Helen Dickson, a corporate transactional lawyer with Burness Paull, explains how the offshore contracting industry is being hit by a perfect storm of lower margins, higher risk and squeezed staff numbers.

What is the mood in the oil and gas contracting market?

HD: It depends what part of the cycle a particular company is in. Those contractors providing services to producing installations are generally more positive. They can all still see a pipeline of work. Firms in the sub-sea construction and drilling sectors are more downbeat as there is clearly not as much new work coming on stream.

How has offshore contracting been affected by the lower margins?

HD: With the low oil price, [in addition to there being fewer new contracts being awarded] everyone is operating on lower margins – and like all companies across the sector, contractors are drastically reducing costs to mitigate reduced margins and stay competitive. One consequence of that is job losses. In particular, we have seen the contracts teams severely affected with significantly reduced headcounts to manage both new and existing contractual commitments.

How does this affect contracting in the industry?

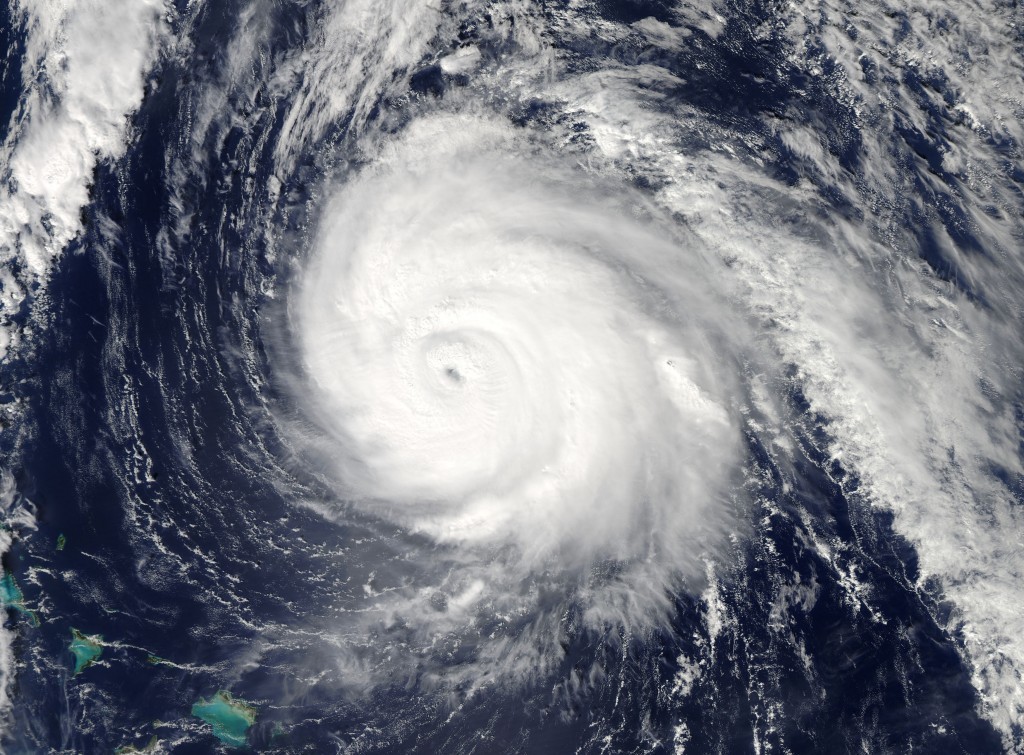

HD: Lots of companies are operating with a reduced in-house contracts support function – but that may not necessarily mean they are doing any less work. Contracts are being scrutinised more than ever with parties looking to re-calibrate the basis of their relationships. This creates a challenging situation, a perfect storm if you like, when you take the economic situation into account; one where contracting risks previously accepted on the basis of higher margins are no longer commercially acceptable coupled with reduced in-house function. Companies are not as well placed to tackle those risks. Some firms are trying to muddle through but often they just have too much to do.

What do you mean by additional contracting risks?

HD: Over the last few years, we have seen a number of companies move away from the industry standard approach to allocation of risk – we see this continuing. As risk takes on a bigger profile as clients are facing those reduced margins – so analysing this risk becomes more important. As we are seeing from our litigation team, more risk creates a potentially more litigious environment as clients pursue more claims.

As I already mentioned, a lot of risk profiling that was acceptable when the market was buoyant is now more commercially unacceptable. In other words, now that the upside is reduced or gone, and companies are facing a greater downside as legal and contractual risk grows, relatively speaking.

Are there any legislative changes that companies need to be aware of too?

HD: Yes, the Modern Slavery Act 2015 means that any firm with a turnover in excess of £36 million must put a statement into its annual report saying it is not employing anyone illegally. The real challenge is that these large companies also have to ensure firms in their supply chains do not fall foul of the Act, which is a fairly onerous responsibility.

How have law firms traditionally been involved in the contracting sector?

HD: There has always been a lot of due diligence, often in preparation for a sale, where we will examine contractual relationships to identify any problems or issues. In certain situations our review has revealed problematic contract terms which have led to changes in the deal terms or the deal stalling. Had the target company taken some advice to both understand and mitigate its contractual risk, things might have been very different.

What other kind of work?

HD: We are often approached to review contracts when clients are entering into new framework agreements with other supply chain contractors or operators. There are also small operators in the oil and gas sector who do not have an in-house legal or contracts team who will outsource the entire supply-chain contracting element of a development or project – and we will manage that for them.

How has work come to the firm in the past?

HD: To be honest, it has been outsourced in a rather piecemeal, ad hoc fashion. Firms like Burness Paull are now taking a more structured approach because there is clearly work out there due to the downsizing of the in-house function and the higher risk profile relative to the lower-margin business cycle.

Is it difficult to understand the changing needs of contractors who have traditionally had strong in-house teams?

HD: Burness Paull has a real empathy with what is happening in the market – having been in oil and gas since the beginning we understand the challenges. Our lawyers have either worked in-house or have worked in the oil and gas sector our entire careers. That gives the team a level of understanding of our clients needs that is difficult to find elsewhere.

Where can out-of-house legal teams add value?

HD: There is a very strong industry focus on greater efficiency as margins tighten. Where in-house teams have been cut back, we can offer a cost-effective, long-term option for contractors and operators working in the North Sea and beyond. We review bids, tenders and contract terms and manage the contracting process generally. Our team has worked in a large number of overseas jurisdictions, including Romania, Egypt, Azerbaijan and Iraq, and is a genuine global player in the sector.

Where does the out-of-house legal sector fit in to this picture?

HD: In this climate, there is definitely a greater role for firms like Burness Paull, with its very long-standing oil and gas expertise. We have more than 40 years of experience in the sector and we are guiding clients through this difficult period. Our team can come into your business and help assess contractual risk, negotiate improved positions and help manage KPI milestones without the need for costly permanent overheads – providing expertise and value for money.

Recommended for you