North Sea oil and gas firm Kistos has revealed that Greater Laggan Area (GLA) development and exploration programmes are due to commence imminently.

By starting work on the package of West of Shetland assets as soon as possible, the partners in the region, plan to cash in on the investment allowance included as part of the UK energy profits levy.

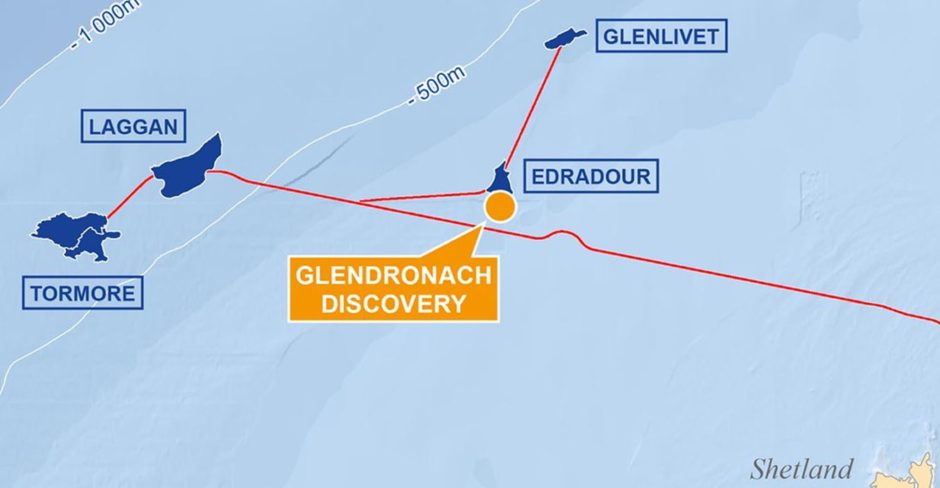

The GLA consists of four producing subsea fields – Laggan, Tormore, Glenlivet

and Edradour – that are tied back to the Shetland Gas Plant (SGP).

TotalEnergies’ Glendronach development, which is situated near to the GLA, is on track to be sanctioned by the end of the year.

Production is anticipated to commence by the end 2024, confirmed Kistos, which has a 20% stake in the field.

Kistos (LON: KIST) confirmed the plans in its half-year results, published Wednesday, in which it posted pre-tax profits for the first half of the year of £87 million, while revenue totalled £118m.

Strong cash generation in H1 2022 was supported by increased production and high gas price, the company said.

Executive chairman Andrew Austin said: “Our strong cash generation for the first half of the year has been driven both by operational excellence across our assets in the Netherlands, and the high demand for natural gas across Europe. This has further strengthened our already robust balance sheet and will allow us to continue to capitalise on the exploration, appraisal, and development opportunities within our portfolio.”

Kistos’ forecasted daily production rates are tipped to more than double following the acquisition of a package of UK assets.

The firm, the current vehicle of Mr Austin, a North Sea veteran, purchased a 20% interest in the GLA and associated infrastructure earlier this year.

Various interests in certain other exploration licences, such as a 25% share in the Benriach prospect, were included as part of the deal.

It marked Kistos’ entry into the UK North Sea, with the company paying French supermajor TotalEnergies (LON: TTE) £123m for the assets.

Mr Austin said: “With the recent addition of our interest in the GLA assets in the UK North Sea, our forecasted daily production rates are set to more than double. Moreover, the GLA assets offer substantial development and exploration upside in the form of Glendronach and Benriach.”

Despite failing to strike a deal with Serica Energy, Kistos still has an “appetite” for mergers and acquisitions (M&A).

Kistos reached out to Serica in mid-May to discuss a potential merger, before launching a formal bid.

There was a back and forth between the two North Sea firms, before a line was drawn under the matter last month.

Mr Austin said: “The Kistos Board and Management Team continues to assess opportunities that align with our existing portfolio. Our recent Proposed Combination with Serica Energy was a clear demonstration of our ambition, and while this proposal did not progress, our appetite for M&A remains core to Kistos’ ethos of delivering material value for our stakeholders.”

Recommended for you