The Megawatt Hour is the latest podcast boxset brought to you by Energy Voice Out Loud in paid partnership with BDO. This monthly series examines how energy storage technologies are reshaping, reinforcing and recharging energy markets in the UK and around the globe.

In the third episode of our series, content editor Andrew Dykes is joined by co-host and BDO associate director Viran de Silva, as well as RheEnergise CEO Stephen Crosher and DNV VP for energy transition and innovation development, Sarah Kimpton.

Having taken a deep dive into the world of batteries, we now look at the other vectors available for storing energy from compressed air to heat – with a particular focus on the longer-term flexibility of hydrogen and pumped hydro.

Ms Kimpton made the case for hydrogen as a particularly useful vector, largely due to its “very versatile” nature. She also helped outline the scale of the challenge of decarbonising energy use, particularly given that at peak use during winter, the UK’s gas networks are responsible for four times as much energy as the electricity networks.

Compared with other longer-duration storage options, “chemical storage overcomes many problems, because storing molecules is inherently easier than storing electrons in a battery,” she continued.

“I think that the storing chemical energy maybe in the form of hydrogen – or whatever it is – is probably going to be an at-scale solution for energy storage.”

Pumped hydro disruptors

Mr Crosher offered a brief history of the world’s largest current source of energy storage, pumped hydro, which was primarily built to balance baseload power from coal and nuclear plants over the past century or so.

However, building new plants requires hundreds of metres of elevation and specific geographical features, and typically involves a necessary amount of environmental destruction to establish dams and infrastructure.

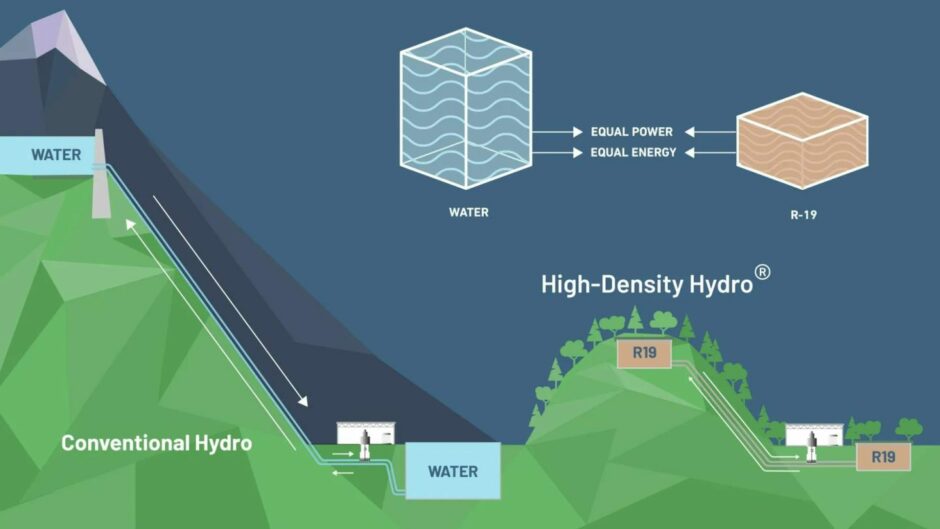

RheEnergise’s solution is to use a manufactured, benign high-density fluid in place of water as part of a closed loop system. Its design means plants can achieve the same power output as a conventional sites, but with a much smaller footprint.

“Either you can reduce volumetrically the size of the construction size of your project; so with a 2.5 times denser fluid the construction size is 60% less, so the speed to build and the cost of building is significantly less,” he explained.

“Or alternatively you can reduce the vertical elevation that you need by again 2.5 times, so we would achieve the same power energy at 200 metres, as you would with a project at 500m.”

While there is still reliance on “a little bit of topography”, Mr Crosher said the reduction in vertical elevation also unlocks “an order of magnitude more sites” suitable for plant construction. Indeed, RheEnergise has identified over 6,500 potential sites in the UK alone where its plants could be sited.

While there are few technical constraints to project sizes, he said the company would look to play in a “sweet spot” of projects ranging from 10MW to 50MW, largely to replace the current system of flexible gas “peaking” plants which tended to be in of a similar scale.

Looking at duration, he said a typical system would be in the region of between six and 20 hours. “If you’re trying to balance the cycles of renewable energy, that’s where the vast bulk is going to be needed,” he added.

However, unlike some storage players, RheEnergise sees itself as a technology and IP owner, rather than a developer and generator. Mr Crosher said its model would be to license the technology to those looking to build their own projects in local markets – whether in the UK or globally.

“We see mines as an attractive market, who have a high level of 24/7 power demand. We also see, paradoxically, EV charging at infrastructure points such as or on motorways, where we sit behind batteries who provide the fast charge,” he added.

Hydrogen: green, blue or grey?

When looking at much longer-term storage options, hydrogen emerges as a potential contender to replace some of the work done by the UK’s gas networks – the “unsung heroes” of the energy system, Ms Kimpton says – which are responsible for some 900 TWh of energy supply.

“Replacing that amount of energy, you can either do it two ways: you can replace it with another low carbon molecule, or you could electrify everything. And either way, I think you’re going to need hydrogen storage,” she explained.

Hydrogen also comes in many forms – from grey, through blue to green – dependent on the net carbon impact of production. It’s important to note that green – produced from electrolysis using renewable power – and blue – using natural gas with the emissions curtailed via carbon capture and storage (CCS) – are the only viable sources if energy use is to be truly decarbonised.

While hydrogen is easy to produce and consume, long-term storage options are still under development. In the UK, Ms Kimpton said the most accessible large-scale option would be to use natural or excavated salt caverns – but that work needs to start soon if the government is serious about hydrogen adoption.

“A salt cavern could take you about 10 years to excavate, and then storing hydrogen in a salt cavern is proven technology. There are other options being looked at – for example repurposing spent hydrocarbon fields and using them for storing hydrogen or even carbon dioxide.”

However, this still requires further investigation – and both solutions require access to infrastructure and the right geology to make this a viable proposition.

Investment frameworks

Looking at the prospects for these forms of storage in the UK, both panelists were clear as to the need for further refinement.

As Mr Crosher noted: “There’s definitely not yet a clear market or regulation around energy storage that that is fit for the future. But the UK Government and other governments do seem very aware that it’s something they do need to resolve.”

He was optimistic that a viable framework could be devised within “three to four years”, though Ms Kimpton was less confident that the right moves were being made in the gas and hydrogen sectors, particularly as the global trade in liquefied natural gas (LNG) – currently the UK’s major backstop for gas supplies – is unlikely to be replicated at the same scale with hydrogen.

“Whenever we need an extra, extra supply of gas, we just order a few more boatloads of LNG and it arrives… But there isn’t anything like that now for moving hydrogen around the world, so I think we’re going to have to be a bit more self-sufficient.”

“Certainly in the short term we’re going to have to generate our own hydrogen, store our own hydrogen to make sure that we can continue to provide the heat and light that that we do now.”

However, she also acknowledged there remains some work to be done on developing a viable market for hydrogen, noting there was something of “a chicken and egg” situation at present.

“You need the storage to persuade people to produce it, and then once it’s gone into storage, then you need the people to use it. We need the government to stimulate that mechanism for and come up with a decent strategy rather than allowing us to depend upon on markets.”

Mr de Silva too concurred that more work was needed by government to devise frameworks that would support the deployment of capital into these schemes. “I think from the government point of view, really we need incentives and encouragement to invest because of the scale of storage that’s needed by 2050.”

Yet whether we opt for heat, hydrogen, pumped hydro or gravity – and most likely all of the above – Mr Crosher finished by pressing the urgent need for action to build the estimated 2TWh of energy storage needed between 2040 and 2050.

“We’re talking about replicating the total global energy storage capacity that has been built over the last 100 years, and doing it every 18-24 months out to 2040.”

“It’s just a phenomenal challenge.”

Listen to The Megawatt Hour podcast by Energy Voice Out Loud here.

Recommended for you

© Supplied by RheEnergise

© Supplied by RheEnergise