The preliminary announcement by OPEC of a deal to cap production between 32.5 and 33 million barrels per day has given a welcome shot in the arm to the upstream market. While the specifics will be announced by OPEC at their November meeting in Vienna, on the face of it, it’s a hugely positive signal for the sector and points to a near term turn in the market.

Our analyst team have been pouring over their Drilling & Production models since early Thursday morning post OPEC announced their intentions and the preliminary conclusion is that if implemented, the oversupply in the global oil market will physically correct in 2017.

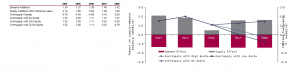

Many media reports have focused on the 700,000 to 750,000 barrels per day reduction the freeze would take out of the market, which is based on OPEC production levels as of August 2016. More important is the consequence of the cap on production levels through 2017 and beyond. Our analysis suggests a decline of as much as 1.2 million barrels in 2017, and 2.3 million barrels in 2018. That’s material.

Prior to Thursdays announcement, and since 2015 unlike many other analysts at the time, Douglas-Westwood was of the view that the supply overhang would persist in 2017 and continue through to 2020. This would have the impact of weighing down commodity prices and associated investment for the rest of the decade.

Assuming nothing material changes during the November meeting and that the markets have confidence that the cap will be implemented, a positive and upward trend will continue for Brent crude prices lifting it beyond its $50 ceiling.

The key question for the offshore and North Sea region is if this change starts to take place this year, in time to influence 2017 spending. To be honest, I find it doubtful as the markets and E&P companies will pause to see what actually happens. While this may be the case, a positive momentum will build in 2017 fuelling increased investment in 2018.

Andrew Reid is a managing director at Douglas Westwood