Sval Energi has signed an agreement to acquire Suncor Energy’s Norwegian business, as the Canadian group looks also to sell off its UK assets amid a pull back from the North Sea.

In quarterly earnings filed on Thursday, Suncor (NYSE:SU) said it had agreed a C$410 million ($318m) deal to sell its exploration and production (E&P) assets in Norway, with Sval confirmed as the buyer on Friday morning.

In addition, Suncor said that based on interest in its UK assets, it has “commenced a sale process for its entire UK E&P portfolio”, though it did not disclose a deal value or name any potential buyers.

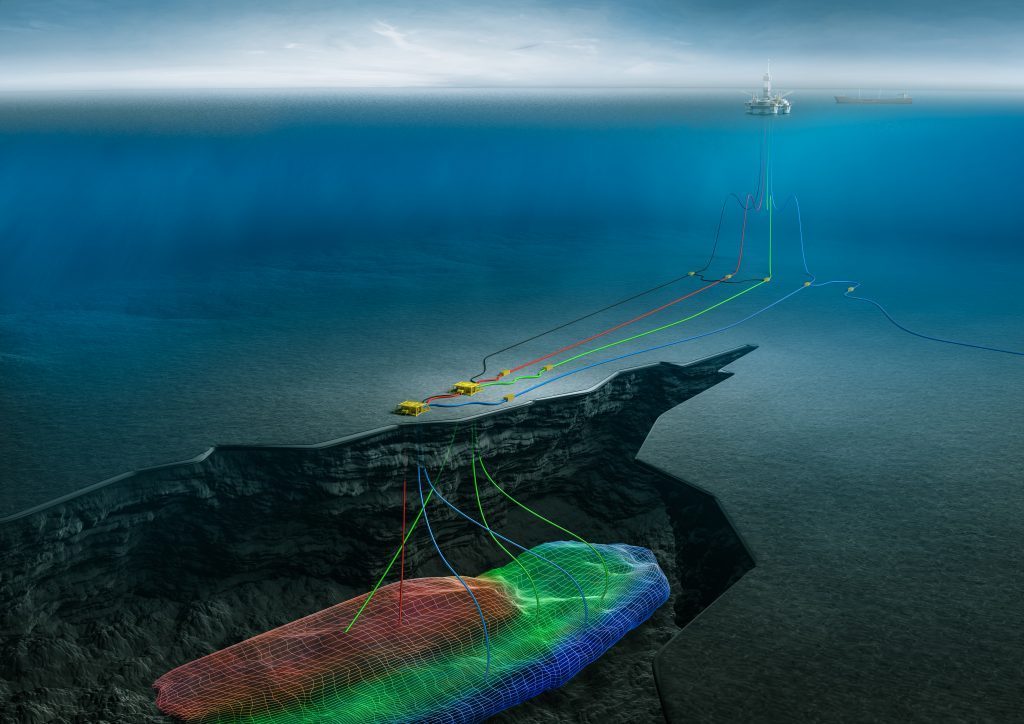

The Norwegian transaction covers a suite of licences and assets across the Norwegian Continental Shelf, including Suncor’s 17.5% stake in the Fenja field (PL 586), 30% share in the Oda field (PL 405) and eight further licenses.

HitecVision-backed Sval said the acquisition would add an average of approximately 4,000 barrels of oil equivalent (boe) in daily production and 19 million boe in reserves to its portfolio.

The sale is expected to be completed in the fourth quarter of 2022, with an effective date of March 1, 2022.

The employees of Suncor Energy Norge will also be transferred to Sval, in accordance with the Norwegian Working Environment Act.

It continues a string of recent transactions for Sval, including its acquisition of Spirit Energy Norway and ownership in the Martin Linge and Ekofisk fields, the latter two still subject to regulatory approvals.

The company says it is “on course” to reach its goal of 100,000 boepd production in 2023.

Sval CEO Nikolai Lyngø said: “This transaction represents another step on our growth journey. We already have a capable team in place and look forward to welcoming new colleagues from Suncor’s Norway team – they will strengthen us even further.

“The Norwegian Continental Shelf is still attractive, and we are building a strong cash-generating business in Norway with producing assets, future developments, and exciting exploration opportunities. We are executing our strategy and transforming into a significant player on the Norwegian Shelf.”

In the UK, Suncor holds a 29.9% interest in the Buzzard field in the central North Sea, which delivers more than 22,000 bpd net to the company.

It also has a 40% stake in the pre-final investment decision (FID) Rosebank development, for which operator Equinor filed key environmental paperwork just yesterday.

The company had reportedly weighed the sale of some Norwegian and UK assets back in 2020, later settling a £240m deal with EnQuest in February 2021 to offload a 26.9% stake in the North Sea’s Golden Eagle field.

Another sale process, covering Suncor’s wind and solar assets, is also reportedly progressing with a deal expected to close “early in 2023.