Offshore wind and hydrogen are “good ingredients but a bad cocktail” according to Rystad Energy, with high costs remaining a “showstopper”.

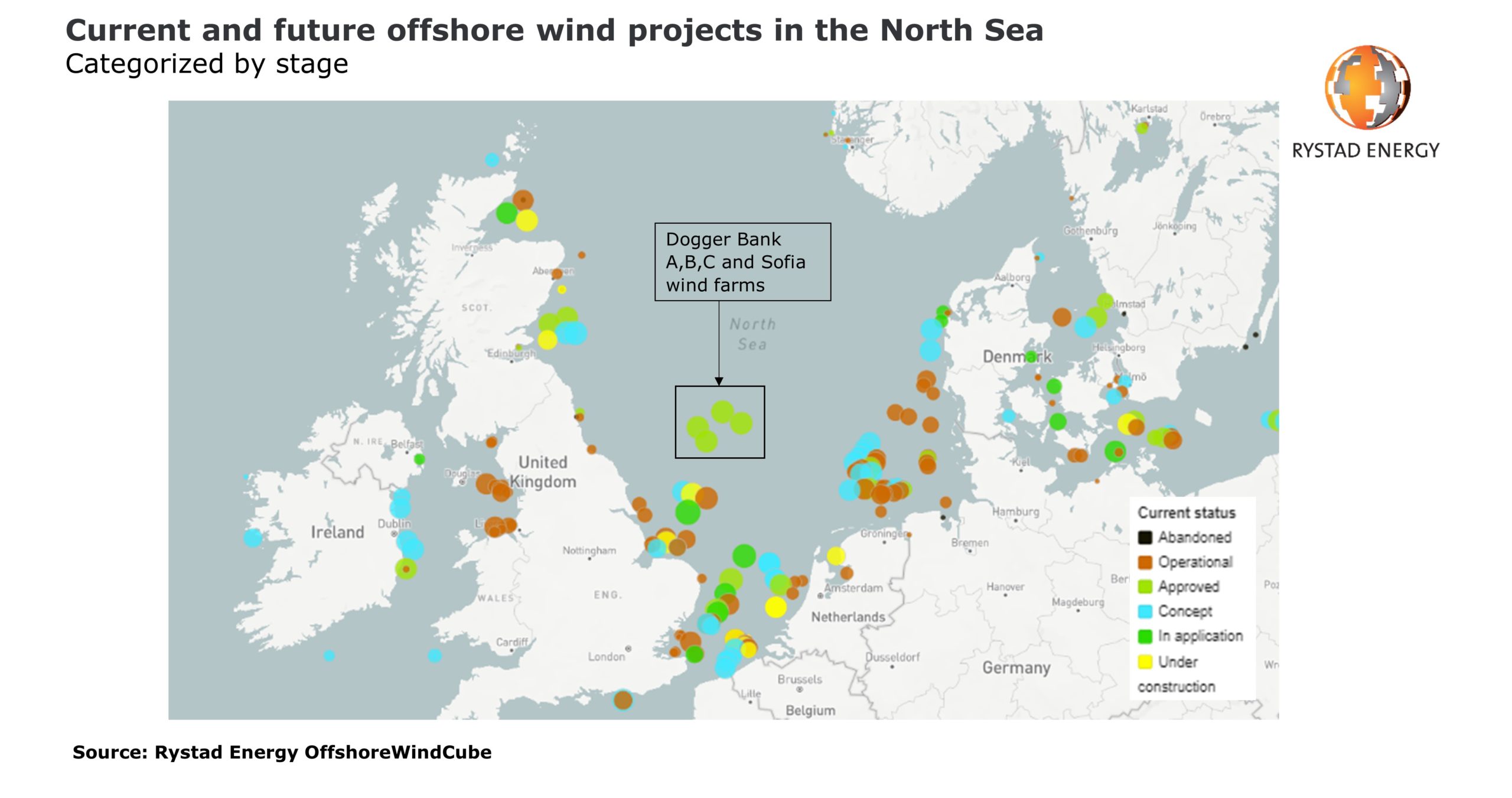

The Norwegian analyst firm has looked at the economics of developing green hydrogen as several large-scale offshore wind farms are planned in the coming years for the North Sea.

Despite the region being a prime spot for it, “the high costs – at least for now – remain a showstopper”, Rystad said.

Modelling it on a one gigawatt (GW) offshore wind farm, and assuming roughly half of its excess power is used for green hydrogen, Rystad said the bulk of it would need to be sold at 5.1 euros per kilogram – about four times the price of hydrogen made from fossil fuels.

The scenario assumed break-even power price of 85 euros per megawatt-hour (MWh), which is close to the strike price of auction round 2 for the UK contract for difference scheme of £74.85 – the case for the Triton Knoll wind farm.

Taken together with the costs of storing hydrogen in salt caverns, and the cost of compressors used to level the pressure of electrolyser output, the economics don’t yet fit.

Rystad said that even in a scenario where wind costs drop to 61 euros per MWh by 2030, it would still require a hydrogen sale price of EUR 3.7/kg which is “a far cry from its much cheaper fossil-fuel-made version”.

The DolpHYn project, a world first green hydrogen scheme coming to Aberdeen, is still in its prototype stages. It has ambitions to eventually scale up to a massive 4GW commercial development, which would require a massive offshore wind project in order to reap the economies of scale.

On the flip side, however, the Rystad said that rapid reductions in offshore wind costs might in turn “accelerate the learning curve for hydrogen”.

Early phase support and subsidies “can create the needed scale, industrialisation and learning needed to tremendously cut costs”.

However determining the full potential of the technology remains challenging – it might decarbonise industries, building heating, marine shipping and aviation.

Energy research analyst Petra Manuel said: “Offshore hydrogen production may become more interesting if a higher carbon tax is imposed on grey hydrogen production.

“This would force existing hydrogen manufacturers to shift more of the production to “blue” hydrogen (grey hydrogen coupled with carbon capture and storage), which in turn would make green hydrogen projects more cost-competitive.”

Recommended for you