Statoil’s head of asset management for Renewables said the lower oil price is both a “challenge and opportunity” for the industry to move into other growth areas.

Trine Ulla spoke to Energy Voice on a visit to the company’s offices in Aberdeen as more work gets underway on the Hywind project.

She said while the lower for longer oil price had created an economic downturn, it would also allow companies in Scotland and in the operator’s main base of Norway to look towards the renewable industry.

Ulla said:”Of course it’s both a challenge and and an opportunity is the way I see it.

“It’s a challenge because of the economic downturn of course – but it’s still an opportunity to build a new industry.

“Which is important and I think its been talked about in the UK for a long, long time, and in Scotland, how you could use renewable energy.

“That you could be the supplier of renewable energy to the whole of Europe; and we have now started discussing this in Norway where it is less mature when it comes to our oil production.

“But now, with the price challenge and everything, we are starting to talk about the green shift also in Norway.

“I think it’s definitely an opportunity.”

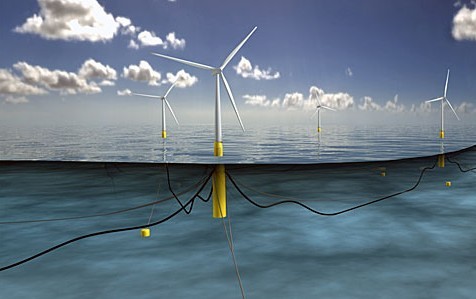

Statoil is also on track with the Hywind project, which will see the installation of five huge turbines in water offshore Aberdeenshire by next year.

Ulla said:“We are now in the middle of placing all the contracts and one of the bigger contracts has actually landed here in Scotland, in Inverness with IsleBurn, and that’s for construction of the 15 suction anchors.

“Then we’ve placed the turbine contract with Siemens and we’ve placed the sub structure contract with a company in Spain, so it’s going to take place all over Europe.

“Over the next few months we will have placed all the main contracts and closer to the summer, in June, we will start onshore construction works.

“One of the things we are going to start doing then is to drill through this wall in Peterhead, we’re going to drill a cable – tunnel if you like – where you can pull in the cable from offshore to onshore, and then it’s digging the cable, building substation, and then next summer again we will start installations.

“The first things that will go into the water basically are these anchors that we’re building up in Inverness and they will be ready for installation, they will be ready in early 2017.

Earlier this year, the company launched Statoil Energy Ventures – a $200million investment fund that aims to expand on its track record in renewables – particularly wind energy.

“The renewable fund we set up, the purpose of them is to broaden our engagement outside of offshore wind and to start investigating or looking into both business models and new technologies if you like.

“With a fund like that we can go into niche parts of the industry to learn because our focus so far has been offshore wind, but this gives us an opportunity to go in and learn more about the other renewables business, if you like.

“We have been looking both towards solar and onshore wind. We think our strength is that we’re capable of handling utility scale projects, we are good at project management, so I think that will be a natural place for us to move.

“But we are open to also enter into other parts of it, but definitely solar and definitely onshore wind: mainly because these are the two most important growth areas within renewable energy”, Ulla added.

As well as working on its current projects, Ulla said the company is keen to seize other opportunities in the future.

She said: “We will now start working, very seriously looking into markets where we can realise the utility scale projects: maybe a project of the size of 500MW or so, because you won’t get economies of scale technologies until you have a large volume that you can build out.

“We would be very interested in looking into opportunities in the UK, especially Scotland, which we think is most suitable with the natural conditions: they have the water depths, the high winds and the infrastructure here on the east coast of Scotland.

“We will look to other markets, expand to other markets and I think this could represent an opportunity for Scotland as well.”

Recommended for you