Rosebank has been known as a complicated prospect to tap into many years – we speak to Professor Nicholas Schofield about the much-overlooked geology underlying this complexity.

The West of Shetland has the UK’s largest undeveloped oil and gas field, Rosebank. After being discovered in 2004 many surprises lay ahead. Multiple companies changed their stakes in Rosebank over time. Only this year, in September 2023, Rosebank has gone to FID for Phase 1 to produce an estimate of 245 million barrels of oil. Over two phases, there will be a target of 300 million barrels of oil after Equinor and Ithaca announced an investment of $3.8bn.

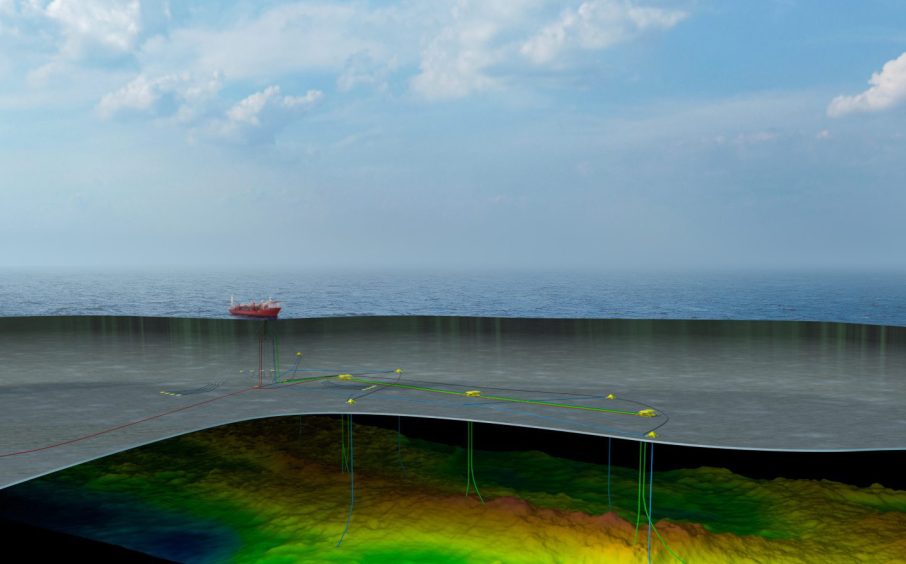

Equinor announced that the start up of Phase 1 is set for the go-ahead in 2026-2027. The company has a 80% stake in Rosebank while UK-based Ithaca has the remaining 20%. This will see the drilling of 4 production and 3 water injection wells. After learning from that stage, Phase 2 will see 3 more production and 2 water injection wells. The subsea wells will be connected back to a redeployed Floating Production Storage and Offloading vessel (FPSO). Engineering operations will be important, but many risks and rewards rely on answering geological questions.

Multiple challenges have complicated the prospect. At times, there was a lack of infrastructure and harsh weather conditions. Deep water and short weather windows ramp up drilling costs compared with other areas of the UK Continental Shelf. Additional drilling complications could result in multi-million pound costs, research stated.

Rosebank rocky challenges

Legislative and economic constraints also slowed development, but less light has been shone on what fundamentally underlies Rosebank’s challenges, the geology. Rosebank has been one of the first attempts to develop and de-risk volcanic reservoirs of its kind, where appraisal wells have been drilled. While some looked promising, there have been imaging obstacles, TGS explained, related to Rosebank’s geology.

Even after years of work and research on Rosebank, mystery remains around its stratigraphy and reservoir plays. The intricate interlacing of volcanic and sedimentary (clastic and volcaniclastic) layers made it difficult to define its characteristics. Reservoir systems of these kinds were little understood by geologists.

Recent research on Rosebank

Researchers from the University of Aberdeen have a long history studying Rosebank. We speak to Prof. Nicholas Schofield from the research team who presented a talk at Aberdeen Energy Talks in December about Rosebank’s history and geological complexity, which has often overlooked by industry professionals outside of geoscience.

“Prior to Rosebank’s discovery in 2004, very little work had been done on and there was little understanding of fluvio-volcanic drainage and reservoir systems within lava fields in general and how they worked at Rosebank in particular. Therefore, it has been a learning curve for everyone, and we still don’t fully understand the reservoir system. Ultimately, there is only so much work one can do on the wells available in Rosebank, and arguably the discovery remains under appraised.”

With a lack of understanding about these types of reservoir systems, Rosebank offers opportunities to learn, particularly when Phase 1 operations begin. Appraisal may be beneficial to reduce risk and uncertainty, but it may not be possible to know what unexpected discoveries could come up until the operations of Phase 1. This is where seismic imaging of the subsurface is crucial.

Seismic imaging structural challenge

In addition to the reservoir systems, the volcanic rocks in Rosebank also cause problems for the imaging quality received about its subsurface. It is one of the biggest challenges seismic interpreters face, because of the way seismic wave velocity responds to volcanics, recording a strongly scattered wavefield which obscures perceived structures. Some researchers have tried to overcome these problems studying subsurface volcanics by using computational methods.

On modern seismic methods, TGS have stated: “Advancements in computing power and storage have contributed greatly to the development and refinement of preprocessing and image processing workflows. The improved computing efficiency when using wave equation-based techniques for velocity model updating has made it possible to image and map intra- and sub-basalt events.”

Seismic imaging volcanic rock layers is difficult because of its physical properties and collecting seismic data can be costly. This was the case for the Ocean Bottom Node (OBN) survey which was collected across Rosebank in 2010 in 2011. Schofield mentioned it covered just the outline of the field, explaining: “This was an expensive survey, and debate has remained if the Joint Venture (JV) partnership at the time would have been better off drilling another appraisal well to reduce subsurface uncertainty. It was hoped that the OBN survey would define the reservoir sequences to a higher degree, and although the resulting greater reservoir definition has done this to a certain extent, the seismic uplift probably had not been as much as had been hoped at the time.”

But there is a silver lining. While seismic data processing methods are well established, the exponential increase of computing power seen today may offer hope for improved seismic imaging of volcanics in the subsurface. “Seismic technology, both in acquisition and processing develops extremely rapidly. In the 10+ years since the last survey, things have moved on. A lot more experience on both how to acquire and process seismic data in regard to volcanic sequences now exists in the industry.”

Many previous assumptions about the reservoir system that deposited Rosebank have been found to be wrong. Seismic and well data combined could help to resolve what is going across the whole of the field holistically.

Subsurface data “king” for de-risking reservoirs

Uncertainty because of seismic imaging quality and geological complexity puts even more importance on the collection of subsurface data in Phase 1. Schofield suggests: “This is going to be one of the most critical parts of the Phase 1 development; good data collection in terms of extensive suite of wireline logs, core and side-wall core needs to be taken.”

“Costs must not be cut on this, as without good subsurface data critical information could be missing to fully de-risk the reservoirs. It’s a horrible feeling to experience, after a well is drilled realising that a critical bit of information is missing that could have answered a particular critical subsurface question or risk.”

Doing another seismic survey would understandably be difficult economically, it might not be worth budgeting tightly on subsurface data collection in Phase 1. “On the first few wells of Phase 1 development on Rosebank, a throwing of the ‘kitchen sink’ approach is probably a good idea. Although this will drive up the price for the initial wells, ultimately the data provided could be critical in the long run for correct decision making,” Schofield adds. Looking ahead, more appears to be more, when it comes to downhole data.

Phase 1 to phase 2 considerations: risks remain

Usually appraisal wells collect enough information to successfully de-risk reservoirs prior to production, leading to lower costs and less unexpected problems encountered further into operations. Schofield advises that “When planning any development, the question is always ‘does enough appraisal data exist to go through to development?’. Arguably, Rosebank is under appraised, meaning that significant uncertainties exist, and risk does remain.”

“Positives do exist however, for example the flow test done in the 2009 appraisal campaign was good and suggested a large-interconnected volume in the Colsay 1 reservoir at least. But aspects such as compartmentalization and subtle trapping across the field is still a large unknown.”

This flow test showed a ‘choked’ flow of 6000 barrels of oil per day (choked means the flow was restricted deliberately during the test). But this may not have been enough to understand production. More data will be important, especially to overcome potential confirmation bias. For instance, assuming intruding volcanics are not there could result in a nasty surprise if found to be obscuring production flow during development.

“When drilling development wells, you want them to be best located to be able to produce at high rates and for a sustained period of time. However, uncertainty remains if the wells (both producers and water injectors) are going to be optimally located. The last thing one wants to happen is drill a development well and have it underperform,” Schofield tells us.

We can see that looking ahead to Phase 2 will depend massively on findings and information taken from Phase 1, where data will help to de-risk the development. Subsurface data is key to understand the reservoir and placement of development wells. But whether some wells are optimally placed or not might not be revealed until later.

What Rosebank means for UK energy security

Even amid the backlash from environmental protestors, and the debate around its development, Rosebank promises more energy security for the UK, and around 1600 jobs for the region.

“I think it’s important to state that Rosebank is a positive development for the UKCS and West of Shetland in particular, we need more Energy Security in the UK and NW Europe. The discovery presents an opportunity to add significant reserves to the UK’s portfolio,” Schofield reflects.

There are aims for Rosebank to be completed efficiently through the reuse of the FPSO, which should help to reduce environmental impacts compared to already established fields. But uncertainty remains around reservoir structures, how much oil and gas can be expected, the placement of wells, production volumes and engineering challenges.

With some final thoughts, Schofield concludes: “We must admit that Rosebank is complex and will be challenging, but it is also important to state that it is rare for any significant oil and gas project development to go entirely to plan, that’s the reality of subsurface unknowns. All companies in the JV (Equinor and Ithaca) have experienced and technically excellent people working for them, and Equinor has built up experience dealing with the Mariner field which has been challenging development for the company.”

Despite its complex geology, Rosebank remains an important development for the west of Shetland and UK energy security. As Phase 1 begins, some plans might change, and obstacles will likely arise, but this will be a learning curve for Phase 2.

Recommended for you

© Supplied by Aberdeen University

© Supplied by Aberdeen University © Supplied by Teekay

© Supplied by Teekay