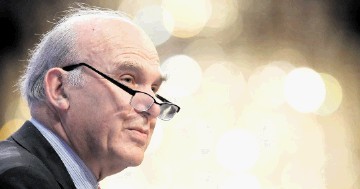

Former business secretary Sir Vince Cable has hit out at the Government’s sale of the Green Investment Bank (GIB), branding the move as “environmentally irresponsible”.

Sir Vince, leader of the Liberal Democrats, said the £2.3 billion sale to a consortium led by Australia’s Macquarie Group risked “setting the UK back years in its efforts to tackle climate change”.

The deal will see GIB bought by Macquarie Group, Macquarie European Infrastructure Fund 5 and the Universities Superannuation Scheme.

It has committed to meeting the GIB’s target of driving £3 billion of investment into green energy projects over the course of the next three years.

Sir Vince said: “The bank has done an extremely good job in supporting renewable energy, energy efficiency and low-carbon projects.

“It has managed to attract over £10 billion of private investment in these sectors that would not otherwise have happened.

“At a time when business confidence is falling and the Conservatives are giving mixed signals on their commitment to the environment, this is the worst time to undermine investment in the green economy.

“The Green Investment Bank’s environmental mission is in danger of disappearing under the ownership of a private Australian bank whose track record does not inspire confidence.”

Under the consortium’s control, the GIB will be rebranded as the Green Investment Group and will channel investment across the UK and Europe with plans to expand internationally.

Macquarie said it will consolidate its UK and European investment business into the GIB to make it the “primary vehicle” for investing in green projects.

Daniel Wong, head of Macquarie Capital Europe, said: “Combined with Macquarie’s resources as the world’s largest infrastructure investor, the Green Investment Group will be uniquely placed to continue in its pioneering role in the world’s transition to a low-carbon economy.”

Macquarie said the Green Investment Group would be spearheaded by Edward Northam and based in Edinburgh and London.

The move will trigger the departure of current chief executive Shaun Kingsbury, who will step down from the role.

Mr Northam, head of the Green Investment Group, said: “This new chapter provides the best of both worlds: a deep sector specialism coupled with access to a global platform and deep pools of capital.

“We have ambitious plans for the growth of the Green Investment Group, starting with a continuation of our role as a leading investor in the UK and building on that through an additional international focus.”

Jonathan Bartley, Green Party co-leader, said the sale was “disastrous” for everyone who cares about the future of renewable energy.

He said: “This was a bad deal for the taxpayer and a bad deal for the planet. In 2016, the GIB started to make a profit and it was set to deliver an annual return of 10%.

“The Government was repeatedly warned that selling the GIB to Macquarie could result in asset-stripping and leave the bank unfit for purpose.

“The sale means taxpayers no longer have a say if this turns out to be true.

“As we grapple with soaring temperatures and a climate change denier in the White House we need to be investing in green energy, not flogging off our future security to the highest bidder.”

The Green Investment Group employs in excess of 120 staff.

Recommended for you