Jersey Oil and Gas is making “great progress” in its quest to find a partner for the Greater Buchan Area (GBA) redevelopment.

The North Sea firm says it is “actively engaged” with multiple counterparties, while studies to identify a development solutions are “now at an advanced stage”.

Providing an update as part of its half-year results, Jersey said its current focus is completing studies to “validate and de-risk” the different solutions for the GBA.

Technical work on the project is expected to wrap up next month, and while Jersey says there “can be no certainty of a successful conclusion”, it stressed constructive commercial discussions are now well underway.

The company previously said it expects to complete the field development plan and take a final investment decision on the GBA next year.

An FID had been estimated in 2022, but Jersey (LON: JOG) reset the timeline in order to allow time for electrifications studies.

Electrification

It has made progress on that front, and revealed that all the solutions on the table for the GBA will be able to tap into power from the Outer Moray Firth offshore wind plans.

The development is currently being considered as part of INTOG leasing round process.

Andrew Benitz, chief executive of Jersey, said: “Great progress is being made with our GBA farm-out process – the key activity for the Group in 2022. Interest is strong, technical studies across the various development solutions are well advanced and commercial discussions are ongoing with serious, well-funded counterparties.

“Since launching the process, the Company’s engagement strategy has been broadened to advance a range of competing development solutions, thereby providing increased optionality.”

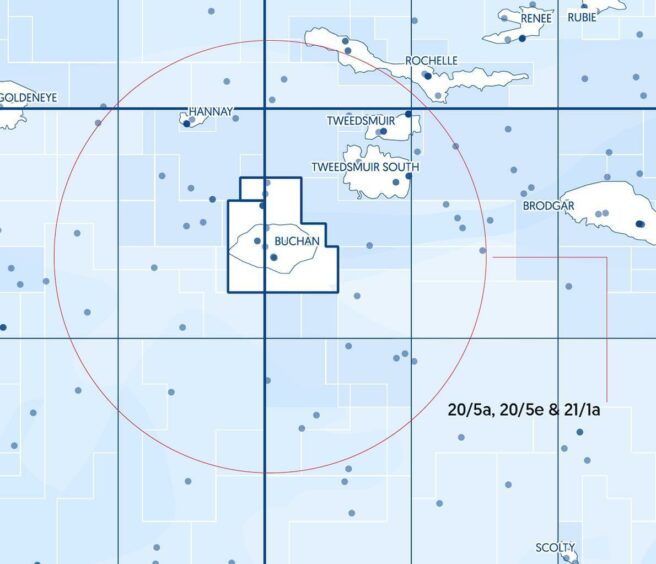

The GBA comprises the Buchan oilfield, as well as the J2 and Verbier oil discoveries.

It boasts estimated gross 2C economic resources of 162 million barrels of oil equivalent (mmboe), making it one of the biggest pre-FID developments in the UK North Sea.

Windfall tax a boon

It is an opportune time to be planning a new North Sea project, with a “generous investment allowance” currently in place for firms.

While Jersey says the windfall tax caught the industry “off guard”, it hailed the tax relief as a “silver lining”.

The mechanism is designed to attract capital spend on new projects to increase North Sea oil and gas flows.

“Projects of the scale of the proposed GBA development should benefit from this investment allowance,” Jersey said.

Half-year results

For the first six months of 2022 the company has reported losses of £1.19 million, almost identical to 2021’s figure of £1.92.

Given it currently has no producing assets Jersey’s revenue remains zero.

The company remains bullish though, and believes the GBA is a “vital resource” in the drive to address energy supply shortfalls.

Jersey said: “We look forward to concluding the farm-out process and thereby securing investment to take this project into development and contributing to ensuring long term energy supply and security for the UK economy.”

Ashley Kelty, and oil and gas analyst at Panmure Gordon, said: “Jersey continues to try and secure a partner for the GBA hub development, with favourable macro backdrop and increasing focus on domestic energy security making the chances of success much greater.

“A number of parties are in the data room and are undertaking diligence. While the imposition of the 25% EPL was a blow to the sector, the generous investment reliefs makes projects such as GBA more attractive to offset the impact of the EPL for companies with production.

“We believe a partner will be secured in the near term, but the terms of any farm-in will be key.”

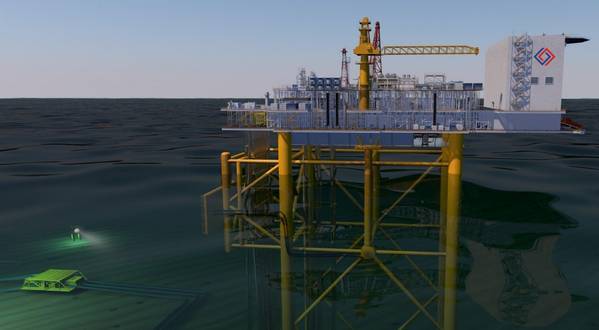

© Supplied by Jersey Oil and Gas

© Supplied by Jersey Oil and Gas © Supplied by Jersey Oil and Gas

© Supplied by Jersey Oil and Gas