Australian firm Hartshead Resources (ASX:HHR) is continuing work on its North Sea developments despite ongoing fiscal uncertainty surrounding the windfall tax.

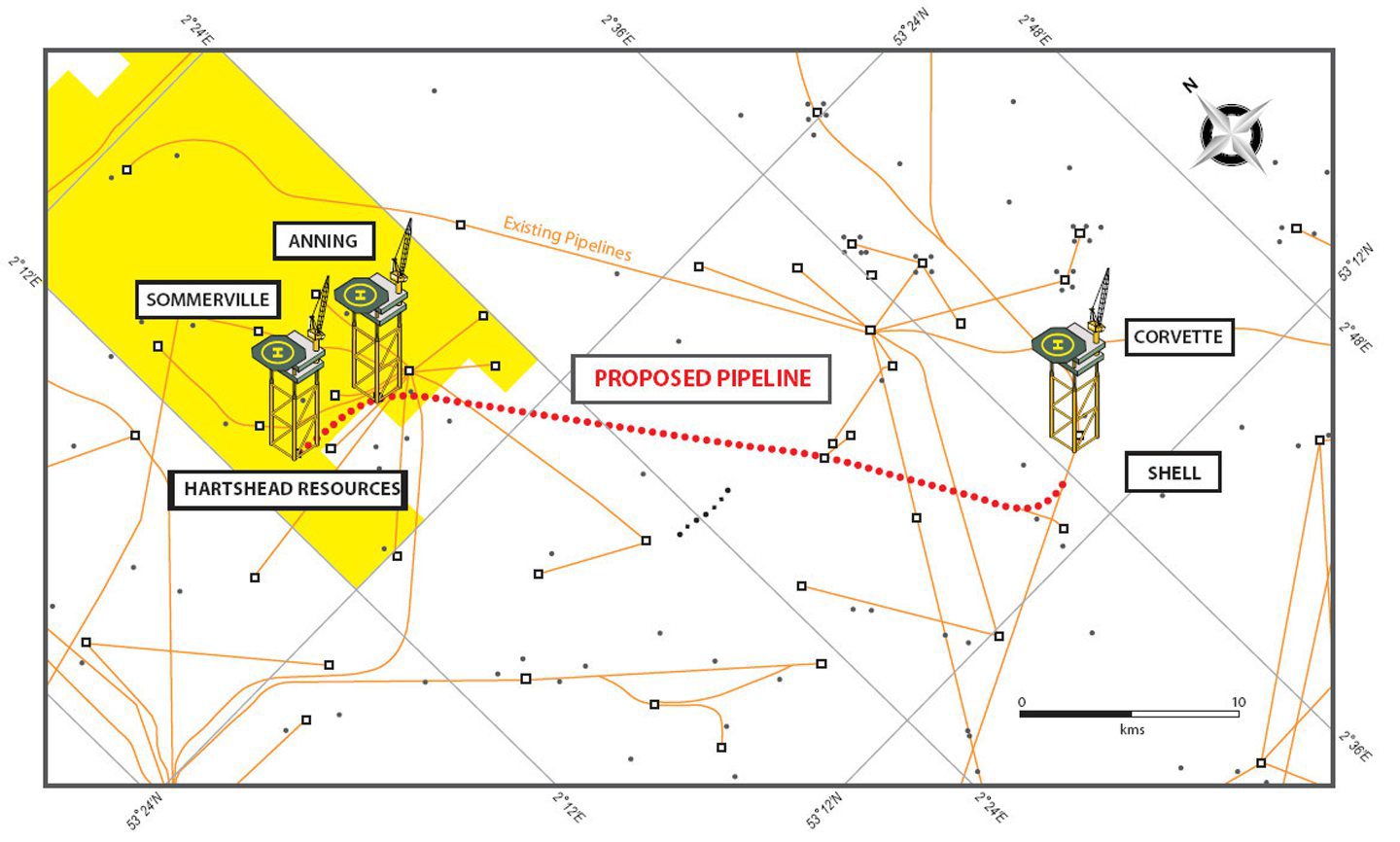

In a quarterly update, Hartshead said it is engaged in ongoing discussions on project finance for its Anning and Somerville gas field development in the Southern North Sea.

The Perth-based firm said earlier this year it was forced to make job cuts on the project after Labour announced its intention to increase the Energy Profits Levy (EPL) and remove investment allowances.

Now in government, Labour this week confirmed its plans which critics say will “hasten the demise” of North Sea investment.

Hartshead said it has conducted “extensive dialogue” with political stakeholders and “actively lobbied” on the proposed EPL changes, receiving assurances that the UK government still wants to “attract and enable” investment in the sector.

But despite the fiscal uncertainty, Hartshead said after undertaking a “cost reduction initiative” it is working with joint venture partner Viaro Energy to reduce costs on the project covering the P2607 licence.

The company said it maintains a strong balance sheet position, with A$22 million (£11.2m) in cash.

Hartshead chief executive officer Chris Lewis said the firm is waiting for more certainty before it takes a final investment decision on the Anning and Somerville project.

“We continue to have productive discussions with all stakeholders, regarding the fiscal framework of the UK energy sector under the new Labour government,” Lewis said.

“Hartshead has a high-value gas development project, a highly motivated joint venture partner alongside us, and a growing portfolio of gas resources.”

Hartshead 33rd North Sea licensing round

Lewis said Hartshead is also awaiting more clarity before deciding on a course of action for the 10 blocks it received in the 33rd licensing round this year.

“With gas prices strengthening since the beginning of the year and through the quarter, we are looking forward to a busy second half of the calendar year following the general election and the change in government,” he said.

Hartshead said it will provide a further update on the licences after it receives a formal offer from the North Sea Transition Authority.

© Supplied by Hartshead Resources

© Supplied by Hartshead Resources