye projects.

The assumption, therefore, is that Exxon has retained those liabilities, making up a share of that £800m expected between 2020-2030.

Last month, NEO CEO Russell Alton said: “What we see is a set of assets with quite a long life to it and when we look at decommissioning liabilities, there’s not very much in the near-term.

“So we’ve got a very manageable profile of decommissioning within the transaction.”

NEO has been asked to comment further on the new analysis.

Another analyst firm keeping a close eye on UK decom is Boston Consulting Group.

Partner Philip Whittaker and associate director Martha Vasquez said: “Although we have seen a number of innovative deal constructs around decom in UK M&A, no specifics have been released with this transaction – so we assume a fairly traditional transfer of liabilities.

“However, differing views on decom liabilities – along with tax position – have been one of the key enablers of recent UK transactions, and will no doubt be one element of NEO’s value creation plan for the acquired assets.”

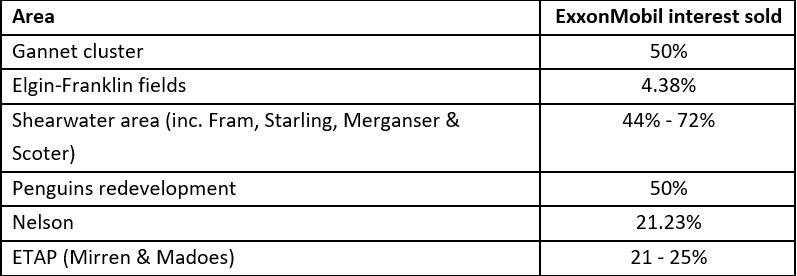

The deal, expected to close in the middle of 2021, covers stakes in 21 assets, including 14 producing fields and a number of infrastructure positions, mainly operated by Shell.

It provides NEO with interests in major producing hubs including the Shearwater area and the new Penguins redevelopment due to come online next year.

© Neo Energy

© Neo Energy