“If leaders of the energy industry want to keep a seat at the negotiating table as society changes around us then……we need to engage radically”

Those are the words of Lord Browne at the recent ONS 2016 conference. They act as a call to the energy industries to work together to meet the demands of the future – no longer oil and gas on one side, and renewables on the other, but both sides engaged to pursue adjacent strategies.

In the UK, particularly with the uncertainty created by a multitude of factors, notably Brexit, the depressed oil price and corresponding loss of jobs, and the removal or reduction of renewable subsidies, we are at a crossroads. Therefore, Lord Browne’s statement is worth exploring further in respect of ways that oil and gas and renewables can work together for the benefit of stakeholders and the community at large including addressing the challenges of climate change.

Diversification into renewable and alternative energy projects also operates as a strategic judgement regarding the likely middle term picture of energy generation globally.

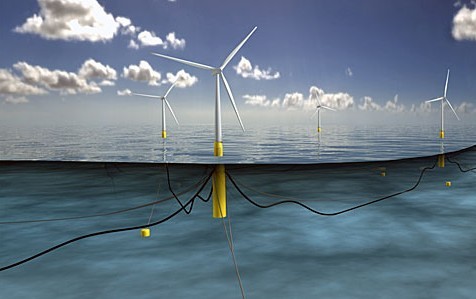

On a commercial level, we are seeing several oil companies making “green” investments. Scandinavian companies DONG and Statoil are recent striking examples in this regard with significant investment already made in offshore wind. The establishment of “New Energies” divisions by Total and Shell continues this trend. Total’s investment in storage technology through the acquisition of Saft affirms their ambition.

For some oil companies, it makes business sense to do this when oil prices are low, and renewable energy developments are perceived as steady long-term investments. However, it is balancing act for oil and gas – there will continue to be a need for fossil fuels, and investments made in renewables, although significant, are small in relation to the wider asset portfolio of the larger oil and gas companies.

A wholesale transition into renewables will clearly not be made, but there is strong merit in engaging to create a flexible and diverse energy mix. To not diversify or at least consider renewables, is effectively to bet that technology does not step forward to diminish the need for oil and gas. DONG and Statoil have shown the shift that can be made to embrace renewables, and their growing renewables arms have to an extent helped them counter the effects of the depressed oil price.

The scale of redundancies made in the oil and gas sector has been sobering, particularly in Scotland. However, with UK offshore wind and the marine industry in particular continuing to grow apace, a significant opportunity exists to ensure that the skilled workforce is not lost, and opportunities are seized by the oil and gas supply chain.

Traditionally, the oil industry provided a more lucrative and safe choice for engineers and technicians. The salaries paid in oil and gas have outweighed those offered in renewables However, in a climate where renewables have found their place and with offshore wind growing, both in the UK and across Europe, operating across the boundaries between traditional and new energy sectors should be straightforward – many of the technical and managerial needs of renewable energy projects are similar to those in traditional power and oil and gas industries. The skills developed in oil and gas with regard to subsea work, helicopters, health and safety, operation and maintenance, fabrication work and the like, can all be used by renewable energy developers – having this body and breadth of expertise can assist in driving down costs in offshore wind, a stated aim of making offshore wind achievable on a truly global scale. It is early days but with each passing month we are seeing more and more of the oil and gas supply chain bidding for and being awarded work in the renewables sector. T here are an increasing number of headline stories like the success of Ecosse Subsea Systems, Petrofac’s contract win for East Anglia 1 and the announcement of contracts for MeyGen including amongst others James Fisher & Sons. A definite trend seems to be emerging as an alignment of the challenges of the renewables industry and the project management and engineering skills of the oil and gas supply chain provides opportunities for real win-win scenarios, especially for offshore projects.

If the UK Government can show strong commitment and provide regulatory certainty to the renewable industry to allow it to fulfil its potential, then renewable energy careers will represent a viable long term career choice for those who are looking to a world where reliance on fossil fuels is diminished by the growth of sustainable technology and development. In addition, the global opportunities of renewable energy are not confined to oil and gas provinces and the location of oil reserves, but are abundant across the world as countries seek to tackle climate change.

All that said, the death of oil has been greatly exaggerated in recent times, and absent some unforeseen events or drastic shock to the world economy, the case for a steady and in time significant recovery in the crude price is very persuasive. The current landscape for renewables developments, including offshore wind, nonetheless represents an adjacent and complementary opportunity for E&P companies and the oil and gas supply chain.

It is an uncertain time for those in the energy sector as the future direction is still very much under debate. Whilst the oil and gas industry is losing highly skilled staff, the renewables industry is in desperate need of skilled staff that can use their experience and facilitate its growth.

This is a great opportunity and could turn an uncertain time into a truly exciting one with regard to taking positive steps towards achieving our energy goals. That traditional oil companies are investing in renewables shows the commercial will behind working together and developing a diverse energy mix.

Therefore, to reiterate Lord Browne’s thoughts, the argument for engagement between oil & gas and renewables is compelling and, by having this engagement now, important steps can be taken towards utilising complementary skills and a more integrated energy mix. Certainly not the beginning of the end for Oil & Gas but rather an opportunity for adjacent investments using complementary skills.

Robin Clarkson is a partner at Burness Paull.