The Fynn Beauly prospect still has an opportunity to deliver “significant value” despite ongoing political uncertainty, according to North Sea operator Parkmead Group (LON:PMG).

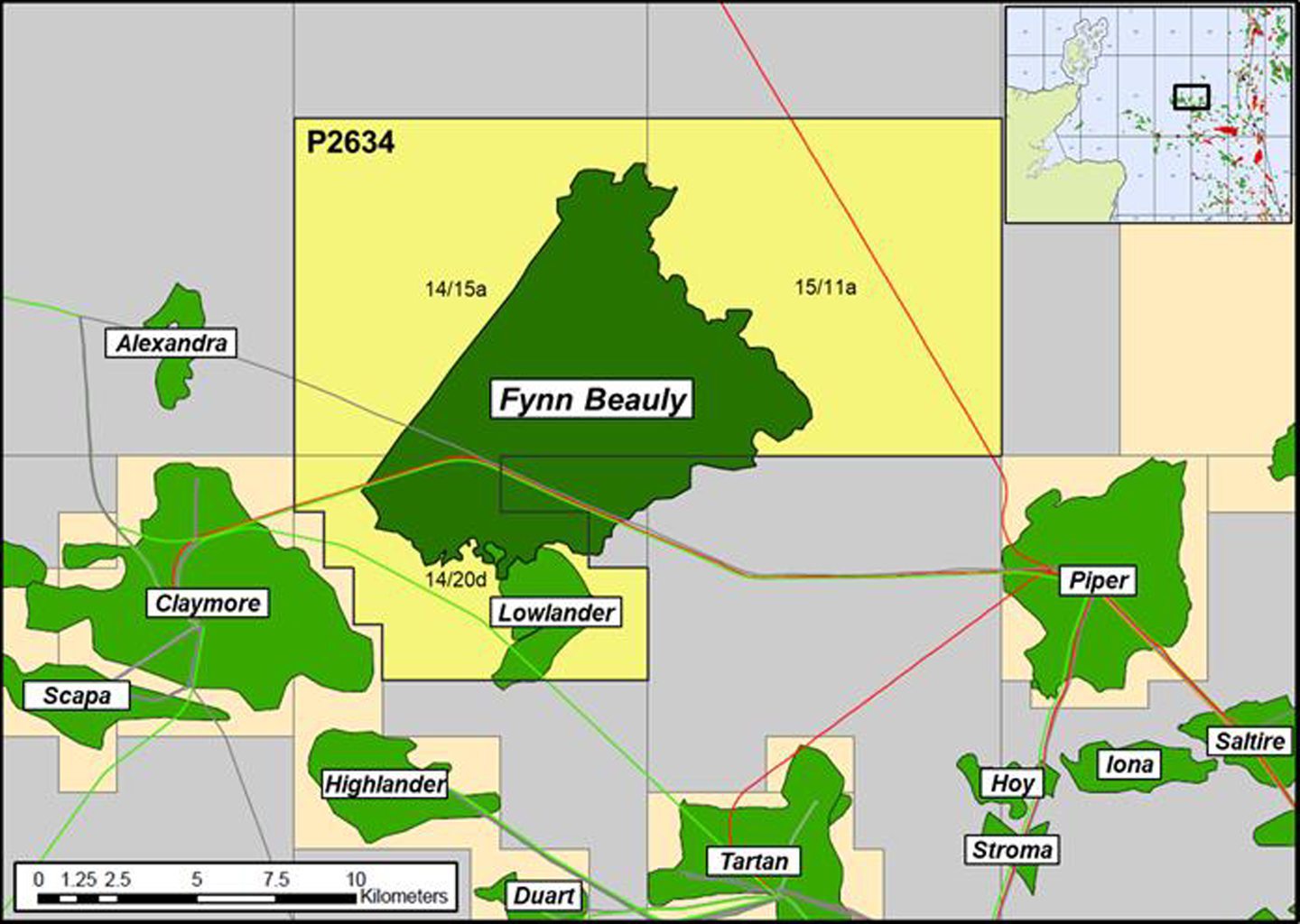

The North Sea Transition Authority (NSTA) awarded the P2634 licence to Parkmead as part of the second tranche of the 33rd licensing round earlier this year.

Parkmead said the NSTA has now formally confirmed the licence, which covers the Fynn oil discovery.

Covering three blocks in the Outer Moray Firth, Fynn is “one of the UK’s largest undeveloped discoveries” according to Parkmead.

The firm holds a 50% interest in the Fynn licence alongside partner Orcadian Energy.

Previous estimates show the heavy oil accumulation contains between 740 million and 1.33 billion barrels, and the two firms will now assess the feasibility of the project.

Parkmead executive chairman Tom Cross said Fynn licence still offers the company and investors “huge potential upside” despite uncertainty over Labour’s North Sea plans.

“Parkmead’s board is very conscious of the current uncertainties around the new UK government’s intentions in respect of future oil and gas projects and developments in the UK North Sea,” Cross said.

“However, Parkmead sees the award of the Fynn licence as an opportunity to deliver significant value to shareholders.

“The team will evaluate whether it can deliver a commercial development of the major Fynn Beauly accumulation that also meets the overarching net zero objectives that are key to obtaining the relevant regulatory approvals.”

Fynn Beauly

Parkmead said it will now work alongside Orcadian to determine whether it can deliver a “technically and economically viable” development at Fynn in line with the NSTA Net Zero Strategy.

The two firms are assessing ways to use enhanced oil recovery techniques to reduce the field’s oil viscosity and make extraction easier, including the potential use of geothermal energy.

While Parkmead appears to be moving forward with its wider drilling strategy, despite delays to its Skerryvore project, other operators are scaling back or altering their plans.

Prior to the recent UK election, Labour promised to increase the windfall tax on oil and gas firms and put an end to new licensing in the North Sea.

The industry has warned the proposals will have a devastating impact on jobs and investment, as well as potential consequences for energy transition goals.

In recent weeks, operator Deltic Energy withdrew from the licence covering the Pensacola discovery while Australian firm Hartshead Resources has also cut back.

Meanwhile, Serica Energy and Harbour Energy are among other firms pivoting away from the UK Continental Shelf.

However, other North Sea firms are continuing to invest in the UK, with Ithaca Energy and Eni agreeing a deal to consolidate their North Sea assets.

© Supplied by Parkmead Group

© Supplied by Parkmead Group © Supplied by Repsol Sinopec Resou

© Supplied by Repsol Sinopec Resou