“Offshore drilling is coming back, big time,” Bjornar Iversen, chief executive of Dolphin Drilling, excitedly told a room of senior company figures, and myself, during a visit to the Borgland Dolphin rig in Norway last month.

And looking at the current lay of the land, it is difficult to disagree with the affable industry veteran, who boasts more than 25 years in the offshore drilling sector, including various senior roles at Odfjell Drilling and Songa Offshore.

Day rates are back at levels not seen for years, and Mr Iversen’s overview of the market holds true with numerous predictions that a ‘supercycle’ is around the corner, if it isn’t already here.

North Sea operators are already scrambling to get hold of drilling rigs as new projects get the go ahead.

It follows a sharp contraction in the global drilling fleet in recent years, driven by successive downturns and sector consolidation.

Mr Iversen said: “Basic rates for rigs are going up, contracts are longer and high spec rates are going up, all because of a lack of assets. The UK market will move summer 2023, followed by Norway the following year.

“There will not be enough rigs in the North Sea to do the work, and we see a supercycle coming that will last for, potentially, up to seven years.”

Oil and gas back in favour

But why this renaissance for oil and gas, an industry that had, to a certain extent, become persona non grata.

As tends to be the case, the intrinsic details are convoluted and complex, but there are a number of key points.

Western governments have hit Russia, one of the world’s largest exporters of oil and gas, with a range of sanctions following Putin’s decision to attack Ukraine.

There is a concerted drive across much of Europe to reduce imports from Russia, signalling a return to high commodity prices and, in turn, sparking inflation and economic slowdown.

On top of that, household energy bills have soared, are still rising, and will increase further.

The upshot is a perfect storm of adversities, which has sent the UK head first into a cost-of-living crisis.

Ideology v Reality

Fortifying energy security – a frontrunner for the phrase of 2022 – is now a key focus for policy makers, and new oil and gas fields are back on the menu.

“There’s been a fight in the world between ideology and reality,” said Mr Iversen, “and politicians have a tendency to follow the former, particularly if you combine it with strong commercial interests.

“But suddenly they saw that this is not workable. There have been shutdowns of coal fired power plants, nuclear plants in Germany and underinvestment in oil and gas for close to a decade. Suddenly, you have an electricity bill which has tripled, and then you realise there is a shortage of something. That brings things back a little bit towards reality again.

“I saw a statistic recently that the lion’s share of all the energy used in the UK has to be imported, so if you close one well here and one well there, you’re just switching off the lights.”

He added: “The UK needs to have a look at its energy supplies, and of course there is a real focus on gas, but also oilfields. There must be rejuvenated momentum offshore in the short to medium term.”

The Borgland Dolphin

Reversing its pre-COP 26 position, Westminster has been clear about its want to scale up North Sea oil and gas production, and to do so rapidly.

Projects that appeared to have stalled, such as Shell’s Jackdaw scheme and Equinor’s Rosebank field, are now in motion once more.

It has led to a clamour for drilling rigs as companies fret about missing out, and Dolphin, founded in 1965, is ready to step up to the plate once more.

Having spent most of her life operating offshore Norway, the company is making final preparations to bring the Borgland rig across the North Sea for use in the UK sector.

Over the years, the semi-submersible has drilled countless wells and discovered scores of big fields on charter for the likes of energy giants Equinor (OSLO: EQNR), Shell (LON: SHEL) and BP (LON: BP).

On the UK side of the fence, Aberdeen-headquartered i3 Energy(LON: i3E) picked the vessel to spud its Serenity and Liberator plays.

Rig is ‘good to go’

Hailed as a “workhorse”, the Borgland was kitted out with a fifth generation topside in 1999 and has been continuously upgraded over the years to meet the demands of the modern drilling environment.

There are plans to optimise the rig further for the UK market, and Dolphin is preparing for an upgrade of the persons on board to 110.

The Borgland is able to operate in waters up to 500 metres, with flexibility due to her high pressure, high temperature (HPHT) capabilities.

Though currently warm stacked near the small Norwegian town of Flekkefjord – a beautiful spot, I might add – it is “good to go” as and when a job comes up in the UK, assured Mr Iversen.

“Borgland has an unrivalled crew, who have delivered over a number of years on the rig. It is an updated rig, with a modern topside and, of course, she is a moored asset, rather than a big DP asset.

“It is a fit for purpose, harsh environment rig, and we are able to mobilise her within 60 to 90 days.”

Dolphin ‘tendering heavily’

Aberdeen-headquartered Dolphin, which employs around 350 workers, is already “tendering heavily” for the Borgland, with six irons in the fire – five in the UK and one in Norway.

And the company, Norway’s oldest offshore driller, has a “great belief” that the vessel can become a frontrunner in the UK drilling sector.

A small team is currently on the rig to ensure all systems remain functioning, and Mr Iversen’s target is to “start the mobilisation around the first quarter of next year.”

He said: “The market change comes first in the UK; the demand normally comes one year before Norway.

“The UK sector is populated by smaller, independent players so the planning cycle is shorter and it moves quicker, especially when oil is at $100 a barrel.”

Best in class

Despite the drive to get oil and gas out of the ground quickly, to help ease energy costs, there is still a need to do so in as low emitting a manner as conceivable.

In accordance with the North Sea Transition Deal, companies have been instructed to axe the carbon intensity of their operations.

As one of the lowest emitting units in Norway, the Borgland can play a big part in helping operators to achieve this.

Mr Iversen said: “Moored rigs means less energy consumption. The Borgland and the Bideford Dolphin (another of the firm’s assets) are the two greenest rigs on the Norwegian Continental Shelf. They are the ones with the lowest energy consumption. That is the beauty of conventionally moored drilling rigs.”

He added: “We work hand in hand with our customers. It is in the DNA of the company to move quickly and listen to what is asked of us; we are not a big American player with 100 rigs and a ‘my way or the highway’ approach. Our main goal is to deliver in a safe and efficient manner.”

Craig Moore, rig manager for Dolphin in the UK, said: “The Borgland has been a top performer on the Norwegian Continental Shelf for a number of years, operating efficiently in some of the harshest environments in the North Sea.

“Benefiting from excellent motion characteristics, coupled with accurate RamRig motion compensation, low fuel consumption, and effective and large deck areas, the Borgland offers great capacity and flexibility to deliver reliable operations in the UKCS.”

New arrivals on the way

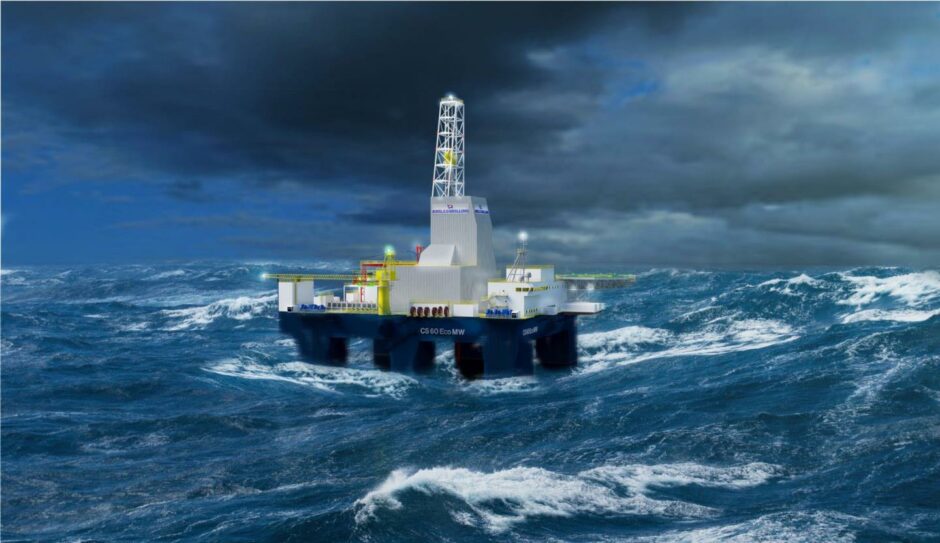

In support of its drive to help operators on both sides of the North Sea tap fields as effectively as possible, Dolphin will soon grow its fleet.

Originally ordered by troubled firm Awilco Drilling, two seventh-generation drilling rigs are due to be delivered by Keppel FELS around the middle of the decade.

Both vessels have been built with eco-designs, a world first, and will operate predominantly in Norway.

On whether Dolphin is investigating adding any more assets to its roster, Mr Iversen said: “We are looking at opportunities, you may well say that.”

Planned public listing impending

With offshore oil and gas on a one-way train to the land of milk and honey, drilling contractors are seeing their stock steadily rise.

Aiming to cash in on that fact, Dolphin has plans for an initial public offering (IPO) on the Oslo Stock Exchange this autumn.

Dolphin is majority-owned by US investment firm SVPGlobal (64%), which stepped in to save the company from bankruptcy in 2019.

SD Standard, controlled by the Norwegian investor Oystein Spetalen, Luxor Capital Partners and Deutsche Bank also have stakes in the company, formerly known as Fred Olsen Energy.

Just a couple of years ago, an IPO would have been a pipe dream for most companies involved in oil and gas, with commodity prices thin and public approval even thinner.

But with a revival in both facets, more and more North Sea firms are looking to dip their toe into the water.

Mr Iversen said: “We have a planned public listing this autumn, probably September or October. That hinges on if the market is right and the capital is there, as well as Dolphin being in the correct position.

“In order to grow, particularly with the new rigs, and in the upcoming supercycle, we to have the flexibility to do more and grab the opportunities that will come, that’s the right thing to do, in a world craving for energy and energy security.”

© Supplied by Fredrik Helliesen/Do

© Supplied by Fredrik Helliesen/Do

© Supplied by Fredrik Helliesen/Do

© Supplied by Fredrik Helliesen/Do © Supplied by Fredrik Helliesen/Do

© Supplied by Fredrik Helliesen/Do © Supplied by Awilco Drilling

© Supplied by Awilco Drilling © Supplied by Fredrik Helliesen/Do

© Supplied by Fredrik Helliesen/Do