Engineering consultancy Apollo is to play a multi-million-pound role in one of the largest new oil and gas projects in the UK North Sea.

The Aberdeen firm has landed the front-end engineering design (Feed) study contract for a project to repurpose and re-use a giant floating production, storage and offloading (FPSO) vessel.

Apollo hailed its Feed role, which is believed to be worth about £2 million, as “pivotal in this exciting venture”.

The work for Neo Energy is also expected to support 40 jobs among the 140-plus workforce at Apollo, which is part of Inverness-headquartered Global Energy Group.

FPSO bound for Greater Buchan Area

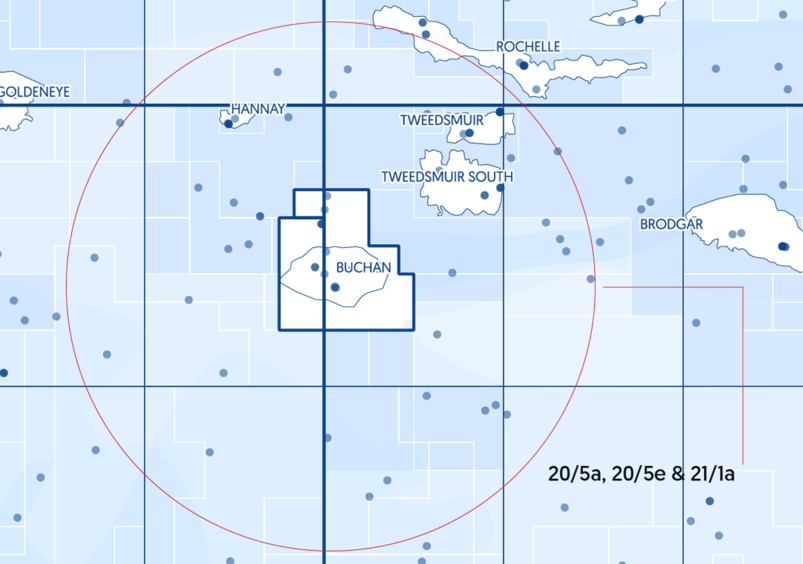

Apollo’s efforts will support Neo’s planned field redevelopment in the Greater Buchan Area (GBA) 120 miles north-east of Aberdeen.

The contract covers asset repairs and modifications for the Western Isles FPSO, as well as late-life extension procedures.

There is also a requirement for complex electrical infrastructure to be integrated into the FPSO ensuring it is “electrification ready” and able to accept power from renewable sources.

This will help to support the asset’s long-term future in line with carbon reduction targets set out in the North Sea Transition Deal and UK Government Net Zero Strategy.

This is a unique and exciting project, with the aim of repurposing and redeploying an existing asset with the latest technology and innovative infrastructure.”

Apollo managing director Richard Bell said: “We are pleased to secure this contract from Neo Energy and look forward to working in partnership to deliver this critical Feed study.

“The contract underpins the competency and quality of the engineering team at Apollo.

“This is a unique and exciting project, with the aim of repurposing and redeploying an existing asset with the latest technology and innovative infrastructure.”

The GBA is one of the largest pre-final investment decision oil and gas projects in the UK North Sea just now, with an estimated 162 million barrels of oil equivalent targeted.

Last week it emerged Aberdeen-based Dana Petroleum was selling its 77% stake in the Western Isles FPSO to co-owner Neo for an undisclosed sum. The vessel is currently working on the Harris and Barra oilfields about 100 miles east of Shetland in the northern North Sea.

Ownership is to eventually be shared with GBA partner Jersey Oil and Gas (JOG).

Modifications to the FPSO are expected to be completed by early 2026, in time for her to be deployed to the GBA and hooked up ready for the anticipated start-up of production in late 2026.

Serica taking 30% stake in GBA

Dana and Neo agreed earlier this year to end production on Harris and Barra “on or around” March 31 2024.

Meanwhile, Serica Energy announced yesterday it planned acquire a 30% non-operated interest in the GBA project from JOG. The deal is subject to regulatory, partner and interested party approvals, but expected to complete in early 2024.

On completion, partners in the GBA will comprise Neo (50% and operator), Serica Energy UK (30%) and JOG (20%).

Recommended for you

© Jersey Oil and Gas

© Jersey Oil and Gas © Supplied by LinkedIn

© Supplied by LinkedIn