Analysts have said it “could be the end of the line” for Aberdeen-headquartered Awilco Drilling after the firm agreed to offload the remains of its fleet.

Earlier today it was announced the firm will sell the WilPhoenix rig to Well-Safe Solutions in a £12.4m deal.

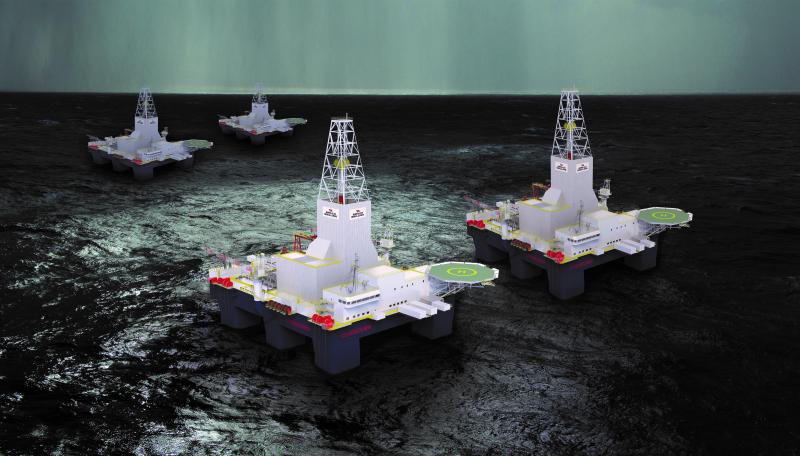

With plans already announced to scrap its only other vessel, the WilHunter, and with hefty legal issues over cancelled orders for new vessels, commentators have said it is “difficult to see how Awilco could continue as a drilling contractor”.

Hailing the deal, Well-Safe Solutions said it would create 100 new roles through a recruitment drive. The transaction is for the vessel only, which means crew and roles won’t transfer.

Awilco said in its 2021 annual accounts that it had 86 offshore crew and 22 onshore staff, but in a statement to Energy Voice today, managing director Roddy Smith confirmed headcount is down to around 20 onshore and 20 offshore.

He said Well-Safe may choose to approach some employees as part of the overall recruitment drive.

Two cancelled rig orders for the Nordic Spring and Nordic Winter have led to heavy arbitration with with the Singapore-based shipbuilder Keppel FELS, who is demanding a total of £516 million.

Awilco, headquartered in Westhill just outside of Aberdeen, also recently lost a £6.8 million tax dispute with HMRC, and reported pre-tax losses for 2021of $43.2m (£34.5m), down from $155.9m (£125m) the previous year.

However Mr Smith said the firm does still have options on the table.

“Awilco Drilling will continue to manage the two arbitration processes in London which are currently forecast to run through until mid-2023,” he said.

“We will also continue to closely monitor opportunities in the drilling contracting and well abandonment space and in the event that an attractive investment opportunity is identified, we will make appropriate recommendations to shareholders at that time.”

Analysts were in unison about the uncertainty ahead for the company.

One analyst, who did not wish to be named, said: “It would appear from the outside at least that options are minimal.

“The crews have been looking for work for sometime and once you lose competence you’re in trouble.

“I don’t believe Awilco’s investors have an appetite to remain in the O&G market so unless they are looking at a transition of some kind then indeed it could be the end of the line for the company in its current guise.”

Sarah McLean, senior rig analyst at Esgian, said the announcement means Awilco will “no longer have a foothold” in the market and it is “difficult to see” how it can continue as a contractor.

Losses and the arbitration mean its “unlikely they would be in a position to rejuvenate their fleet with newer units, especially in light of rising rig values”.

She continued: “Previously, the company said that it is pursuing opportunities in consolidation, acquisition and/or management of units. However, as things stand, it seems unlikely that Awilco will consolidate/acquire, which leaves rig management as an option, unless the company has decided to leave offshore drilling altogether.”

Ms McLean said attrition of older rigs in the market, coupled with rising demand, will likely see a rise in dayrates, which was echoed by her colleagues.

Teresa Wilkie, research director for Westwood Global’s RigLogix platform, said the future looks “very uncertain” for Awilco unless they “have plans to move into a new area, buy new rigs (which seems unlikely with the ongoing litigation with Keppel over the cancelled orders for the Nordic Spring and Nordic Winter semis) or look to manage other assets”.

On the wider market conditions, she said: “The past years have been a tough innings for many of the smaller North Sea-based rig owners, especially those where their bread and butter has been in the UK market, where we’ve seen development, exploration and P&A campaigns continually delayed and those that have gone ahead have achieved dayrate levels only just covering operating costs.

“The outlook over the next few years does indeed look brighter in terms of demand but this has come too little too late for some. The available pool of rigs that can now work in UK waters is smaller than ever following a lot of scrapping of units due to paltry demand.

“If we do see this expected upswing in demand now that the UK has pledged to help remove some of the red tape around new projects to help with energy security, companies may find that costs for hiring a rig may move upwards quickly due to this limited capacity and higher demand.”

Recommended for you