The North Sea Transition Authority (NSTA) has issued 31 new exploration licences as part of the third tranche of its latest Licensing Round, with firms including Hartshead Resources, Neptune Energy and Perenco UK among the winners.

The NSTA said the licences offered in the latest round are expected to add an estimated 600 million barrels of oil equivalent (mmboe) up to 2060, or 545mmboe by 2050.

The release of the third tranche follows the awarding of 27 licences in the first tranche in October last year, and 24 licences awarded in the second tranche in January.

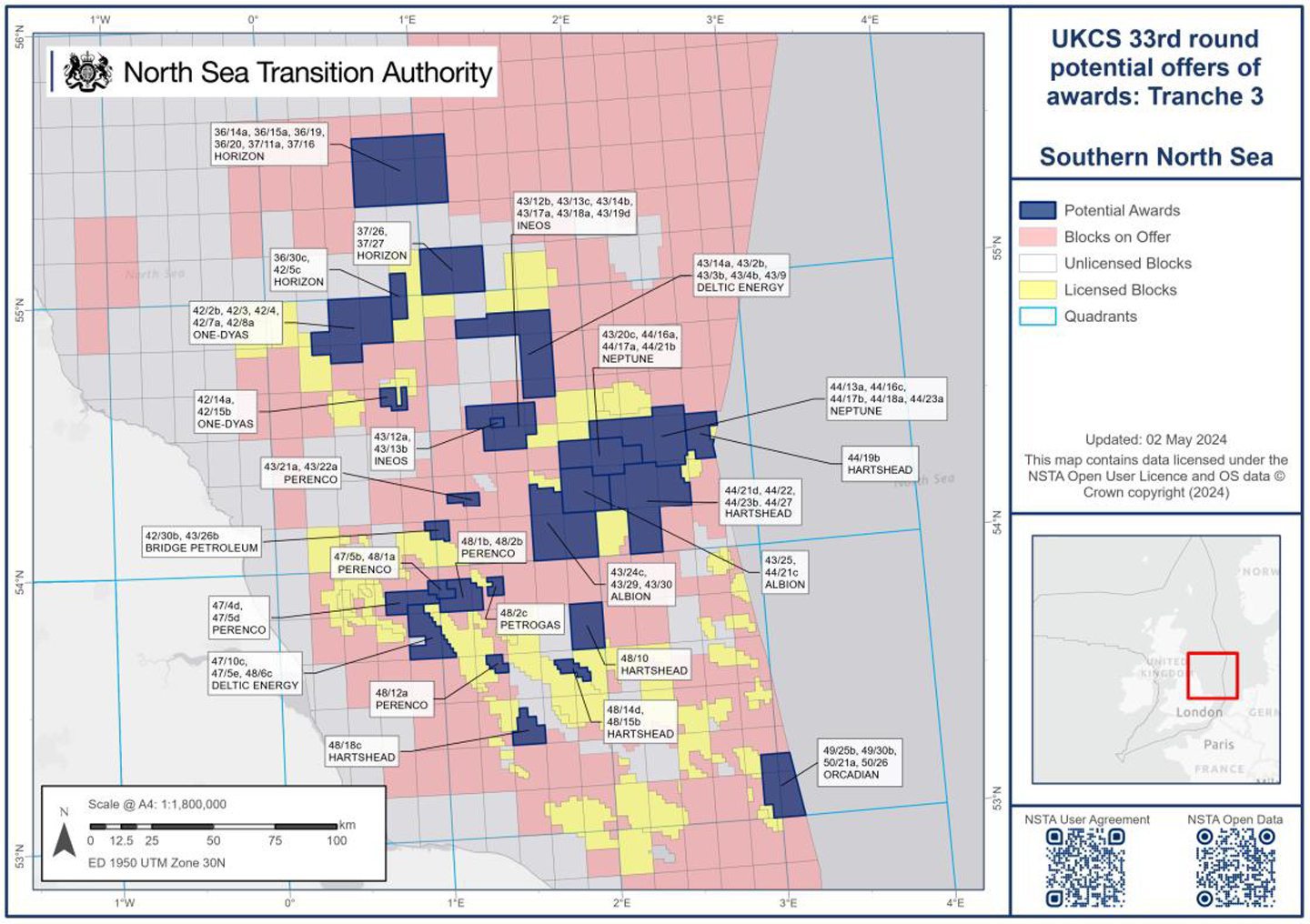

A total of 19 companies have been offered licences in the third tranche, spanning some 88 blocks and part-blocks in the Southern North Sea, Central North Sea and East Irish Sea.

Australian firms Finder Energy and Hartshead Resources were two of the biggest winners from the third tranche, with Finder scooping up 12 blocks across two licences.

Meanwhile, Hartshead secured 10 blocks across six separate licences.

33rd Licensing Round

Other big winners included Horizon Energy Partners, Neptune – part of Italy’s Eni, Perenco UK, INEOS UK SNS and ONE-Dyas.

Shell was the only one of the supermajors featured in the latest tranche, partnering with Dutch firm ONE-Dyas on two licences covering six blocks in the Southern North Sea.

The NSTA said the 31 offers in the final tranche are made up of 29 new licences and two merges of existing licences.

Of the 29 new licences, 23 are Initial Term Phase A or B, two will be Initial Term

Phase C (firm wells), and the remaining four will go straight to Second Term,

meaning they can theoretically go into production more quickly.

The NSTA said Phase A is a period for carrying out geotechnical studies and geophysical data reprocessing; Phase B is a period for undertaking seismic surveys and acquiring

other geophysical data; and Phase C is for drilling.

Southern North Sea

The majority of licences awarded in Tranche 3 of the 33rd NSTA Licensing Round are mainly focused on gas extraction and are located in the Southern North Sea.

The NSTA awarded licences to operators covering the following blocks:

- Albion Energy: 43/24c, 43/29, 43/30 & 43/25, 44/21c

- Bridge Petroleum: 42/30b, 43/26b

- Deltic Energy: 43/2b, 43/3b, 43/4b, 43/9, 43/14a & 47/5e, 47/10c, 48/6c

- Hartshead Resources: 48/10 & 48/14d, 48/15b

- Hartshead Resources (with Comtrack): 48/18c

- Hartshead Resources (with Meridian Resources UK): 44/19b & 44/21d, 44/22, 44/23b, 44/27

- Horizon Energy Partners (partnering with Reabold Resources on one licence): 37/26, 37/27 & 36/30c, 42/5c & 36/14a, 36/15a, 36/19, 36/20, 37/11a, 37/16

- INEOS UK SNS (partnering with ONE-Dyas): 43/12a, 43/13b & 43/12b, 43/13c, 43/14b, 43/17a, 43/18a, 43/19d

- Neptune Energy: 44/13a, 44/16c, 44/17b, 44/18a, 44/23a

- ONE-Dyas (partnering with Shell UK): 42/2b, 42/3, 42/4, 42/7a, 42/8a & 42/14a, 42/15b

- Orcadian Energy: 50/21a, 50/26, 49/25b, 49/30b

- Perenco UK: 43/21a, 43/22a & 47/5b, 48/1a & 48/1b, 48/2b & 48/12a

- Petrogas: 48/2c

Australian firm Hartshead Resources is one of the big winners of the 33rd licensing round, coming away with nine blocks in the Southern North Sea across five licences (including two with Merdian Resources and one with Comtrack.

Hartshead is currently progressing its development at the Anning and Sommerville hub in the SNS, but the project has been hit by uncertainty due to the political wrangling over the windfall tax.

Other big winners in the SNS area include Deltic Energy, Horizon Energy Partners, Ineos UK SNS, Ocradian Energy, Perenco UK and Neptune Energy.

North Sea newcomer

The awardees also include North Sea newcomer Albion Energy.

According to the Jersey-based firm’s website, Albion has discovered close to 1.2 billion barrels of oil equivalent and realised close to $2 billion net in asset sales.

Started in 1992 by Heritage Oil founder Tony Buckingham, Albion has primarily focused on assets in Africa and the Middle East with operations in Angola, Ghana, Republic of Congo, Uganda, Tanzania, Iraqi Kurdistan, Pakistan and Papua New Guina.

The list of licensees also marks the return of Cyprus-based Comtrack UK to the North Sea.

According to the firm’s website, Comtrack has previously been involved in North Sea oil and gas operations as a major shareholder of Scotsdale Ltd.

Founded in 2004, Scotsdale acquired interests in North Sea licences in the UK, Danish and Dutch sectors before the company was sold in 2008.

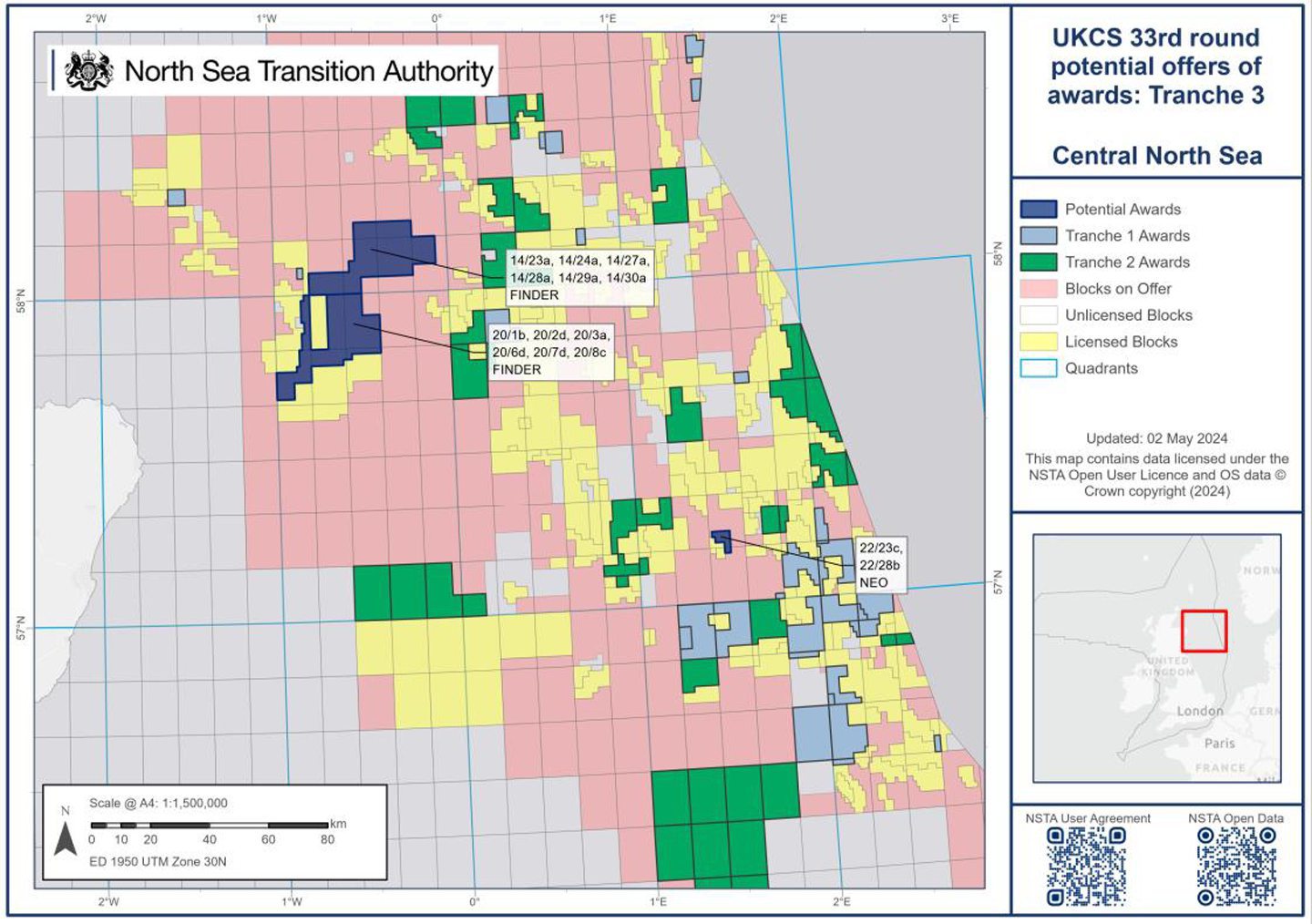

Central North Sea

Further north, the latest tranche of NSTA 33rd licensing round sees three companies awarded 14 blocks in the Central North Sea area, including:

- Finder Energy: 14/23a, 14/24a, 14/27a, 14/28a, 14/29a, 14/30a

- Finder Energy (with Dana Petroleum E&P): 20/1b, 20/2d, 20/3a, 20/6d, 20/7d, 20/8c

- NEO Energy: 22/23c, 22/28b

Based in Perth, Australian firm Finder Energy’s latest awards add to its existing four production licences in the Central North Sea, including a potential 150 million barrel field near to the Buzzard project.

Finder also maintains 100% interests in two licences on the North West Shelf off the coast of Western Australia.

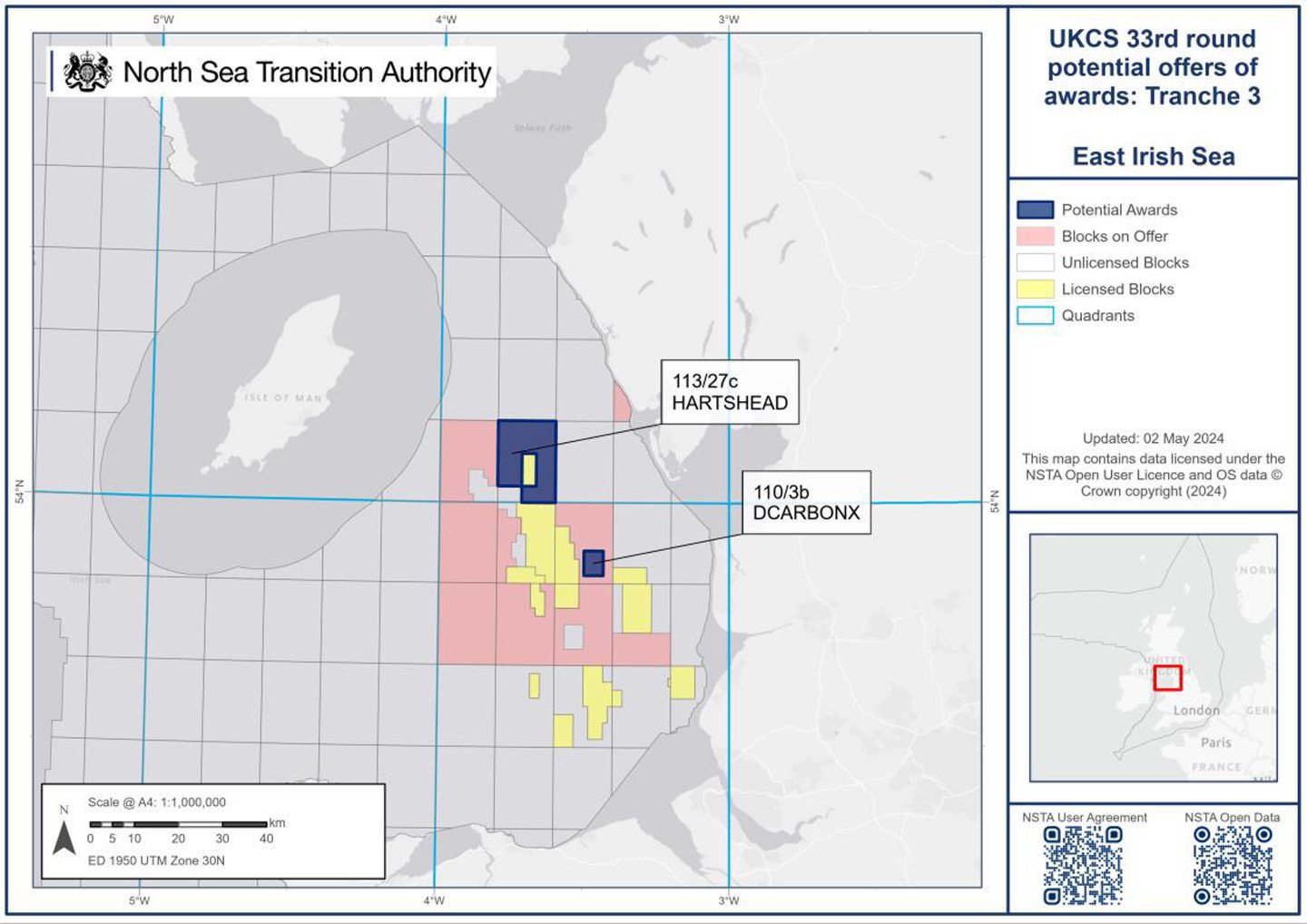

East Irish Sea

The final area included in the third tranche covered two blocks in the East Irish Sea awarded to two firms, including:

- Hartshead Resources (with Comtrack): 113/27c

- DCarbonX: 110/3b

Based in London and Dublin, subsurface storage start-up DCarbonX already holds a gas storage licence in the East Irish Sea at the depleted Bains field.

The firm is also progressing plans for its Gateway Project, which aims to repurpose offshore salt caverns for potential future hydrogen storage.

North Sea remains a ‘vibrant home for exploration’

Announcing the latest tranche of licences, the NSTA said the North Sea remains a “vibrant home for exploration”.

The NSTA said the total number of awards in the 33rd round are “broadly similar” to the previous two rounds.

The 33rd licensing round saw a total of 82 offers to 50 companies from a total of 115 bids from 76 companies across 257 blocks and part-blocks.

Meanwhile, the 32nd licensing round in 2020 offered 113 licences over 260 blocks or part-blocks to 65 companies, while the 31st round in 2019 (which focused on frontier areas) offered 37 areas over 141 blocks and part-blocks to 30 companies.

New clause for wind lease overlap

The NSTA also said that following discussions with The Crown Estate and Crown Estate Scotland, the regulator has introduced a new clause for overlapping oil and gas licences and wind leases for the first time.

“This will be the main commercial mechanism for these licences to resolve spatial overlaps and to support co-existence of these important industries,” the NSTA said.

The announcement follows a story in The Guardian yesterday which included criticism of the UK government from environmental campaigners for allowing oil and gas exploration in areas covered by offshore wind leases.

A spokesperson for the NSTA said: “The granting of an exploration licence does not eliminate the use of that area for offshore wind, and we wholly support the use of offshore wind as a means of power generation.

“The NSTA has worked closely to manage any potential overlaps and for the first time have agreed a new co-location clause which means that for any activity to take place oil and gas operators will have to come to an agreement with wind lease holder on how to proceed before further permission for activity is granted.

“It is possible for different activities to take place in the same areas through early engagement and coordination, careful sequencing of activities, and deployment of specific technology.”

In addition, the licences announced today may not be the last awarded in the 33rd licensing round, with the NSTA saying further consideration is being given to a small number of remaining applications and “a few more licences may be offered at a later date”.

OEUK welcomes focus on gas extraction

Offshore Energies UK (OEUK) welcomed the new North Sea licences, which it said will “strengthen every sector in the UK”.

OEUK said the licences will strengthen UK energy security and business confidence “as the expansion into wind, hydrogen and carbon capture and storage accelerates”.

According to OEUK, the large gas-focused licences have the potential to come on stream within the next five years.

OEUK argued the licences will make the UK less reliant on imported gas with greater carbon intensity.

The organisation’s chief executive David Whitehouse said the licences will help to “protect jobs” and power and heat UK homes and businesses.

Mr Whitehouse also said the country faces a choice in the upcoming general election to either build a “homegrown energy transition” or to import more energy and limit the growth of new wind, hydrogen and carbon capture industries.

The UK’s Conservative government has introduced legislation to mandate annual North Sea licensing rounds.

Meanwhile, the opposition Labour party has pledged to increase the windfall tax and block new oil and gas drilling in the North Sea.

“Our energy security, economic growth, and thousands of jobs in almost every parliamentary constituency up and down the UK are at stake,” Mr Whitehouse said.

“We all recognise that our energy mix must change, and our sector is ramping up renewables and accelerating the drive to net zero. But this journey will take time.”

“Meanwhile our North Sea basin is naturally declining.”

Mr Whitehouse said the UK currently has over 280 oil and gas fields, but by 2030 as many as 180 of them will have stopped producing.

“We need the churn of licences for an orderly transition that supports jobs and communities across the country and meets our energy needs,” he said.

North Sea licences a ‘pipedream’

However, environmental campaigners have criticised the issuing of new North Sea licences as a “pipedream” for energy security.

Uplift executive director Tessa Khan said the UK government is “clearly out of ideas”.

“This licensing round, which was first announced under Liz Truss’ government, is likely to result in very little oil and gas reaching the UK,” Ms Khan said.

“In the last thirteen years under the Conservatives, hundreds of new licences have been issued, which have produced just 16 days worth of extra gas.

“This isn’t an energy strategy, it’s a pipedream.”

Ms Khan also said plans to use wind energy to power oil and gas rigs, such as the INTOG leasing round, will divert renewable energy from homes and send the UK “backwards in terms of energy security”.

“Despite all the warnings that opening new oil and gas fields will push us past safe climate limits, Rishi Sunak has chosen to push new drilling as part of his pitch to voters,” Ms Khan said.

“Unlike more renewables and insulating homes, it will do nothing to lower energy bills, it just boosts the profits of oil and gas companies.”

Uplift joined with fellow campaign group Greenpeace UK to launch a legal challenge against the 33rd licensing round last year, arguing the UK government “failed to properly assess the climate impact” of the new round and failed to properly consider “reasonable alternatives”.

However, the High Court dismissed the challenge in October last year.

© North Sea Transition Authority

© North Sea Transition Authority © Supplied by North Sea Transition

© Supplied by North Sea Transition © North Sea Transition Authority

© North Sea Transition Authority © Supplied by Iberdrola

© Supplied by Iberdrola © Supplied by OEUK

© Supplied by OEUK © Uplift

© Uplift