The bulk of new diesel supply stemming from a $1 billion expansion at the UK’s largest oil refinery operated by Exxon Mobil Corp. (NYSE:XOM) will be available in the first quarter of 2025.

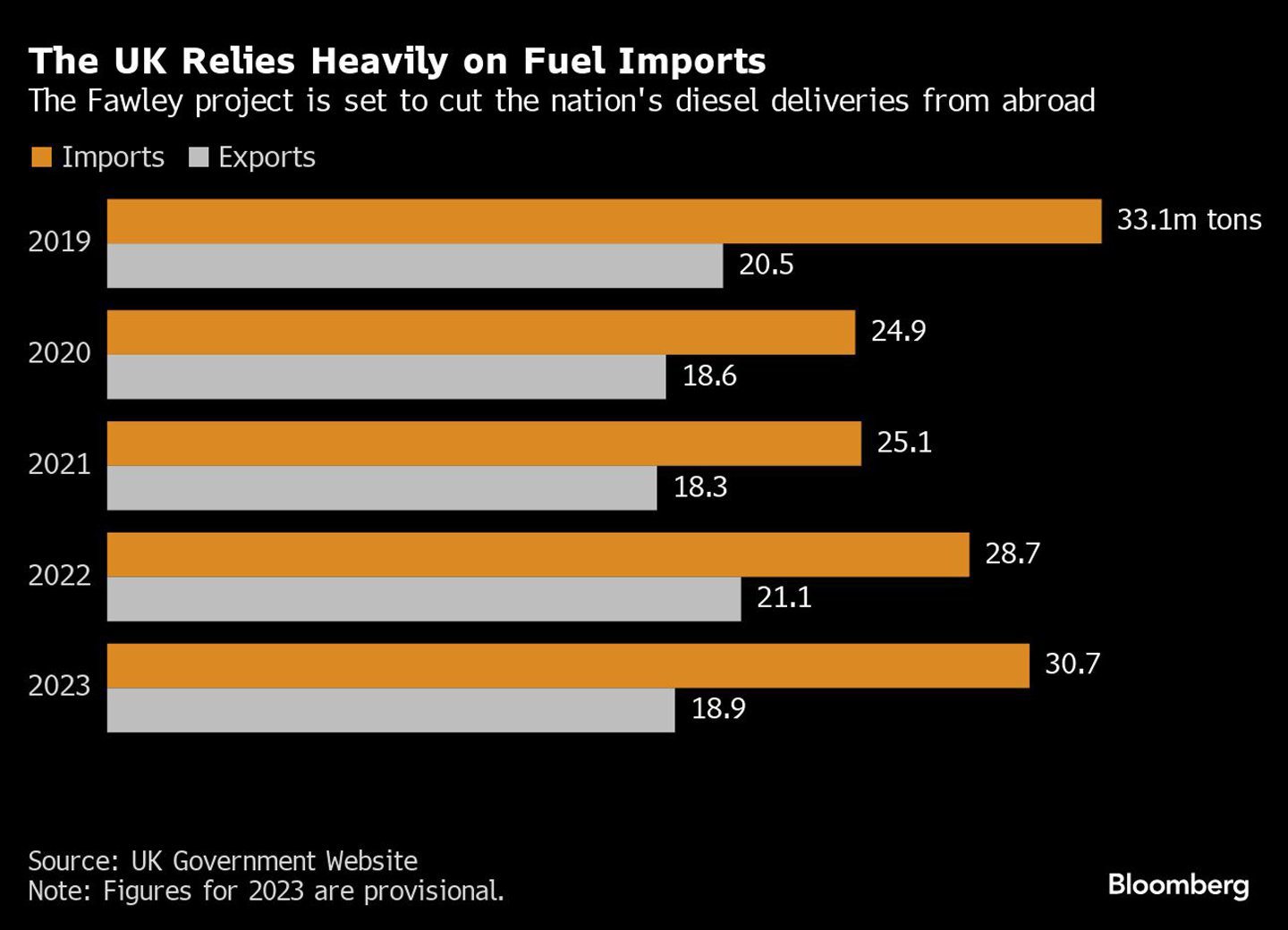

A new production facility at the Fawley refinery on the south coast of England will initially be geared to production of diesel, helping to reduce imports of the fuel into the UK. It could be reconfigured at a later point to make conventional jet fuel or sustainable aviation fuel from vegetable oils. It will also allow for more petrochemicals output.

“There is a lot of molecular magic we can do with this kit,” Nick Bone, the head of the plant, said during a site visit last week.

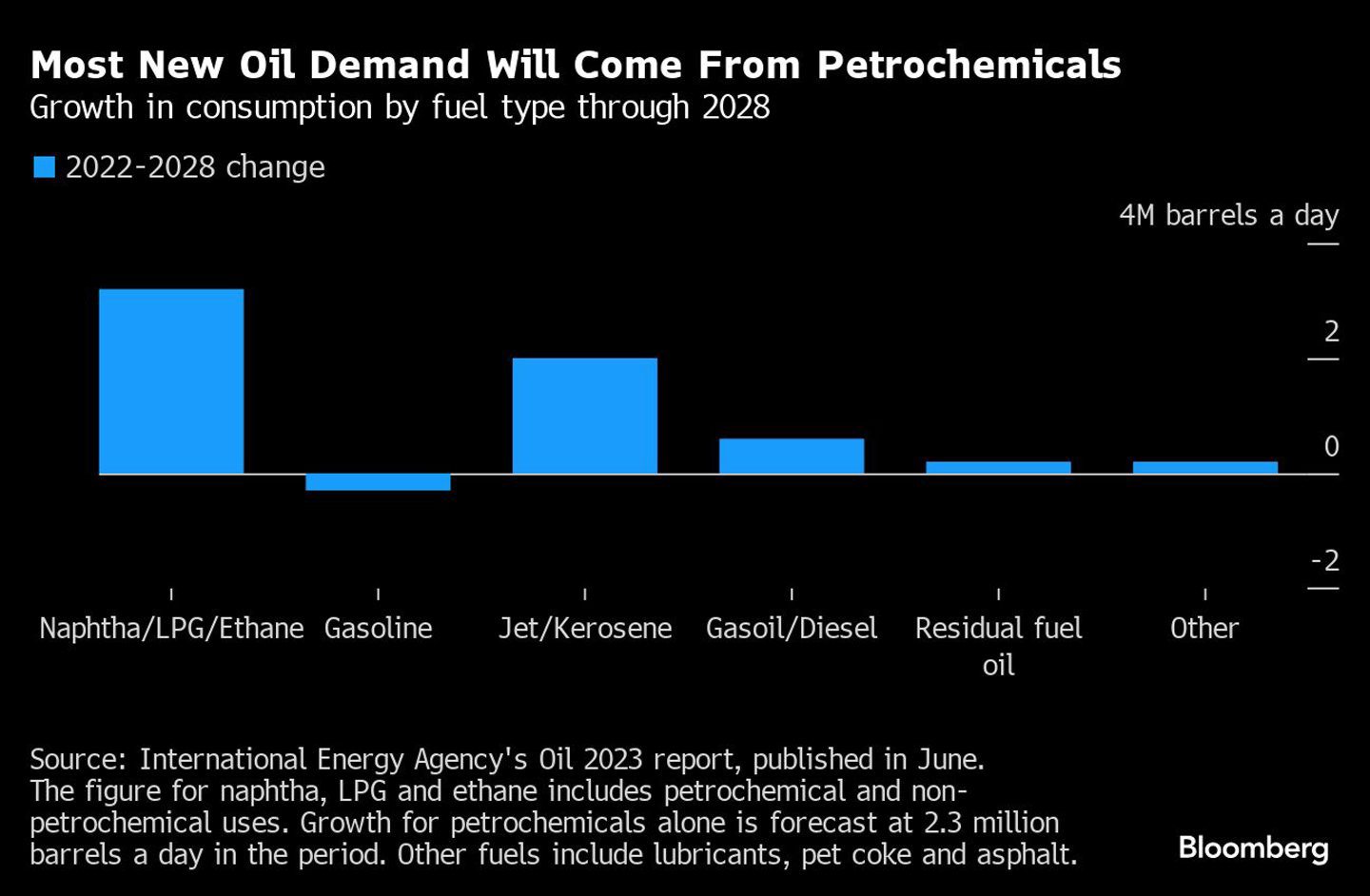

Originally configured as a gasoline-focused site, the project that’s finishing at Fawley, called Fast, will shift its production balance away from the motor fuel toward diesel, jet fuel and chemicals. Exxon has previously said its refining business could move away from gasoline and toward chemicals, where demand growth is forecast to outpace other products in the coming years. Fawley is Exxon’s second-biggest oil-processing facility in Europe, with capacity to process about 270,000 barrels of crude a day.

The Fawley investment includes the construction of what’s known as a hydrotreater. Exxon has also built a plant to make hydrogen, which will be used in diesel production, as well as helping to boost chemicals output at the site.

The investment coincides with forecasts that the European refining industry will shrink in response to waning regional demand for road fuels, coupled with competition from the Middle East and Asia where rivals aren’t subject to carbon levies.

Europe is set to lose crude-processing and diesel-making capacity from 2025, just as the Exxon expansion at Fawley reaches full pelt. PetroIneos Grangemouth in Scotland, as well as Shell Plc Rheinland and BP Plc Gelsenkirchen in Germany, are all scheduled to close or repurpose their big diesel-making machines known as hydrocrackers. All three sites will retain their chemicals operations.

Exxon’s investment also included the expansion of a jet fuel pipeline that runs from the Fawley site to its West London terminal close to Heathrow airport, which is complete. The expanded link allows Exxon to move product including sustainable aviation fuel made by competitors that arrives at Fawley on Europe’s longest privately-owned jetty.

More on Exxon’s plans at Fawley:

- The new Fast hydrotreater will run on a feedstock known as 0.1% gasoil. It operates at higher pressure than an existing hydrotreater on the site, making it more efficient.

- Spending in existing facilities that was included in the Fast project will result in some additional fuel supply this year.

- The new hydrogen plant, which has daily capacity is 55 million standard cubic feet, will push up consumption of natural gas at Fawley. The site’s main source of hydrogen is currently from its reformer.

- Exxon Fawley is looking at using pellets made from municipal waste to make fuels in the longer term.

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg