It is feared the ballooning cost of raw materials will “definitely be a stumbling block” to the deployment of green energy projects.

Renewables experts from Bracewell believe inflationary pressures have made low carbon schemes across the globe that were recently a “safe bet” far more challenging.

Andrej Kormuth, a partner at the international law firm, said: “What that means in the long term is a difficult thing to predict.

“There’s certainly a bit of consolidation occurring; a lot of the deals that have been procured have taken significantly longer to get backed. Some of them still haven’t been, and only a small portion have gone into construction.

“The inflation that we see today is definitely going to be a stumbling block in the future development of renewables.”

In the last decade or so, the price of renewables has fallen steadily, spurred on by the growth in deployment.

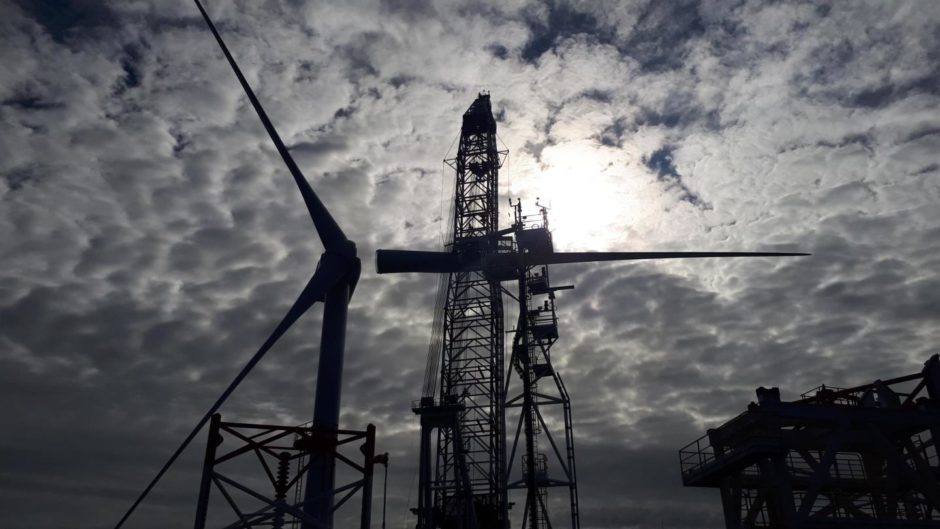

Government support schemes have underpinned an expansion of installed capacity, particularly in the likes of offshore wind.

Many had expected prices to continue heading one way, but sharp rises in the price of raw materials have challenged that.

Renewables inflation by numbers

Bracewell recently received a notice from an EPC contractor outlining that the cost of steel and copper – key components in wind turbines – have risen 55% in the last year.

On top of that, photovoltaic modules, or solar panels, are up 270%, while logistics costs have soared by an eye-watering 700%.

He added: “We are now looking at very difficult assets. We’re dealing with a lot of developers who were jubilant a year ago, and are now realising that they have projects that are very difficult to execute.”

A crunch on supply chains, due in part to Covid lockdowns, combined with rising energy prices are a key reason behind the inflation that is gripping much of the globe.

Companies feeling the pressure

Italian offshore contractor Saipem issued a profit warning earlier this year due to rising costs and slimmer project margins in offshore wind.

On the manufacturing side, Vestas has warned that the cost of wind turbines is likely to increase further, trimming its takings.

Spotlighting the issues the International Energy Agency forecast in June that after a decade of accelerating growth, the expansion in global renewable power is expected to slow slightly next year.

Ro Lazarovitch, a project lawyer and partner at Bracewell, said: “The biggest story in town is inflation – that is having the biggest impact on the renewables globally. The war in Ukraine has accelerated that inflationary trend by increasing energy prices across the board.

“Where does that bring us in terms of the broader story? Well I think there was a narrative highlighted, particularly during lockdowns, that the transition would be skipped. That the world would move from hydrocarbons to renewables immediately, without an intermediary gas transition. Recent events have shifted that.”

He added: “But I don’t think that this return to a transition narrative, as opposed to a switch narrative, means that renewables are off the table. They are very much there, there’s a lot of talk about them, and a lot of activity in that space.”

Recommended for you

© Bloomberg

© Bloomberg © Supplied by Ocean Winds

© Supplied by Ocean Winds