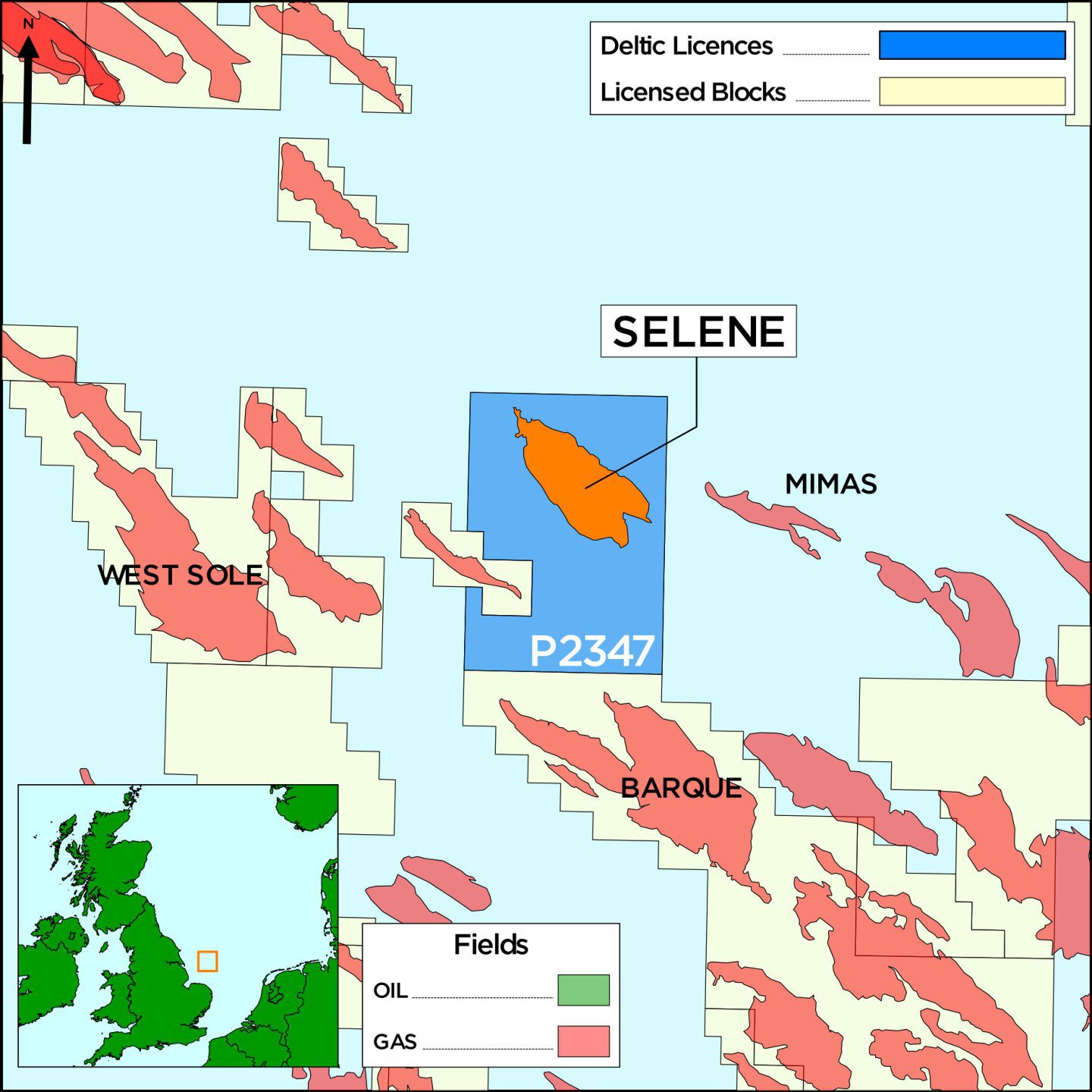

North Sea operator Shell has commenced drilling operations at the Selene prospect, Deltic Energy (AIM:DELT) announced today.

Shell mobilised the Valaris 123 rig for the drilling campaign at Selene last week. Deltic holds a 25% interest in the field, which contains an estimated 318 billion cubic feet of gas.

The exploration well will be the first spudded in UK waters in 2024, and comes shortly after Deltic withdrew from its Pensacola project due to political uncertainty.

Analysts say the fiscal and political uncertainty has seen a shift away from larger standalone projects like Pensacola towards shorter cycle opportunities like Selene.

These lower risk developments are located close to existing production infrastructure and can defer decommissioning, advisory firm SP Angel said.

Windfall tax uncertainty

Numerous North Sea operators delayed or scaled back projects in the leadup to the UK election due to concerns over Labour’s proposed windfall tax changes.

The new Labour government yesterday confirmed changes to the Energy Profits Levy (EPL) windfall tax and the removal of investment allowances.

North Sea observers criticised the move, and said it will “hasten the demise” of investment in the UK continental shelf.

Panmure Gordon director and oil and gas research analyst Ashley Kelty said Selene is a “high impact well” for Deltic and success “could transform the outlook for the company” after the disappointment of Pensacola.

Meanwhile, Jersey Oil and Gas (AIM:JOG) said today it will “carefully consider” the impact of the EPL changes to its Greater Buchan Area development.

JOG said the full implications will “only be clear when the level of capital allowance claims available as deductions to the EPL are provided in the October budget”.

Recommended for you

© Image: Deltic Energy

© Image: Deltic Energy