Carbon capture and storage (CCS) is now firmly on the agenda as a way of mitigating at least some of the impacts of climate change.

But time in which to implement large-scale permanent solutions

to the storage of waste carbon dioxide (CO2), even as a means

to maximising hydrocarbons recovery, is fast running out.

One of the reasons why CCSis a popular option is that most of the key building bricks to

its enablement exist and are proven.

Usage is much less well developed, but progress is being

made.

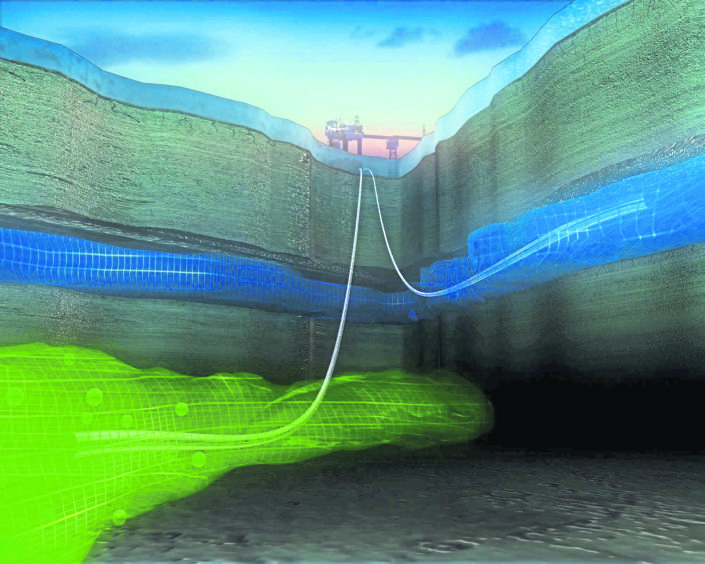

At the Equinor-operated Sleipner gas field in the Norwegian North Sea, the high

CO2 content of the reservoir is stripped on site and injected

below ground, while the cleaned-up natural gas is

exported ashore.

Worldwide there are now more than 40 large CCS projects listed by the Global CCS Institute (GCCSI) as being in gestation, double the tally of 2014.

But there are major issues standing in the way of a globalscale CCS push in the name of

climate change mitigation, and this is highlighted in a new report from the Global CCS Institute.

It analyses policy priorities required to incentivise large-scale uptake of what is clearly

becoming a capital intensive industry in its own right, but where state funding has been

necessary in a number of cases to kickstart meaningful activity.

No country has a comprehensive framework to support the scaling

up of CCS and is consistent with meeting climate targets agreed

at the COP 21 summit in Paris, December 2015.

Notwithstanding, there are 18 large-scale CCS facilities in operation today, with five under construction and 20 at early stages, according to the institute’s policy paper.

Australia’s first andlong-delayed CCS facility, serving Chevron’s Gorgon field, is due to come onstream this year.

GCCSI warned that the privatesector won’t deploy CCS at the scale required to meet climate change targets because of “multiple market failures and broader barriers to investment”.

GCCSI said: “These market failures translate to risks, some of which are general project risks that can be mitigated over the course of deployment, while others are hard-to-reduce risks that will need to be allocated to government, at least in the short

term.”

Current CCS schemes have been enabled by supportive policy and favourable project conditions, and provide a valuable insight into how the core barriers have

been overcome.

While the specific mechanisms used to overcome the market failures have differed, there are common features that are reflected across a number of

projects.

“The main way through which a value has been placed on capturing CO2 has been in its

use for enhanced oil recovery (EOR) rather than through any individual policy mechanism,” the institute said.

Of the 18 projects currently operating, 13 sell CO2 for EOR,

the process where CO2 is injected into oil reservoirs to improve flow properties and increase oil production.

Any greenhouse gas reduction benefits have been collateral.

While not publicly available, according to the institute, the price of CO2 for EOR is thought to be linked to the price of oil, which makes sense.

For example, the cost of CO2 is around $30 per tonne at an oil price around $70.

“At these prices, the revenue from the sale of CO2 for EOR alone may be sufficient to

cover the costs of capturing and transporting CO2,” says the institute.

“This combination of favourable project costs and revenues from the sale of CO2 for

EOR has been the main driver of early CCS projects in the US.”

CCS has been used as an EOR tool for a lot longer than most

realise.

Shell has been active in CO2-based EOR for 40 years through pilot projects and as an initiator of large-scale CO2 transport and EOR floods in the Permian Basin.

Occidental Petroleum has also been a major user of the technique for decades, and it

is the US model that is almost certainly behind a failed attempt by BP to try the same in the UK with its Miller gasfield.

BP proposed a £500 million project at Peterhead Power Station in 2005 that would

involve exporting the CO2 to Miller, the prize being 40m barrels of additional oil.

BP pulled out of the plan in May 2007, citing delays to the launch of a government funding competition, while there were also concerns about the storage

capacity of the field.

Then-CEO John Browne wanted public money on the table. He argued the 40m

additional barrels would not deliver sufficient returns to BP to justify the cost of converting the power station.

Chevron and Oxy are hedging their bets, and last winter both injected funds into Canadian company Carbon Engineering, which has developed technology that captures CO2 directly from the atmosphere and converts it into low-carbon fuels for transport and EOR use.

The firm has been removing CO2 from the atmosphere since 2015 at a pilot plant in British Columbia and converting it into fuel since 2017.

So far, the US is the only nation to put a significant value – up to

$50 per tonne by 2026 – on CO2 storage.

Norway is the only country that has implemented a carbon tax sufficient to support a

business case for geological storage of CO2 produced during gas production.

But 80% of global emissions are still not covered by carbon pricing and half of current

emissions covered by carbon pricing initiatives are priced at less than $10 per tonne of CO2.

The institute said this highlights an important gap in

the existing policy framework, and one that, if plugged in the short-term, could help

move carbon capture up the deployment curve and encourage more countries like the UK to stop dithering.

Turning to the EU, where CCS is said to be enjoying a revival of interest fuelled by the

region’s prowess in industrial mitigation technology, eight large-scale CCS facilities are now in development.

This is largely led by the UK, Norway and the Netherlands, where industrial clusters around North Sea storage options provide an opportunity to significantly reduce the unit cost of CO2 storage.

Feasibility funding budgets have been confirmed for a Full Chain CCS facility, which will entail transport and storage in the offshore Smeaheia area, with an expected CO2 storage capacity of up to 100m tonnes.

In the US, “the stronghold of global CCS deployment to date”, development activities

have slowed, with one facility (Lake Charles) in advanced development. This slowdown is expected to be temporary as new legislation has been enacted that gives CCS favourable tax treatment.

Saudi Arabia and the UAE have adopted a strategy of state ownership of CCS facilities to supply CO2 for EOR, rather than establishing policy to encourage private sector investment.

THE UK SITUATION

For nigh on 20 years, the UK has blown hot and cold on CCS, largely on cost and policy failure grounds.

But there is ambition, and it is gradually gaining

momentum.

The GCCSI reckons existing industry clusters will form a key asset for the deployment of CCS by the UK.

“ S e v e r a l i n d u s t r i a l initiatives have already built

a strong business case for the development of industrial CCS,” it says.

“The Teesside Collective and Caledonia Clean Energy facilities are two ambitious commercial-scale CCS projects that could potentially kickstart the deployment of carbon capture utilisation and storage in the UK.

“Hydrogen is also an important part of the ongoing discussion in building a cost-effective pathway to decarbonisation of energy and gas. Promising developments

include HyNet North West led by Cadent, the UK’s largest gas distribution network, and

H21 North of England led by Northern Gas Networks.”

Many Energy Voice readers are probably familiar with the Acorn

project, led by Aberdeenshire firm Pale Blue Dot Energy.

Its ambition is to pilot a small scale capture development with

a capacity of 200,000 tonnes per annum and later upscale to

3-4m.

It will involve injection from a new subsea well into the

redundant Goldeneye gasfield.

Pale Blue Dot wants to establish a major hydrogen and

CCS hub at St Fergus, create an economic opportunity for Peterhead, and repurpose a pipeline to deal with Scotland’s central belt emissions.

It also hopes to develop an international CO2 storage hub in the central North Sea that unlocks CO2 transportation and storage solutions for other clusters across the UK and potentially Europe.

The venture is funded under the Advancing CCS Technologies initiative, which is part of

the European Research Area Networks programme.

This is the second attempt at using Goldeneye for CCS.

The first was derailed by the government just days before the COP 21 summit when it pulled the plug on a £1bn competition.

A venture between Shell and SSE at Peterhead Power Station and involving Goldeneye was competing for funds with a project in Yorkshire.

The latest attempt by the UK Government to stimulate CCUS in Britain involves far less

money – a miserly £26m split between nine projects – with Pale Blue Dot receiving £4.8m.

When set against the scale of the CCS challenge and its critical

role in reversing the global climate catastrophe that is daily unfolding, £26m is chicken-feed.

THE NOT-SO-SMALL MATTER OF INTEGRITY

Let’s assume CCS prevails. Having stuffed millions of tonnes of CO2 out of sight, how

does one keep an eye on it?

After all, like radiation, it is effectively invisible but hugely damaging.

According to British Geological Survey, CO2 storage regulations will require that operations are rigorously monitored.

Pre-injection monitoring of a CO2 storage site is required to build up a baseline picture of the geology and the environment before any CO2 is stored.

When injection has started, monitoring surveys would be repeated to build up time-lapse images of site properties.

Results can then be compared to the baseline survey to build up a picture of how things are changing through time.

The storage site would need to be monitored throughout the injection phase and for some time thereafter to ensure the system is behaving as predicted.

One of the crucial tools readily available for this task is seismic, as used on Sleipner.

But the frequency and duration of monitoring are major cost

drivers which must be targeted as storage becomes a commercial

activity.

Back to the North Sea and the STEMM-CCS project, which also

has a seismic dimension – it is a €15.9 million project intended to deliver new approaches, methodologies and tools for the safe operation of offshore CCS sites.

Early this year, the STEMMCCS team conducted a critical three-week trial involving the

injection of CO2 into sediments associated with the depleted Goldeneye field, followed by intensive monitoring.

The aim of the experiment was to simulate a sub-seafloor CO2 escape under real-life conditions in the North Sea.

The project team arrived in the Goldeneye field on April 27 aboard the research vessels James Cook and Poseidon.

Tanks of the gas (laced with inert chemical tracers)

aboard the James Cook were injected into seafloor sediments and the first bubbles of CO2 broke through on May 11.

The consequences of this CO2 release have since been carefully monitored by a sophisticated array of chemical sensors, acoustic devices, visual observations and seismic surveys.

The last of the instrumentation deployed was recovered in

May 23. Since then, the task of analysing the results has been the core focus.

With more than 40 ROV dives and lander deployments, and with five sensors on each of those deployments, there is a huge amount of data gathered at and around the site to analyse and draw conclusions from.

A project report is expected around the end of this year.

Recommended for you