Historically a less volatile sector when it comes to prices, the liquefied natural gas (LNG) market is now facing uncertainty. As such, Simon Redmond, commodities specialist and Director at Standard & Poor’s, offers his top ten developments for the year ahead.

Prices of liquefied natural gas (LNG) have been less volatile than some other commodities in recent decades – largely because most LNG is sold via oil-linked, long-term contracts. Guaranteeing some revenue visibility for upstream producers, and supply to downstream utilities, such contracts provide some protection from short-term changes to market conditions.

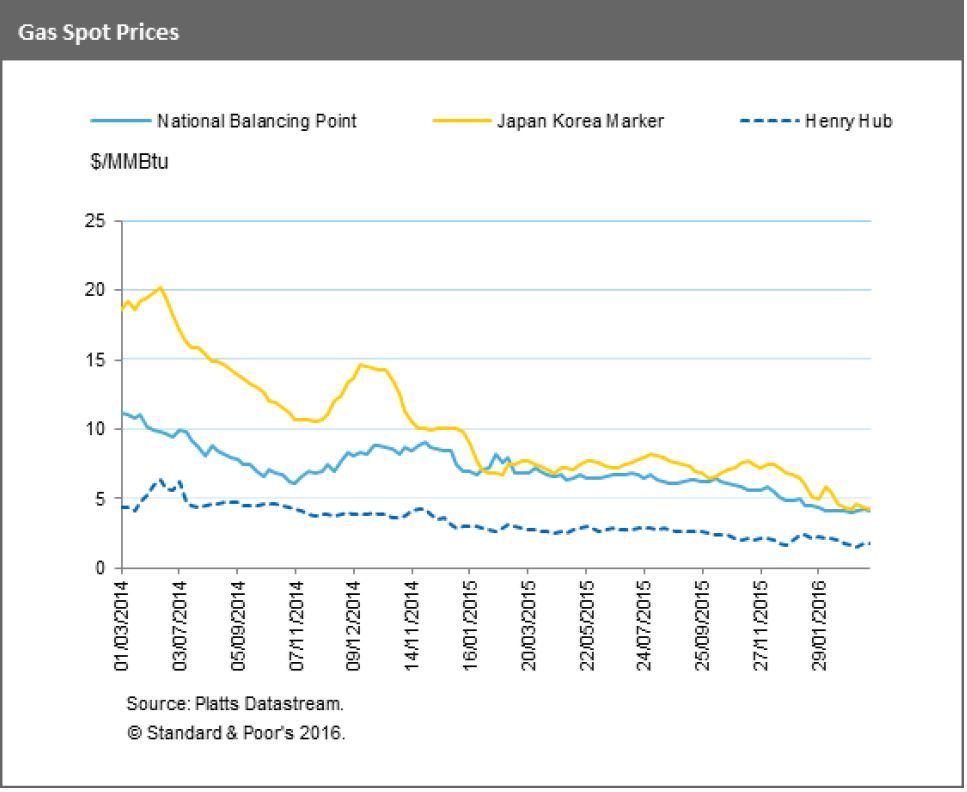

Yet uncertainties over price and profitability for producers are growing due to over-supply. As this supply remains unmet by near-term demand, ‘spot prices’ – the commodity’s price at any given time – have fallen, meaning uncontracted project revenues are at risk. With obvious implications for the creditworthiness of projects, gaining insight into key developments in the market is vital for investors.

1. Contracts are changing to favour off-takers

One major trend is that the balance in negotiations for LNG contracts has swung in favour of utilities and off-takers. Given the long-term nature of these contracts, they are more often linked to benchmarks such as average oil prices, rather than the less-liquid spot prices. Yet the terms of existing contracts may not fully reflect the decline in global oil prices – hence making legacy contracts less attractive to buyers than the low prices of the uncontracted spot market.

For instance, in January this year, Indian LNG buyer Petronet renegotiated terms with Qatari supplier RasGas – changing delivery schedules and pricing mechanisms – in part in order to better reflect LNG’s lower market prices.

2. There is a glut in global supply

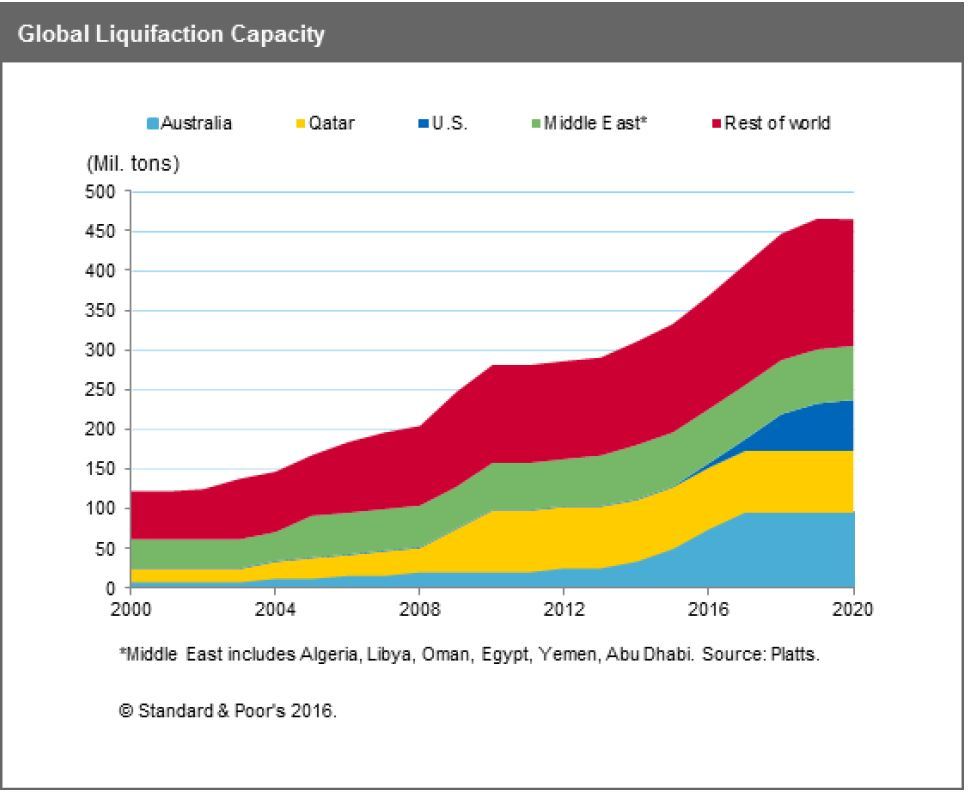

Part of the reason for this price decline is the ample global supply of LNG, which is set to skyrocket – from roughly 330 million tonnes per annum (mtpa) last year, to 460 mtpa towards 2020. This marks an increase of around 40% (see graph 1).

Notably, Australia is looking to ramp up production, and its LNG exports could outpace those of Qatar – the world’s top producer – in the next few years. In addition, the US is planning five new terminals to export some of the glut of shale gas.

Graph 1: Global liquefaction capacity

3. Cutbacks in production do not seem on the cards

Cuts to this LNG supply are unlikely in general. This is because, once in operation, a liquefaction plant’s costs remain relatively low. As with oil and other gas producers, it is more economical for companies to continue producing and selling LNG to realise some revenues rather than reducing supply.

4. Sector prospects seem poor for uncontracted projects

Unmet by demand, such supply has caused LNG spot prices to decline (see graph 2). Therefore, new uncontracted or deferred supply of LNG, exposed to market variations, will bring lower revenues for producers.

5. Margins tighten for established producers

In this unsettled environment, established producers of LNG will likely take longer to repay their debts and find their dividends smaller: lower spot prices for their uncontracted LNG will bring uncertainty to revenues, while reduced oil prices also stand to dampen down the price of their contracted volumes.

6. Credit risk varies by project and company

That said, impacts vary by development stage. More positively, for instance, some new LNG projects have now emerged from the development stage – which entails significant construction risks – into the more secure and less expensive production stage.

7. The need to attract investors is driving strategy

Despite the fact that new LNG projects can provide important economic diversification for oil companies, upstream companies now need to do more to entice investors. This is often leading them to focus on projects with comparatively rapid returns, rather than long-term investments like LNG.

8. Ratings could be under pressure

Currently, almost all of Standard & Poor’s ratings of LNG-producing companies are investment grade (that is, BBB- or higher). But we have recently reviewed the ratings on some upstream companies, given commodity spot prices. Dealing with fixed production costs, such companies may find they have less financial headroom than expected as revenues fall.

For example, two ‘A’-rated RasGas projects in Qatar received negative outlooks recently – the first revision of this kind in a decade. This implies that the next year or two brings a one-in-three chance of a ratings downgrade for these LNG projects.

9. Recovery looks unlikely

The medium-term outlook remains gloomy. With such ample LNG supply, the recent strengthening of Brent crude from its multi-year lows will limit downside for contracted revenues, but uncontracted volumes may only find homes at weak price points in 2016 and beyond. Coupled with the fact that the LNG market is generally slow to change direction, it would take a significant event to shift expectations in 2016.

10. Revival of global demand remains far off

Further down the line, prospects for LNG prices might improve – especially if stronger than expected economic growth in China and elsewhere isn’t covered by softening oil supply. Higher coal prices, or demand from European power generators as they switch to gas, could also spur a recovery. Yet, crucially, these scenarios remain hypothetical.

Recommended for you