Oil giant Shell (LON:SHEL) has begun a hunt to find a buyer for its stake in the controversial Cambo field in the UK North Sea, according to reports.

Reuters is quoting industry sources who say the London-listed supermajor has a launched a sale process to offload its 30% interest in the West of Shetland project.

Investment bank Jefferies has been drafted in to find a buyer for the stake, the news agency is reporting.

If a buyer is found, it could open the door for the development of Cambo, which has been public enemy number one for environmental groups in recent times.

Just before the turn of the year, Shell sent shockwaves through the industry when it announced that it wouldn’t be progressing with the 175 million barrel, citing the economics of the project.

There was speculation at the time that the negative attention the field had attracted played a part in the decision, but company chief executive Ben van Beurden stressed that was not the case.

Following Shell’s decision to opt out of the project, Cambo seemed dead in the water, and environmentalists claimed a big victory.

But Westminster’s drive to bolster energy security, sparked by Russia’s attack on Ukraine, combined with the high oil price, has reinvigorated the scheme.

There was even speculation that Shell would reconsider its decision to leave the project, but this was also dismissed by the company.

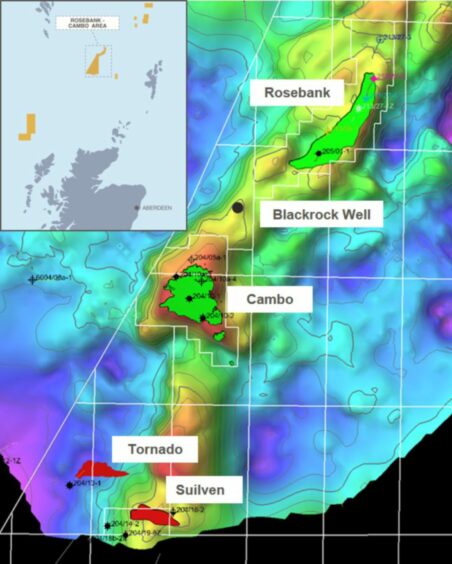

Cambo is located west of Shetland, near to Equinor’s Rosebank project – the two are among the UK North Sea’s largest untapped resources.

According to Reuters’ sources, whichever company takes on Shell’s stake in the field will “most likely support” its development – as it stands the project is on hold.

The remaining 70% interest in the field is held by Siccar Point Energy, which was bought by Ithaca Energy earlier this year in a deal worth almost $1.5 billion.

Ithaca has been contacted for comment.

Recommended for you

© Colin Hattersley

© Colin Hattersley © SYSTEM

© SYSTEM