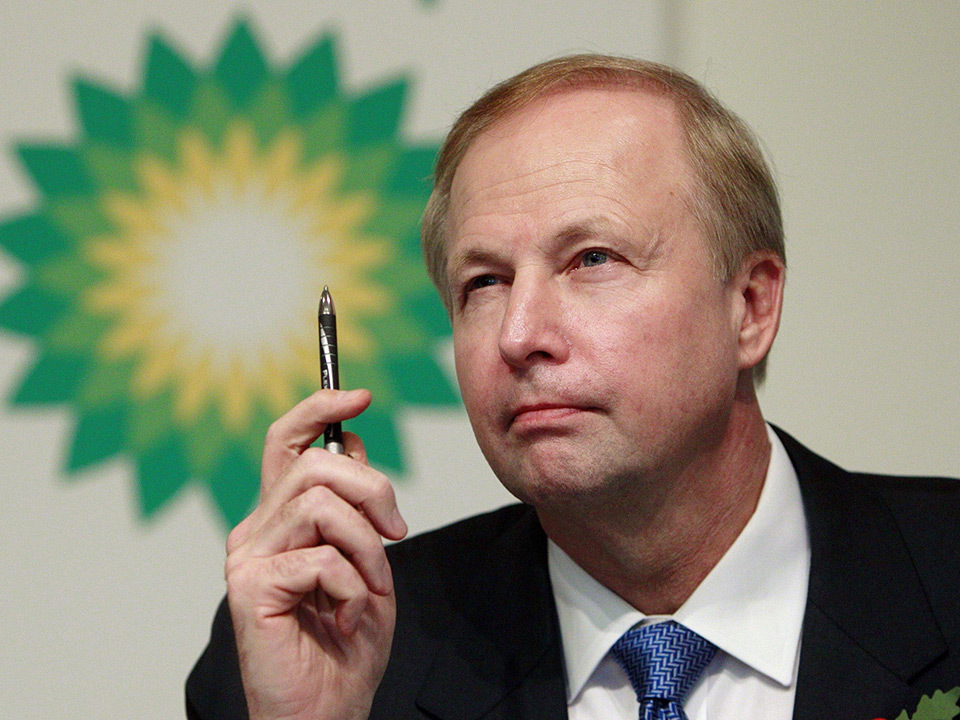

A campaign group is urging Shell and BP shareholders to use binding votes on pay plans to encourage bosses to embrace green energy, a news report said yesterday.

ShareAction said sticking with old remuneration policies that reward executives for digging for oil would lead to both companies becoming obsolete and going bankrupt, The Guardian reported.

In line with rules introduced in 2013, large companies like Shell and BP face binding shareholder votes on three-year pay policies next year, the report said.

Catherine Howarth, ShareAction’s chief executive, was quoted as saying: “Responsible investors who are serious about climate risk have a crucial opportunity to walk the talk at BP and Shell next year by pushing for remuneration policies designed make these companies commercially resilient in a low carbon world – and voting down policies which fail that test.”

BP said it would consult shareholders on its pay policy plans before the end of 2016, while Shell said it would read ShareAction’s report with interest, according to The Guardian.

Earlier this year, BP shareholders voted against pay rises for the firm’s directors.

Recommended for you