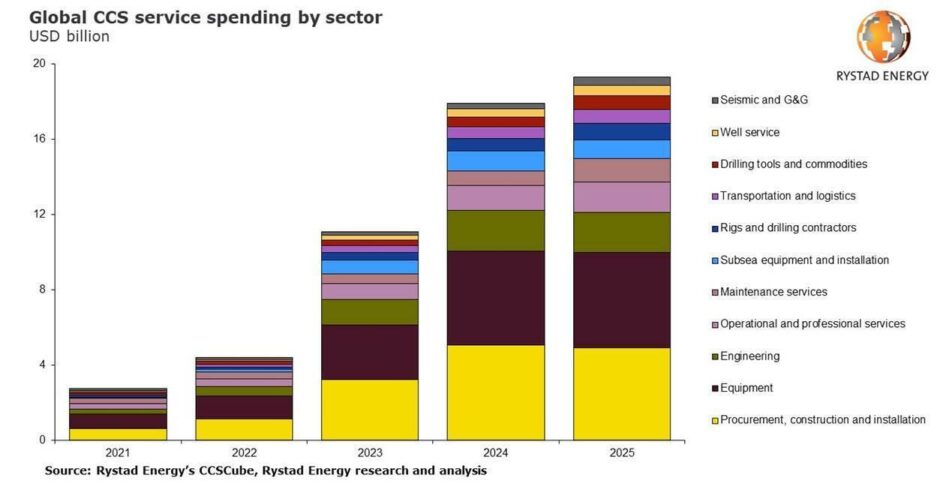

Service sector spending on carbon capture and storage (CCS) developments is set to skyrocket this decade, quadrupling between 2022-25, Rystad Energy research suggests.

Oslo-based energy researcher Rystad expects cumulative global expenditure over the next three years to rise above $50 billion.

Total spending for announced commercial projects in 2022 is projected to hit $4.4bn, up from $2.8bn last year, and is forecast to nearly triple in 2023, topping $11 billion for the year.

Projections show 2024 and 2025 will see an additional $18 billion and $19 billion, respectively, bringing the projected total to $52 billion by the middle of the decade. Its totals only include announced projects, assuming all projects move ahead as planned, and do not account for pilot or demonstration-only developments.

Europe and North America will drive spending, with 63 out of the 84 announced commercial CCS projects expected to start operations by 2025 situated in these two regions.

Capital will be spent on a range of services related to the installation of the capture unit, transportation of carbon dioxide (CO2) and storage.

There are 56 commercial CCS projects already in operation globally, capable of capturing up to 41 million tonnes per annum (tpa) of CO2 across various industries. Based on already announced projects, nearly 140 CCS plants could be operational by 2025, capturing at least 150 million tpa of CO2 if all projects move ahead as scheduled.

“CCS technology is viewed as a fundamental component of the societal decarbonization required for a successful energy transition. Although the technology dates back to the 1970s, the number of CCS project announcements has surged in the last two years, and service sector spending is expected to go through the roof in the coming years as a result,” says Rystad Energy senior analyst Lein Mann Hansen.

Spending breakdown

Almost two-thirds of service spending will go towards equipping the facility with CO2 capture components and maintaining operations. Engineering, procurement, construction and installation (EPCI) costs will be the primary driver of spending, contributing about $35bn to the headline total by 2025.

Annual EPCI spending will hit $12 billion in 2025, a more than 300% increase from the $2.8 billion projected for this year, analysts said.

Transportation – which follows capture of the CO2 – will require service purchases worth $8.5 billion through 2025. CO2 can be commercially transported in gas and liquid form to the storage area using pipelines, trucks and ships. Within each project and depending on the transport distance and location of the target storage location, the mode of transportation can vary. Pipelines are widely used to transport CO2, and there are 51 operational onshore pipelines, 38 of which are located in North America.

Onshore storage is currently the dominant mode of storage since it is cheaper and less complex. However, there will be an uptick in the number of offshore storage sites driven by Europe, including the Netherlands and the UK.

There are five operational offshore pipelines, but the number could increase to 50 once the under-construction and planned projects with an offshore storage site become operational. Additional capital will, therefore, be required to lay the necessary subsea pipelines to transport the CO2 to the storage site.

Rystad says this will lead to growth in the subsea pipeline, shipping and offshore installation markets over the coming years.

The third and final step in most cases is storage. The process starts with identifying the potential storage location and is followed by drilling wells for injection and monitoring purposes, with associated drilling tools and oil country tubular goods (OCTG) then required. The storage process will drive at least $9 billion in service purchases through 2025.

The majority of these new additions will stem from Europe and North America, which account for 85% of the service purchases expected through 2025. The European market will account for more than 50% of the purchases despite having almost the same number of projects in the pipeline as North America. This is because many of the new upcoming projects in Europe will store CO2 offshore.

Offshore storage is more expensive as it requires, for example, laying subsea pipelines for transport using pipelaying vessels, offshore rigs operating at higher rates to drill injection wells, and is coupled with higher labour rates in the region.

The growth in Europe is fueled by high European Union Emissions Trading System (EU ETS) prices along with favourable carbon policies and support for CCS projects. The North American CCS landscape is continuing to gain momentum with multiple projects announced in the US and Canada, driven by national incentives and funds supporting the technology.

Recommended for you

© Supplied by Rystad Energy

© Supplied by Rystad Energy