Noble Corporation (NYSE:NE) has grabbed “first mover advantage” in an offshore rig market set for further consolidation, according to analyst firm Wood Mackenzie.

Earlier this week, Noble announced it would acquire smaller competitor Diamond Offshore in a cash and stock deal worth around $1.6bn.

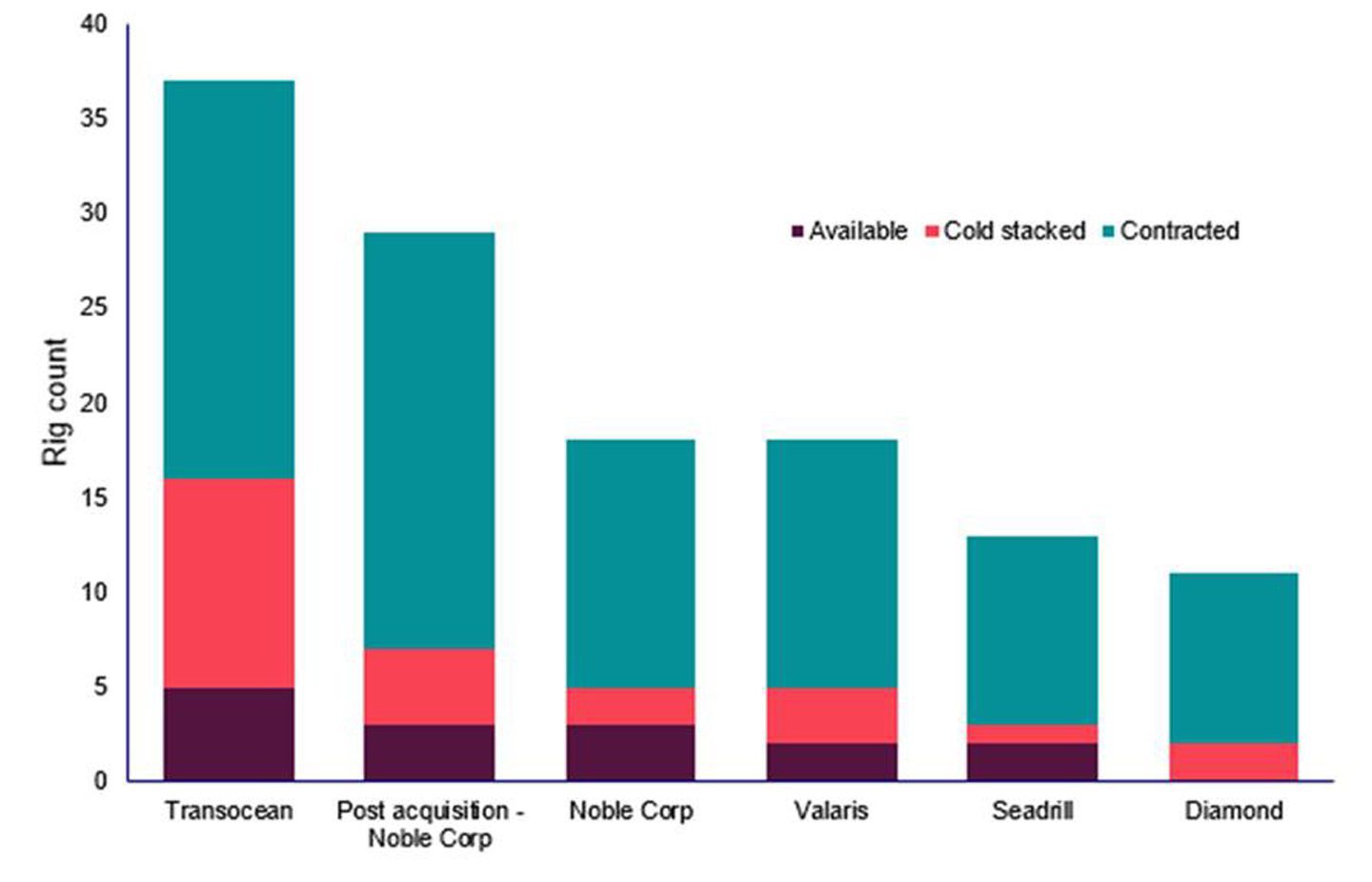

Following the deal, Noble will own and operate a drilling fleet of 41 rigs, including 28 floaters and 13 jack-ups, with an order backlog close to $6.5bn.

The move marked a stunning turnaround for Noble, coming less than four years after the Texas firm filed for bankruptcy during the pandemic.

Wood Mackenzie upstream supply chain principal analyst Leslie Cook said the deal gives Noble “first mover advantage” in a market expected to consolidate further.

“We have been predicting offshore rig market consolidation for some time and with little appetite from owners to add new rigs as rig demand is flattening out, we believed growth would be inorganic,” Ms Cook said.

“It therefore comes as little surprise that the first major deal in the upstream service sector has been announced.”

Deal solidifies Noble’s top two position

Ms Cook said the deal solidifies Noble’s position in the top two of the world’s offshore rig contractors, which could impact the market moving forward.

“With this deal, more than 60% of total floater backlog is with four drilling contractors,” she said.

“While we believe this will have little impact on day rates in the shorter term, we do believe that the consolidation of the market will afford rig contractors more control in the medium and long term.

“With day rates currently reaching US$500k/day, this will be an ongoing concern for operators adhering to capital discipline and planning for long-term drilling programmes.”

Noble broadens client footprint

Wood Mackenzie said with the Diamond takeover improves, Noble will improve its position in the most commercially advantageous markets.

The move also broadens Noble’s client footprint, improves access to the UK and Australian markets and strengthens its position in the lucrative US Gulf of Mexico.

“If expected synergies and costs are realised, it will increase effective utilisation and make Noble’s fleet more competitive,” Wood Mac said.

In addition, the Diamond also provides a “good cultural fit” and will diversify Noble’s portfolio without diluting the marketability of its assets.

Recommended for you

© Supplied by Diamond Offshore

© Supplied by Diamond Offshore © Wood Mackenzie

© Wood Mackenzie