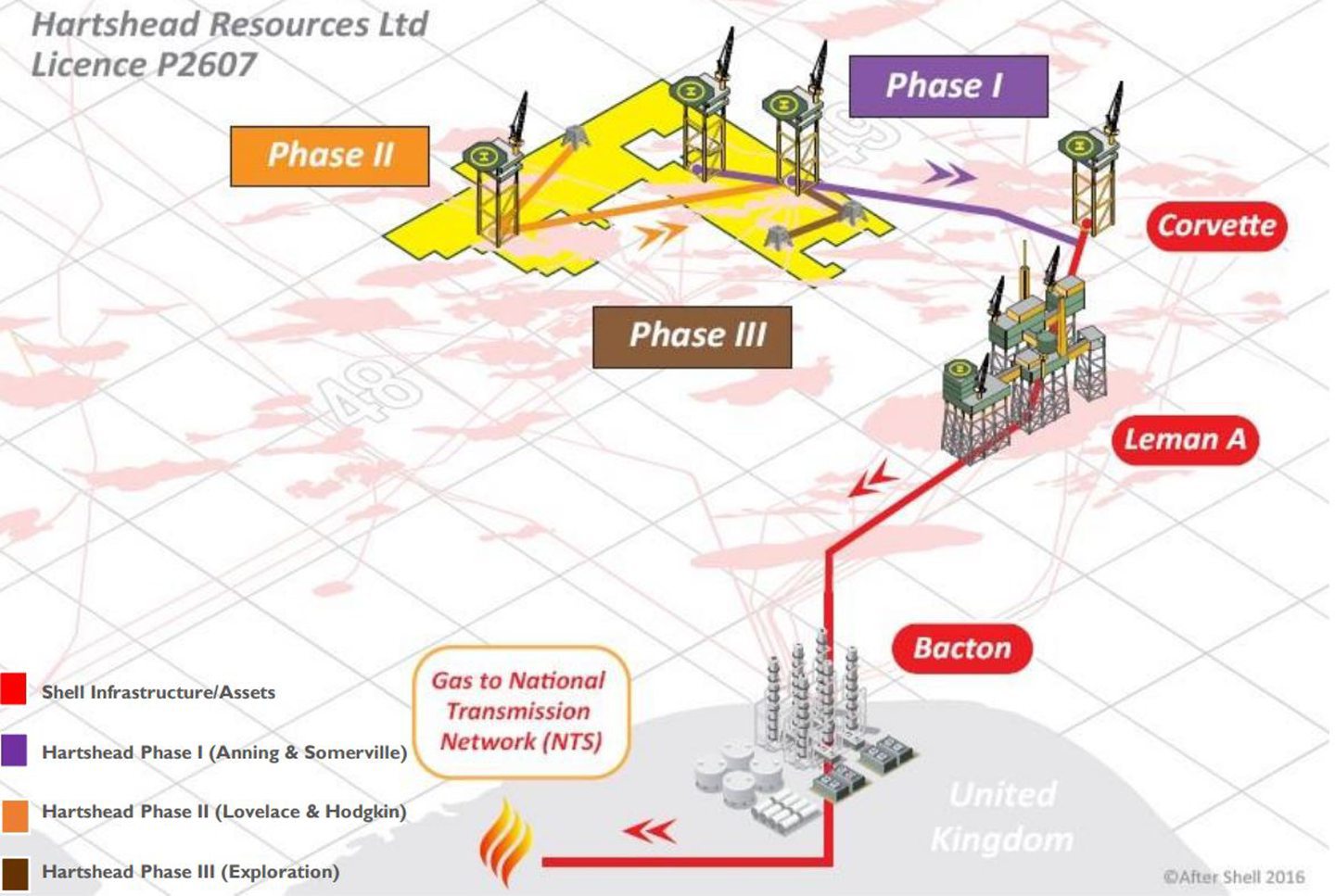

North Sea operator Hartshead Resources (ASX:HRR) has provided an update on its Anning and Somerville gas project as it moves closer to a field development plan.

The Australian firm said it has largely completed interpreting reprocessed seismic data for the fields with “very positive results”.

Hartshead said the revised interpretation for Anning and Somerville confirms previous work which indicated a small increase in gas reserve estimates at the P2607 licence.

The company has used the improved seismic data to “enhance the subsurface model” for the fields, which allows for building a single model covering both.

The new model will facilitate detailed responses to questions posed by the North Sea Transition Authority (NSTA) regulator as part of the approval process, Hartshead said.

It will also allow Hartshead to optimise well trajectories, “ensuring maximum gas recovery from the most cost effective drilling operations”.

Hartshead chief executive Chris Lewis also pointed to continued “strong gas demand” in Europe as evidence of the need for projects like Anning and Somerville.

“The recent sub-surface work undertaken by the team serves to increase our confidence in the volumes of gas remaining to be recovered at Anning and Somerville, as well as assisting with future detailed well planning to maximise recovery and minimise risk,” Lewis said.

“All of this work ensures that the field development execution will be successful in delivering gas to the UK grid.

“We see strong gas prices in Europe leading out of summer, demonstrating the continued robustness of the European gas market which unpins future gas prices in the UK.”

Hartshead and Viaro Energy

Recent moves by Viaro Energy to acquire Shell and Exxon Mobil assets in the Southern North Sea (SNS) could also benefit the Anning and Somerville project, Hartshead said.

Viaro bought a majority stake in a series of North Sea fields covered by the P2607 licence from Hartshead last year in a £105 million deal.

The deal include Anning and Somerville, as well as the Hodgkin and Lovelace plays.

The two operators also agreed an A$800m (£410m) ‘financing backstop‘ for the project earlier this year.

Following the deal with Shell and Exxon, Viaro will now take on the Leman and Corvette fields and offshore infrastructure, which Hartshead has identified as a possible offtake route for its Phase 1 development.

The operational update from Hartshead comes shortly after the firm said it is continuing discussions on project finance for Anning and Somerville despite ongoing fiscal uncertainty surrounding the windfall tax.

The Perth-based firm said earlier this year it was forced to make job cuts on the project after Labour announced its intention to increase the Energy Profits Levy (EPL) and remove investment allowances.

Hartshead said it is “awaiting further clarity” on the EPL changes before deciding on a course of action for the 10 blocks it received in the 33rd licensing round this year.

© Supplied by Hartshead

© Supplied by Hartshead