Offshore vessel contractors are caught in the midst of “worrying times” with more than a quarter of the fleet laid up and reactivation costs high, new research shows.

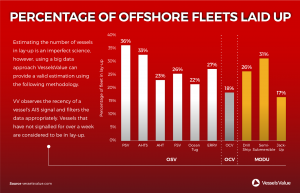

Out of a 10,000 strong global fleet, 28% of ships are not in use, according to research by VesselsValue.

Platform supply vessels top the table with 36% laid up, according to the website, which provides data on ship values, ownership histories and tracking.

Charlie Hockless, senior offshore analyst at VesselsValue, said the market was in a sorry state and that he had been “delivering bad news” to people for a long time.

Mr Hockless also said he was “very nervous” about the next few years.

He said: “In terms of the offshore market this has been one of the worst periods in 30 years.

“In terms of reactivation, most modern vessels were not built to not work.

“They were ordered at a time when industry was in a boom period. It wasn’t conceivable that they would be cold stacked.”

Last month, Transocean released its latest fleet report, which showed a $40million reactivation cost for the Transocean Barents rig.

Mr Hockless said the cost of reactivating a cold-stacked rig could be anywhere between $25million and $100million.

He said. “The cost of reactivation depends how well has the rig been looked after.

“But cold-stacked rigs are going to be looked upon less favourably than ones that have been working over the last four years.

“Operators want an asset that has been proven to work, not one that has been laid up for three years.

“There will be questions over whether it will work correctly.”

He said dust and mould could have accumulated in living quarters over the years, meaning they would have to be refurbished.

Machinery and equipment could also have fallen into disrepair. Mobilisation is an expensive business.

Mr Hockless said the reactivation of vessels needs to be “controlled cleverly” when the recovery comes.

“If the rates are stable the last thing we want is a lot of supply,” he said. “If 30% of market returns, rates will crash back down.

“And that’s not taking account of vessels which are being built to order.

“There are almost 500 offshore supply vessels on order.

“… Supply is just going to be overwhelmed and rates will suffer.

He added: “I’m very nervous about next few years because scrapping is so unattractive to owners.

“There is not much steel in an offshore supply vessel, they’re not going to get much money for it.”

Recommended for you