A “large majority” of future renewable energy projects could be based in Scotland, according to analysts for a energy research firm.

Cornwall Insight claims that, with a potential 13 gigawatts (GW) of pipeline projects eligible in the UK Govrnment’s new action scheme, Scotland could benefit through new categories being included, such as onshore wind, solar power and rural island wind.

Preempting the UK-wide fourth offshore wind action round, the Scottish Government’s new draft sector marine proposals show at least three potential areas for offshore wind development around Aberdeen, with an even greater number considered off the north-east and Highlands.

A number of smaller licences have also been made available for floating offshore wind projects.

James Brabben, wholesale manager at Cornwall Insight, said:”The results are revealing not just from a commercial perspective but on the interactions of wider policy and network charging.

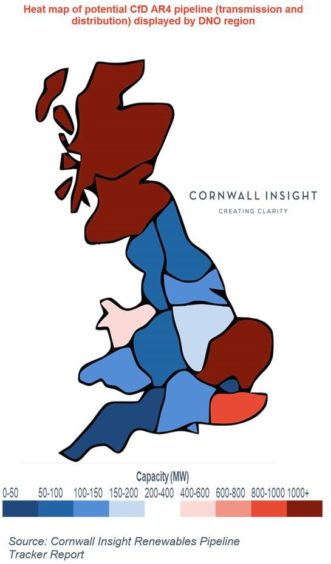

“The onshore wind capacity totals 4.2GW, a high figure considering the ~13GW in operation currently. Of this, over 3.8GW is in Scotland, highlighting the continued concentration of sites here.

“Scotland is also home to all of the RIW pipeline, which totals 900MW.

“Dominating this is the potential 450MW Viking wind farm development on the Shetland Isles.

“With offshore wind carved into a separate ‘Pot 3’, RIW projects could be in a more competitive position when compared to previous auctions.”

Scotland already boasts the fourth largest operational offshore wind farm in the world with the Beatrice 84-turbine wind farm, while the Moray East project – a near 100-turbine development – is currently in construction.

A new heat map produced by Cornwall insight shows the concentration of the potential successful projects in the UK – a large majority is located in Scotland.

Mr Brabben added: “Although the auction is set to be a competitive one, the location of potential applications may cause other issues such as high Transmission Network Use of System (TNUoS) costs for larger sites in Scotland, differences in load factors and site conditions and wider financing and strategic factors at play from project sponsors.

“The pipeline may also change as we head through to 2021.

“Particularly as some sites continue to look at subsidy-free and merchant options instead, while new sites may also join the queue for the CfD.”