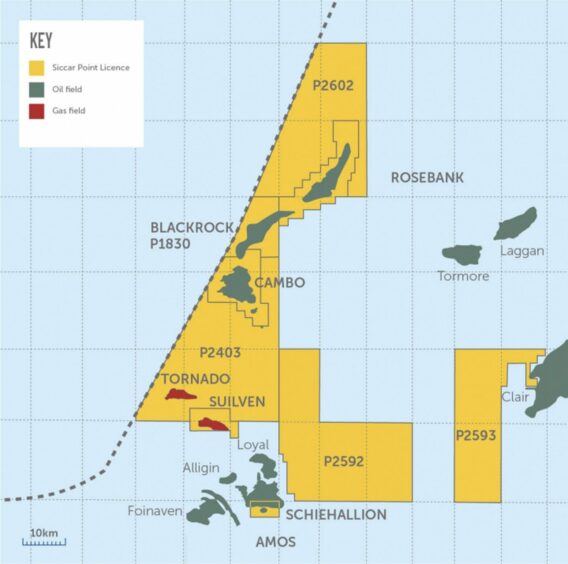

North Sea firm Siccar Point Energy is nearing a decision on how best to proceed with its West of Shetland Tornado project.

Located about 18 miles south-west of the notorious Cambo project, the gas field has recoverable resources of around 80 million barrels of oil equivalent.

A call on Tornado, discovered in 2009 by OMV, will be made by September, according to the North Sea Transition Authority’s energy pathfinder database.

Three options are under consideration by Siccar Point; acquire 3D seismic data, drill the field or relinquish the licence.

As it stands the project “continues to progress” and the field is being assessed for development alongside the nearby Suilven scheme as part of a “gas area strategy”.

As a standalone though, Siccar Point says Tornado is “unlikely to be commercial”, and work is ongoing to identify further gas prospects in the region.

On Monday Ithaca Energy completed its $1.5 billion acquisition of Siccar Point – the deal was initially announced in April.

Options on the table

Dave Moseley, vice president of North Sea research at Welligence, said: “Ithaca’s acquisition of Siccar Point includes the Tornado discovery which it had been progressing.

“Assuming Ithaca sees value in the project, the choice of tie-back host will likely be dictated by the speed at which Ithaca wants to progress.”

Siccar Point holds a 50% operating stake in Tornado, while oil giant Shell (LON: SHEL) owns the other half

A tie-in to the nearby Schiehallion field, operated by BP, is “one potential option” for the project, but only if “capacity allows”.

Cambo in the frame

Otherwise, Tornado is “dependent upon a development of Cambo”, the controversial oil project, Mr Moseley said.

He added: “Ownership synergies with Cambo may make this the more logical option, particularly as Tornado is a considerable time away from final investment decision, and first production is tentatively pegged for 2030.

“Tornado is a gas discovery with a thin oil rim and will therefore require offtake via the West of Shetland Pipeline (WOSP) system, into which Cambo will deliver gas via a new pipeline.

“Although current high gas prices and the new energy profits levy have improved the economics of existing gas fields and near-term developments, the long lead-in times associated with Tornado mean these are unlikely to be drivers for the project.”

West of Shetland

Siccar Point’s plans to develop Tornado as part of a “regional gas development hub” could also be stunted by a lack of traction West of Shetland.

Much of the industry’s hope for future growth hangs on the harsh region, but it has often proved a hard nut crack.

Mr Moseley said: “The West of Shetlands is a significant contributor of future UK production over the next decade, partly driven by fields such as Clair and Schiehallion. However, new material projects have been in short supply.

“The failure of Siccar Point’s Lyon exploration well and CNOOC’s Cragganmore appraisal well in 2019 wrote-off the potential for a northern gas area incorporating the Bunnehaven, Tobermory and Cragganmore discoveries.

“Developments have been limited to small, near field tie-backs such as Victory, Glendronach (scoping) and Alligin (onstream).”

Recommended for you

© Supplied by Siccar Point Energy

© Supplied by Siccar Point Energy © Supplied by BP

© Supplied by BP