Oil giant Shell (LON: SHEL) appears to be making headway on finding a buyer for its stake in a controversial West of Shetland oilfield.

The chairman of Ithaca Energy (LON: ITH), which is partnered with the supermajor on Cambo, told analysts and investors that the sales process, now at its halfway point, is “progressing well”.

Gilad Myerson added that he is hopeful of a breakthrough before long so that the project can begin to move towards a final investment decision (FID).

It is now well over a year and a half since Shell announced it wouldn’t be moving forward with its 30% share in Cambo, a decision that sent shockwaves through the industry.

There were initial rumours that the group put its stake in the oilfield up for auction in August 2022, though this was never confirmed by the company.

Half way through the sales drive

In May a six-month sales process was formally launched after a deal on a marketing process was agreed with Ithaca, the operator and holder of the remaining 70% in Cambo.

At the time Ithaca chief executive Alan Bruce described the pact as a “meaningful step” forwards for the huge field.

Until Shell finds a buyer for its interest the development cannot properly mature, and the timeline for a long-awaited FID remains unclear.

Speaking in the wake of the release of Ithaca’s half-year results on Wednesday, Mr Myerson said: “On Cambo, Shell has a 30% share and our understanding is they are progressing well – hopefully that sales process will end soon. That will allow us to continue the project towards FID.”

Options on the table, but FID hinges on a decision

There is a possibility that Ithaca may take on Shell’s stake in Cambo and develop the project alone, though this seems unlikely given its high capex costs.

If a buyer does come in for the share but wants further exposure, then Ithaca could sell up to 19.99% of its own interest but retain operatorship.

Either way, a settlement needs to be reached before an FID on Cambo can come into the equation.

And even if that significant milestone is reached questions marks will remain over the future of the scheme, which has attracted an unprecedented amount of public opposition.

Cambo is estimated to hold up to 800 million barrels of oil in-place, with the first phase expected to recover 170m barrels.

Its huge scale of has prompted a backlash from climate campaigners, who claimed a death blow when Shell pulled out of the project tin 2021 – the supermajor has always maintained it was a decision based on the project economics.

While things have gone quiet on the Cambo front in recent months, largely because its future has been in limbo, it’s inevitable that whoever inherits the stake will be in for severe scrutiny.

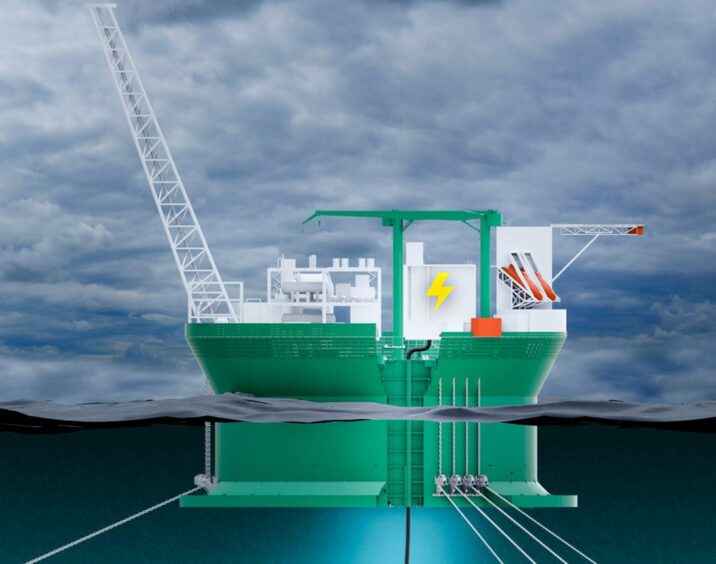

© Supplied by Ithaca Energy

© Supplied by Ithaca Energy © Colin Hattersley

© Colin Hattersley