Harbour Energy has confirmed it plans to “re-phase” up to $100 million per year of decommissioning spend in the wake of the windfall tax.

In its annual report published last week, the UK’s largest producer reaffirmed plans to reduce its UK capital expenditure in light of the Energy Profits Levy (EPL) with “certain investment opportunities delayed or no longer being progressed.”

Harbour (LON:HBR) said it had now “re-phased certain decommissioning activities” with a view to spending around $200-250 million per year in the near term, compared with previous forecasts of $300 million per year.

Alongside this, it restated plans for “a significant reduction” in its UK workforce.

A vocal critic of the windfall tax, Harbour said the measures have “wiped out” its 2022 profits and it would now look away from the UK to areas such as Southeast Asia and Mexico for portfolio development.

Spending pushed to 2025

Its decom strategy aligns with an assessment by oil economist Professor Alex Kemp, who last year suggested one side effect of the EPL would be the prioritising of spending on new field developments over decommissioning because of the structure of its investment allowances.

“Also, note that, when there is a requirement on an operator to provide a bank guarantee for the decommissioning liability, the effect of the EPL, by reducing industry net cash flows, means that the size of the fee payable to the bank will increase,” he told Energy Voice.

He said the effect would likely mean a chunk of UK decommissioning activity would be to some extent postponed until after 2025.

It also chimes with forecasts by trade body Offshore Energies UK, which sees around £20bn spent on decom over the next decade.

The latest Decommissioning Insight report expects an “upsurge” in spending from £1.3bn in 2021 to around £2bn per year through to the end of 2024 due to cost inflation and a post-Covid boom.

Indeed, the organisation recently warned of a major crunch of skills and resources as oil and gas decommissioning and offshore wind installation compete for similar skills and assets during a jam-packed 2024.

However, OEUK also expects a tail-off as expenditure is increasingly moved into the late 2020s or the next decade, in part due to “uncertainties” surrounding the effects of the EPL.

Expenditure is expected to rise again after 2028, and from 2030 is predicted to exceed £2bn per year.

$300m spend in 2022

Harbour’s annual report notes a sizable decrease in its overall decommissioning provision, down from $5.4bn in 2021 to $4.1bn in 2022.

It said the reduction is primarily due to an increase in the risk-free rate used in its estimate, as well as currency changes and changes to cost estimates.

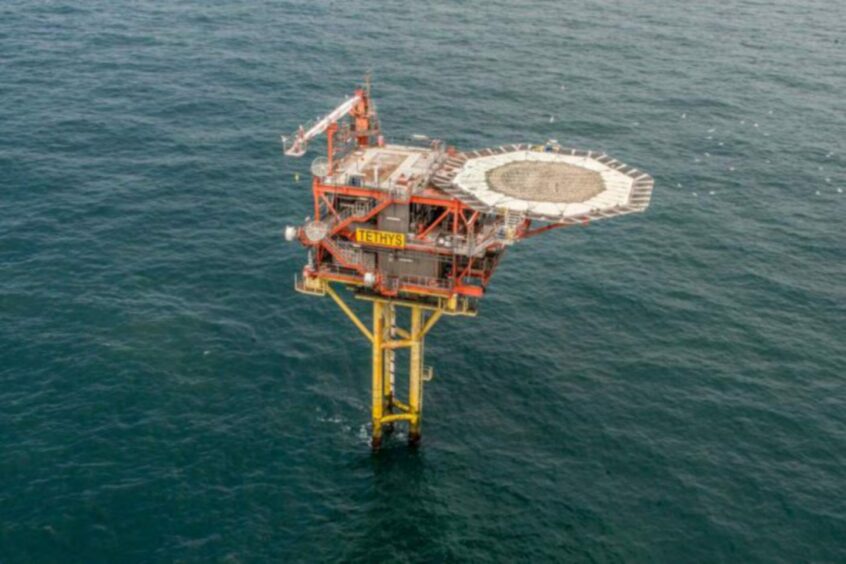

Roughly $300m was spent last year, with the firm successfully removing the Murdoch complex as well as four satellite platforms from the Lincolnshire Offshore Gas Gathering System (LOGGS).

Subsea equipment was removed from the Balmoral area in preparation for well plug and abandonment (P&A) while dismantlement of the Balmoral Floating Production Vessel remains ongoing, it said.

A southern North Sea campaign to decommission legacy ConocoPhilips infrastructure is also expected to complete next year. This will conclude a 10-year programme, involving the P&A of 145 wells, removal and recycling of 38 platforms and cleaning and flushing of over 900 miles of pipeline.

Around a dozen V-field assets from Harbour’s southern North Sea portfolio have already been dismantled in recent years.

Meanwhile, the group awaits further news on the government’s Track 2 carbon capture process which would see government support offered to two major CCS schemes in which it is involved, the Acorn project in Scotland’s north east and Viking in South Humber.

Provided that funding is forthcoming, Harbour hopes to make a final investment decision on both schemes by 2024, ahead of start-ups in 2027.

Recommended for you