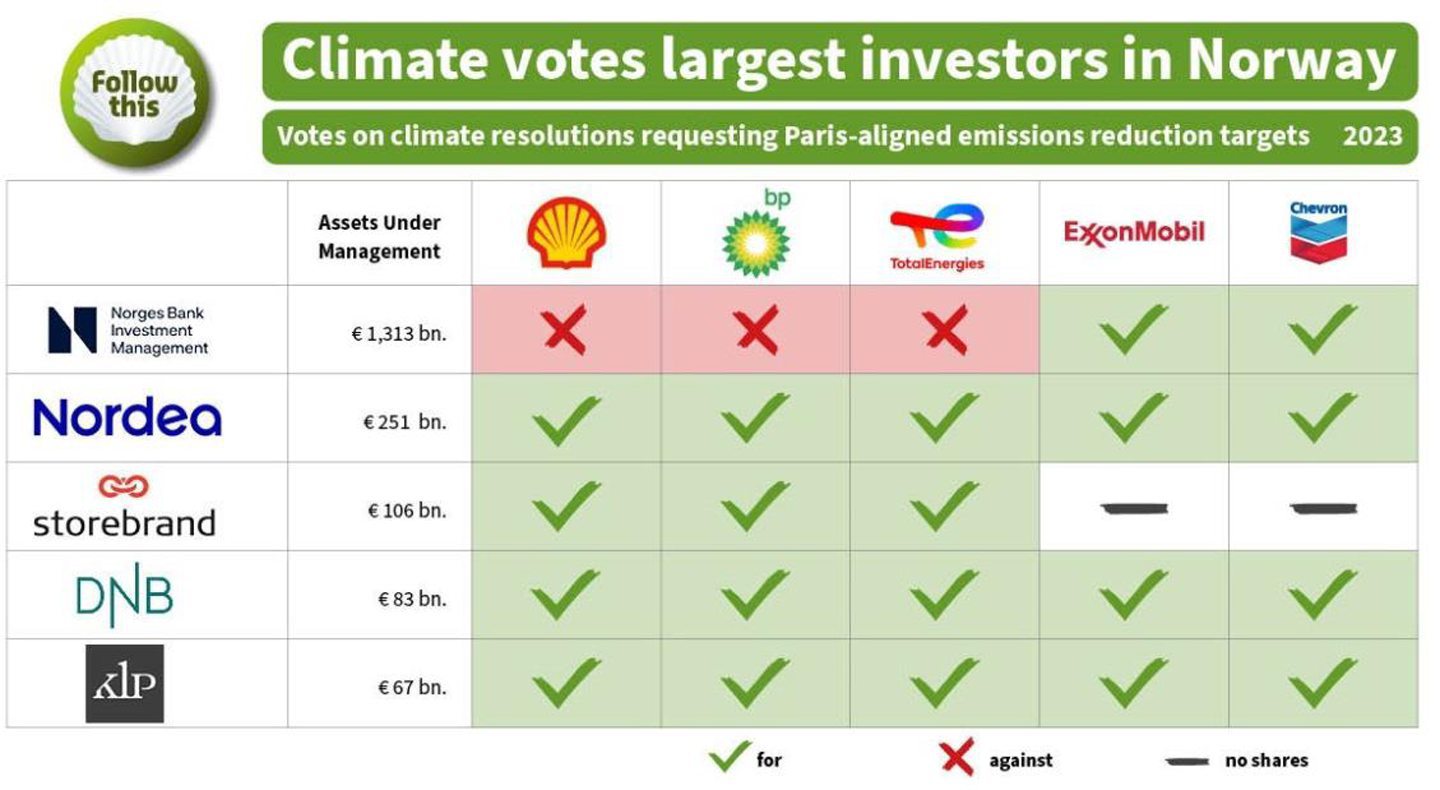

Norway’s five largest investors prefer to vote in support of shareholder climate resolutions at major oil and gas firms rather than divesting their shares, according to a new report.

Climate focused activist shareholder group Follow This found Norwegian investors supported nearly all climate resolutions at Big Oil firms in 2023.

Follow This said this voting behaviour contrasts with the approach taken by many investment firms in Europe, which tend to prefer “engagement or divestment”.

In the United Kingdom, Follow This said most large investors voted against climate resolutions in 2023, favouring an approach based on engagement.

Meanwhile in the Netherlands, many large investors have divested from Big Oil entirely.

Norwegian investors support climate resolutions

Follow This founder Mark van Baal said the Norwegian investors, which include Norges Bank, Nordea, Storebrand, DNB and KLP, show that voting is “essential” to active ownership.

“Big Oil will only change if shareholders vote for change,” Mr van Baal said.

“Investors who divest, transfer their shares to less responsible shareholders, enabling Big Oil to drill for more oil and gas with disastrous consequences for climate and economy.”

Mr van Baal said Norwegian investors are a “true steward” of the global economy, while their international peers enable oil majors to continue causing “climate breakdown”.

Based in Amsterdam, Follow This seeks to push major fossil fuel producers, like Shell and ExxonMobil, to align their climate targets with the Paris Climate Agreement ‘from the inside’ as a shareholder.

A climate resolution put forward by Follow This will be voted on by Shell (LON: SHEL) shareholders at the company’s annual general meeting in London in May.

The 2024 climate resolution at Shell is co-filed by 27 institutional investors with around £3.4 trillion in assets under management.

Meanwhile, Exxon (NYSE:XOM) is suing the shareholder activist group as it seeks to tighten rules on what proposals get on proxy ballots in the US.

Voting part of ‘active ownership’

Follow This said voting is an essential part of active ownership of fossil fuel companies, a view it said is shared by Norwegian investors.

According to a responsible investment report from Norges Bank, the firm’s goal is “to reduce risks and promote long-term value creation at the companies we invest in through active ownership”.

“We do this through dialogue with companies and voting at their shareholder meetings,” the Norges Bank report said.

Meanwhile, Nordea said: “We exercise our voting rights at annual general meetings (AGMs) to support initiatives related to the environment, biodiversity and human rights.”

Follow This said Norges Bank voted in favour of the Follow This climate resolution at both Exxon and Chevron last year, and the fund’s chief executive Nicolai Tangen recently criticised Exxon’s “aggressive” climate lawsuit against shareholders.

Mr van Baal called on Norges Bank to vote in favour of the climate resolution put forward by Follow This at Shell’s AGM this year.

“Their vote will send a strong signal to the boardrooms of all oil majors including Exxon’s,” he said.

Big Oil shareholder activism

Follow This said shareholder voting support of climate targets “must increase” to force the supermajors to take greater action.

While 20% of Shell shareholders voted in favour of the Follow This climate resolution in 2023, the London-listed firm recently watered down its 2030 climate targets.

Mr van Baal said this demonstrates that one fifth of shareholders is not enough to drive change.

“Paris will fail unless the oil industry changes. That’s a decision for shareholders,” he said.

“Investors do not have to sacrifice climate action in favour of short-term profits.

“This is a false dilemma: shareholders can enjoy dividends from oil and gas while oil majors invest these profits in renewables to drive down emissions at the same time.

“Taking short-term fossil fuel profits and addressing long-term climate risks are not mutually exclusive.”

But while many investors are campaigning for major oil producers to massively increase their climate efforts, others are seeking the opposite.

Activist investor fund Bluebell last year urged BP (LON:BP) to abandon its commitments to reduce oil and gas output and other parts of its clean energy strategy.

Climate activism in the courts

Shareholder activism isn’t the only avenue climate campaigners are seeking to change the trajectory of Big Oil firms.

Layers for Shell are this week appealing a landmark court ruling in the Netherlands which ordered the company to cut its carbon emissions by 45% by 2030.

A separate UK legal challenge targeting Shell’s board of directors over the company’s net zero policy failed last year.

UK environmental campaign groups Greenpeace and Uplift are also challenging the decision to approve Equinor’s Rosebank oil field.

Greenpeace is also involved in a separate challenge to Shell’s Jackdaw gas project, which is on hold pending the outcome of another Supreme Court case centred on an onshore oil well in Surrey.

Meanwhile in Norway, a district court in Oslo recently declared the Norwegian government’s approval of development plans at the Breidablikk, Tyrving and Yggdrasil fields in the North Sea to be invalid.

The court decided the three licences, split between companies including Equinor and Aker BP, were invalid largely due to the lack of consideration given to downstream emissions.

Recommended for you

© Follow This

© Follow This © Follow This

© Follow This © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Shutterstock

© Shutterstock